Japan Cargo Security and Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Type (Cargo Screening and Inspection, Surveillance and Monitoring, Tracking and Tracing Systems, and Access Control and Authentication), By Transport (Air Cargo Security, Maritime Cargo Security, Rail Cargo Security, and Road Cargo Security), By End-User (Logistics and Freight Forwarding, E-commerce and Retail, Aviation and Maritime Operators, and Government and Defense), and Japan Cargo Security and Surveillance Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseJapan Cargo Security and Surveillance Market Size Insights Forecasts to 2035

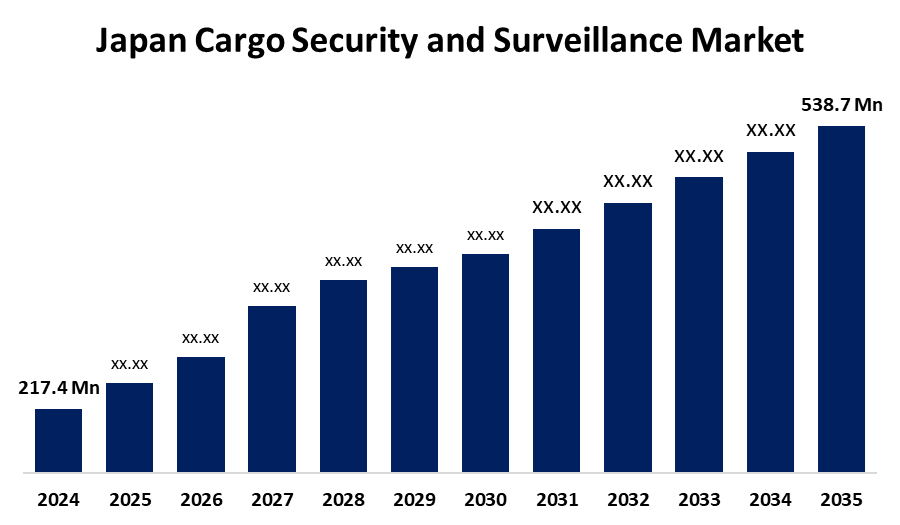

- The Japan Cargo Security and Surveillance Market Size Was Estimated at USD 217.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.6% from 2025 to 2035

- The Japan Cargo Security and Surveillance Market Size is Expected to Reach USD 538.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Cargo Security and Surveillance Market Size is anticipated to reach USD 538.7 million by 2035, growing at a CAGR of 8.6% from 2025 to 2035. The Japan cargo security and surveillance market is expanding due to growing concerns over cargo theft, greater logistics automation, and the integration of smart technology. Governmental efforts and stricter security laws also fuel investment in sophisticated surveillance options.

Market Overview

The Japan cargo security and surveillance market refers to technologies and services aimed at safeguarding merchandise in transit to maintain safety, compliance, and operational effectiveness. X-ray scanners, explosive detection systems (EDS), video monitoring, and GPS or RFID-based tracking are the key solutions. They are essential in logistics, e-commerce, aviation, maritime, and defense applications. Market strengths are Japanese strong technological infrastructure and a very robust regulatory framework that encourages compliance and safety. Opportunities exist in bringing together AI and machine learning to support predictive analysis and concurrent monitoring. Growth is fueled due to Japan dependence on secure supply chains, an increase in e-commerce demand, and strict regulatory environments. The focus of the government on infrastructure resilience and digitalization has encouraged the uptake of innovative technologies such as IoT and blockchain to further improve cargo security. Government programs, including investment in smart logistics and more stringent cargo handling policies, contribute further to market expansion.

Report Coverage

This research report categorizes the market for the Japan cargo security and surveillance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cargo security and surveillance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cargo security and surveillance market.

Japan Cargo Security and Surveillance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 217.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.6% |

| 2035 Value Projection: | USD 538.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Transport, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Yamato Holdings, Fujitsu, Nippon Express, Japan Post, BAE Systems, Subaru Corporation, Honeywell, Sagawa Express, Sony, Dahua Technology, Hikvision, Kawasaki Heavy Industries, Panasonic, Mitsubishi Heavy Industries, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand for e-commerce drives the Japan cargo security and surveillance market, while supply chain safety concerns and government regulations increase. The rising industrialization and the necessity to secure valuable shipments from theft and damage contribute further to market expansion. Also, innovation in technology, such as IoT, AI, and blockchain, increases real-time monitoring and predictive security technologies. Government policies encouraging smart logistics and infrastructure robustness also significantly contribute to faster adoption across the aviation, shipping, and logistics industries.

Restraining Factors

The Japan cargo security and surveillance market is restrained high cost of implementation, regulatory compliance complexities, and privacy for data. Furthermore, the need to integrate new technologies into legacy infrastructure and a lack of skilled talent restrain market growth.

Market Segmentation

The Japan cargo security and surveillance market share is classified into type, transport, and end-user.

- The cargo screening and inspection segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cargo security and surveillance market is segmented by type into cargo screening and inspection, surveillance and monitoring, tracking and tracing systems, and access control and authentication. Among these, the cargo screening and inspection segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the requirement for robust security practices to stop smuggling, unlawful practices, and ensure safety assurance. With increasing worldwide commerce, high-tech screening devices such as X-ray and CT scanners are vital for compliance with standards and guaranteeing air, sea, and land cargo shipments.

- The air cargo security segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cargo security and surveillance market is segmented by transport into air cargo security, maritime cargo security, rail cargo security, and road cargo security. Among these, the air cargo security segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to air freight is usually expensive and time-critical. Tight international rules and security measures, in addition to a requirement for sophisticated screening and tracking technologies, fuel the call for strong air cargo security solutions that maintain safety, compliance, and effective worldwide trade.

- The logistics and freight forwarding segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cargo security and surveillance market is segmented by end-user into logistics and freight forwarding, e-commerce and retail, aviation and maritime operators, and government and defense. Among these, the logistics and freight forwarding segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing international need for safe and effective shipping of goods. As cargo volume increases, shipping providers need sophisticated security systems to protect shipments, protect against robbery, minimize damage, and adhere to international guidelines, which makes this an integral industry to the overall market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cargo security and surveillance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamato Holdings

- Fujitsu

- Nippon Express

- Japan Post

- BAE Systems

- Subaru Corporation

- Honeywell

- Sagawa Express

- Sony

- Dahua Technology

- Hikvision

- Kawasaki Heavy Industries

- Panasonic

- Mitsubishi Heavy Industries

- Others

Recent Developments:

- In August 2024, Yamato Holdings, Japan Airlines, and SPRING JAPAN launched late-night domestic cargo flights between Haneda and Sapporo or Kitakyushu. These dedicated services improve regional trade, enable fresh, rapid deliveries, and support stable, cyclic logistics, making Haneda the fifth airport served and strengthening Japan’s national and international freight networks.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan cargo security and surveillance market based on the below-mentioned segments:

Japan Cargo Security and Surveillance Market, By Type

- Cargo Screening and Inspection

- Surveillance and Monitoring

- Tracking and Tracing Systems

- Access Control and Authentication

Japan Cargo Security and Surveillance Market, By Transport

- Air Cargo Security

- Maritime Cargo Security

- Rail Cargo Security

- Road Cargo Security

Japan Cargo Security and Surveillance Market, By End-User

- Logistics and Freight Forwarding

- E-commerce and Retail

- Aviation and Maritime Operators

- Government and Defense

Need help to buy this report?