Japan Cancer Biologic Therapy Market Size, Share, and COVID-19 Impact Analysis, By Type of Therapy (Monoclonal Antibodies, Vaccines, Cytokines, and Gene Therapy), By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, and Prostate Cancer), By Administration Route (Intravenous, Subcutaneous, Oral, and Intramuscular), and Japan Cancer Biologic Therapy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Cancer Biologic Therapy Market Insights Forecasts to 2035

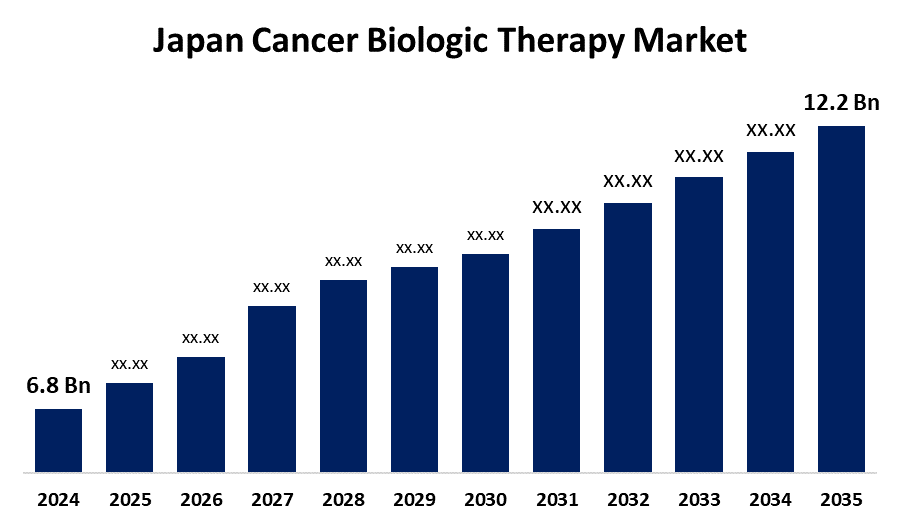

- The Japan Cancer Biologic Therapy Market Size Was Estimated at USD 6.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.46% from 2025 to 2035

- The Japan Cancer Biologic Therapy Market Size is Expected to Reach USD 12.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Cancer Biologic Therapy Market Size is anticipated to reach USD 12.2 Billion by 2035, growing at a CAGR of 5.46% from 2025 to 2035. The market for Japan cancer biologic therapy is expanding as a result of increasing prevalence of cancer, advances in biotechnology, government incentives, rising healthcare expenses, and a move towards personalized medicine, all of which are fueling demand for novel and targeted biologic therapies.

Market Overview

The Japan cancer biologic therapy market refers to advanced treatments such as monoclonal antibodies, immunotherapies, and targeted therapies that use living organisms or their derivatives to fight cancer. These therapies are used to treat lung, breast, colorectal, and melanoma cancers, among others, with increased precision and fewer side effects compared to conventional chemotherapy. The market is aided by an established healthcare network, high disease awareness, and a high level of focus on research and development. Growth opportunities lie in increasing biosimilars, regenerative medicine, and customized therapies. Market expansion is driven by Japan's aging population, leading to an increased incidence of cancer, and advances in biotechnology and precision medicine. Government programs such as the Sakigake Designation system enable the faster development and approval of new therapies, improving patient access to advanced therapies. Increased funding for cancer research further supports innovation in biologic therapies.

Report Coverage

This research report categorizes the market for the Japan cancer biologic therapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cancer biologic therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cancer biologic therapy market.

Japan Cancer Biologic Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.46% |

| 2035 Value Projection: | USD 12.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type of Therapy, By Cancer Type and By Administration Route |

| Companies covered:: | Daiichi Sankyo, Chugai Pharmaceutical, Novartis, Takeda Pharmaceutical Company, Astellas Pharma, Bristol-Myers Squibb, Kyowa Kirin, Gilead Sciences, Fujifilm Cellular Dynamics, Mitsubishi Tanabe Pharma, Merck & Co, Amgen, Eli Lilly and Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan cancer biologic therapy market is driven by the country's aging population and increasing cancer incidences. Biotechnology advancements introduce new therapies such as monoclonal antibodies, cancer vaccines, and gene therapies. Initiatives by the government, like the Sakigake Designation system, accelerate approval of innovative therapies to increase patient access. Chugai Pharmaceutical, Eisai, and Daiichi Sankyo are among the flagship companies leading research and development. Higher biosimilar adoption provides affordable options. Favorable policies and continuous investment generate long-term market growth and personalized therapy.

Restraining Factors

The Japan cancer biologic therapy market is restrained by expensive treatments, complicated regulatory procedures for approval, and sparse reimbursement policies. Furthermore, issues such as possible side effects and the necessity of specialized healthcare infrastructure hamper widespread adoption and slow down market growth.

Market Segmentation

The Japan cancer biologic therapy market share is classified into type of therapy, cancer type, and administration route.

- The monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cancer biologic therapy market is segmented by type of therapy into monoclonal antibodies, vaccines, cytokines, and gene therapy. Among these, the monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their specific activity, efficacy, and minimal side effects. Used extensively for the treatment of cancers like breast, lung, and colorectal, they are favored for their specificity in tumor cell targeting, leading to improved patient outcomes and survival rates.

- The breast cancer segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cancer biologic therapy market is segmented by cancer type into breast cancer, lung cancer, colorectal cancer, and prostate cancer. Among these, the breast cancer segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high incidence among females, growing awareness, and early screening programs. Targeted biologic therapy availability, including HER2 inhibitors, has greatly enhanced treatment efficacy, propelling demand and making it the market leader by cancer type.

- The intravenous segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cancer biologic therapy market is segmented by administration route into intravenous, subcutaneous, oral, and intramuscular. Among these, the intravenous segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its capacity to provide massive doses directly into the bloodstream for quicker, controllable, and efficient treatment. It is highly applied in hospitals to deliver monoclonal antibodies and other biologics, providing high bioavailability and immediate therapeutic effect in cancer patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cancer biologic therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daiichi Sankyo

- Chugai Pharmaceutical

- Novartis

- Takeda Pharmaceutical Company

- Astellas Pharma

- Bristol-Myers Squibb

- Kyowa Kirin

- Gilead Sciences

- Fujifilm Cellular Dynamics

- Mitsubishi Tanabe Pharma

- Merck & Co

- Amgen

- Eli Lilly and Company

- Others

Recent Developments:

- In November 2024, Takeda launched FRUZAQLA® Capsules (fruquintinib) 1mg/5mg in Japan, a selective oral VEGFR-1, -2, and -3 inhibitor for advanced or recurrent colorectal cancer unresponsive to chemotherapy. It is the first novel oral targeted therapy for metastatic colorectal cancer in Japan, regardless of biomarker status, introduced in over a decade.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan cancer biologic therapy market based on the below-mentioned segments:

Japan Cancer Biologic Therapy Market, By Type of Therapy

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Gene Therapy

Japan Cancer Biologic Therapy Market, By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

Japan Cancer Biologic Therapy Market, By Administration Route

- Intravenous

- Subcutaneous

- Oral

- Intramuscular

Need help to buy this report?