Japan Business Process Management Market Size, Share, and COVID-19 Impact Analysis, By Component (IT Solution and IT Service), By Business Function (Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, and Others), By Vertical (Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, and Others), and Japan Business Process Management Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Business Process Management Market Insights Forecasts to 2035

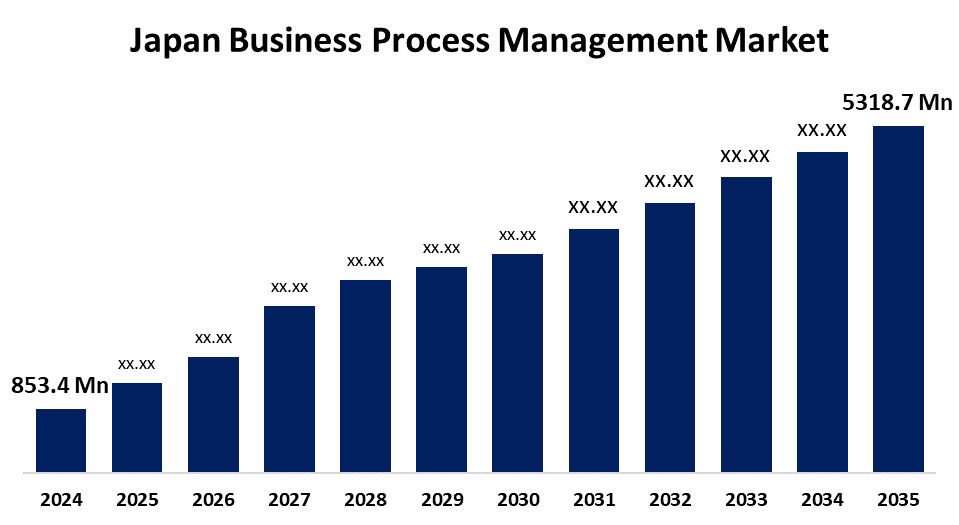

- The Japan Business Process Management Market Size Was Estimated at USD 853.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.1% from 2025 to 2035

- The Japan Business Process Management Market Size is Expected to Reach USD 5318.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Business Process Management Market Size is anticipated to Reach USD 5318.7 Million by 2035, Growing at a CAGR of 18.1% from 2025 to 2035. The Japan business process management market is expanding swiftly with digital transformation, automation requirements, and compliance regulations. Convergence of AI and IoT strengthens the BPM function, providing intelligent process management and predictive analytics to improve operational efficiency and decision-making.

Market Overview

The Japan Business Process Management Market Size refers to the use of tools, techniques, and services for improving, automating, and managing business processes of an organization to improve operational efficiency and responsiveness. BPM is extensively applied in various sectors like manufacturing, finance, healthcare, and IT to automate work processes, cut costs, and increase service quality. Some of the major drivers of the market are Japan focus on digital transformation, mounting pressure to enhance productivity with an aging population, and rising need for process standardization and automation. Strengths of the market are Japan strong technologically oriented infrastructure, digital literacy, and the availability of innovative IT services providers. Opportunities are arising in process automation with AI, cloud-based BPM solutions, and business analytics platform integration to enable concurrent resolution. Moreover, the Society 5.0 government initiatives and projects fostering digital innovation and labour productivity are driving business process management adoption.

Report Coverage

This research report categorizes the market for the Japan business process management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan business process management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan business process management market.

Japan Business Process Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 853.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 18.1% |

| 2035 Value Projection: | USD 5318.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Business Function |

| Companies covered:: | Fujitsu, Nintex, Oracle, Appian, IBM, NTT Data, SAP, Microsoft, Infosys BPM, Genpact, Software AG, Pegasystems, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan business process management market is fuelled by increasing demand for business efficiency, cost savings, and improved workflow automation across industry segments. With an increasingly ageing workforce and shortages in labour, organisations are fast embracing BPM solutions to ensure productivity. The drive towards digital transformation, particularly in the post-pandemic era, has also hurried BPM uptake. Integration of new technologies such as AI, machine learning, and cloud computing increases process visibility and responsiveness. Also, government programs encouraging innovation and productivity gains stimulate the increasing demand for BPM tools and services in different business domains.

Restraining Factors

The Japan business process management market faces constraints due to high initial implementation costs, resistance to organizational change, and a shortage of skilled BPM professionals with the necessary experience to manage and optimize business processes effectively. Furthermore, sophisticated legacy systems and data security issues hamper broad adoption across some industries.

Market Segmentation

The Japan business process management market share is classified into component, business function, and vertical.

- The IT solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan business process management market is segmented by component into IT solution and IT service. Among these, the IT solution segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their process improvement discovers inefficiencies and streamlines operations, making it more efficient. Automation eliminates manual processes with AI and rule-based systems. Also, content and document management guarantee information accessibility, conformity, and efficient organization in enterprises.

- The accounting and finance segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan business process management market is segmented by business function into human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others. Among these, the accounting and finance segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the accuracy, compliance, and efficiency requirements of the financial sector propel BPM demand. BPM simplifies and automates complicated processes such as reporting, budgeting, and invoicing through tasks such as accounting automation, minimizing errors, increasing transparency, accelerating transactions, decreasing costs, and maintaining strict audit trails, requirements for optimal financial management.

- The BFSI segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan business process management market is segmented by vertical into government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others. Among these, the BFSI segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. BPM solutions in BFSI simplify intricate financial processes, improve risk management, and facilitate compliance with regulations. BPM automates repetitive processes, centralizes activities, and maximizes customer satisfaction. BPM also eases main challenges such as regulatory reporting and the detection of fraud, further augmenting its role in the financial industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan business process management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu

- Nintex

- Oracle

- Appian

- IBM

- NTT Data

- SAP

- Microsoft

- Infosys BPM

- Genpact

- Software AG

- Pegasystems

- Others

Recent Developments:

- In June 2024, Nintex announced new AI-powered improvements to the Nintex Process Platform, aimed at significantly reducing the time needed to document, manage, and automate business processes. These updates expand Nintex’s growing portfolio of AI-driven process intelligence and automation capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan business process management market based on the below-mentioned segments:

Japan Business Process Management Market, By Component

- IT Solution

- IT Service

Japan Business Process Management Market, By Business Function

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

Japan Business Process Management Market, By Vertical

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

Need help to buy this report?