Japan CEP Market Size, Share, and COVID-19 Impact Analysis, By Business (Business to Business (B2B) and Business to Consumer (B2C)), By Destination (Domestic and International), By End-User (Services, Wholesale and Retail Trade, Manufacturing, Construction), and Japan CEP Market Insights Forecasts 2022 - 2032

Industry: Automotive & TransportationJapan CEP Market Insights Forecasts to 2032

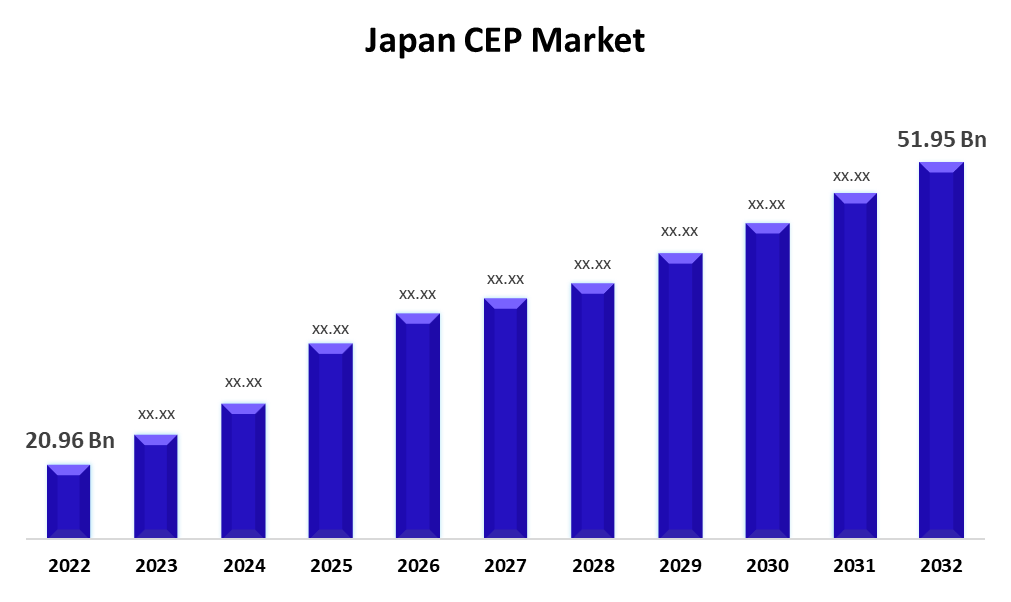

- The Japan CEP Market Size was valued at USD 20.96 Billion in 2022

- The Market Size is Growing at a CAGR of 9.50% from 2022 to 2032

- The Japan CEP Market Size is Expected to Reach USD 51.95 Billion by 2032

Get more details on this report -

The Japan CEP Market Size is Expected to Reach USD 51.95 Billion by 2032, at a CAGR of 9.50% during the forecast period 2022 to 2032.

Market Overview

Courier, Express, and Parcel (CEP) is a collection of services that involves the delivery of various goods and products across regions via various mediums such as air, water, and land. These CEP packages are mostly non-palletized and weigh around a hundred pounds collectively. The business-to-business (B2B), business-to-customer (B2C), and customer-to-customer (C2C) models are heavily used in CEP services. They are combined with a variety of value-added services to improve the delivery experience for the user. Express deliveries are primarily time-bound, with various high-value consignments delivered within a few days or at a pre-arranged date and time.

Report Coverage

This research report categorizes the market for the Japan CEP market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan CEP market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan CEP market.

Japan CEP Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 20.96 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.50% |

| 2032 Value Projection: | USD 51.95 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Business, By End-User |

| Companies covered:: | Yamato, Sagawa Express, Japan Post, Seino Transportation, United Parcel Service, FedEx, DHL, Takahashi, TNT Express, Nippon Express Company, National Air Cargo and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The CEP market has been fueled by the exponential growth of e-commerce in Japan. Online retailers and marketplaces rely heavily on CEP services to quickly and efficiently fulfill customer orders, and the rise in urbanization and changing consumer lifestyles has created a demand for faster and more convenient delivery options. CEP firms are constantly innovating to meet these changing customer expectations. Furthermore, the integration of advanced technologies such as artificial intelligence, machine learning, and robotic process automation has revolutionized the CEP market. These advancements have increased operational efficiency, improved tracking capabilities, and shortened delivery times. The growth of Japan trade has increased cross-border shipments. CEP providers are critical in facilitating seamless international deliveries, thereby increasing trade volumes and revenue.

Restraining Factors

The CEP market is governed by several regulatory frameworks, including customs regulations, import/export restrictions, and data protection legislation. Compliance with these regulations can be complex and time-consuming, posing challenges for market participants, and last-mile delivery, which involves transporting packages from the distribution center to the final destination, can be logistically difficult, particularly in densely populated urban areas. Congestion, limited parking, and strict delivery time frames can all hamper operational efficiency.

Market Segment

- In 2022, the business-to-consumer (B2C) segment accounted for the largest revenue share over the forecast period.

Based on the business, the Japan CEP market is segmented into business-to-business (B2B) and business-to-consumer (B2C). Among these, the business-to-consumer (B2C) segment has the largest revenue share over the forecast period. The expansion of the e-commerce sector and an increase in customer awareness are likely to drive the B2C segment. This is expected to fuel the courier express and parcel market during the forecast period. The focus is shifting from business to business (B2B) to business to consumer (B2C) due to increased demand for e-commerce businesses. Furthermore, there has been an increase in cross-border online shopping and e-commerce sales.

- In 2022, the domestic segment accounted for a significant revenue share over the forecast period.

Based on the destination, the Japan CEP market is segmented into domestic and international. Among these, the domestic segment has a significant revenue share over the forecast period. The distribution channels for consumer goods and industrial products are very different. Due to limited space and dense urban populations, small retail stores have been and continue to be dominant points of consumer sales. As a result, retailers frequently stock limited quantities of a product, and wholesalers must deliver small quantities of a product more frequently. The Japanese cultural preference for doing business face-to-face, as well as loyalty or a sense of obligation in relationships, keep this system in place, but the costs of this less efficient distribution system are passed on to the consumer in the final price of the product.

- In 2022, the services segment accounted for the largest revenue share over the forecast period.

Based on the end user, the Japan CEP market is segmented into services, wholesale and retail trade, manufacturing, and construction. Among these, the services segment has the largest revenue share over the forecast period. The services segment is responsible for product trading between the banking, financial services, and insurance (BFSI) units across different regions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan CEP market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamato

- Sagawa Express

- Japan Post

- Seino Transportation

- United Parcel Service

- FedEx

- DHL

- Takahashi

- TNT Express

- Nippon Express Company

- National Air Cargo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Yamato Transport and Japan Post announced Monday that they will collaborate on mailbox and small parcel deliveries. The two companies want to improve delivery efficiency to deal with the "2024 problem," which is expected to result in severe truck driver shortages due to new overtime work restrictions.

- In May 2023, Nippon Express acquired Austria's Cargo-Partner for approximately USD 743 million (subject to regulatory approvals). This is Nippon Express's largest acquisition to date and yet another Japanese corporate-led M&A drive for international diversification and growth in response to Japan's aging and shrinking economy.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan CEP Market based on the below-mentioned segments:

Japan CEP Market, By Business

- Business to Business (B2B)

- Business to Consumer (B2C)

Japan CEP Market, By Destination

- Domestic

- International

Japan CEP Market, By End-user

- Services

- Wholesale and Retail Trade

- Manufacturing

- Construction

Need help to buy this report?