Japan Bulletproof Glass Market Size, Share, and COVID-19 Impact Analysis, By Type (Acrylic, Traditional Laminated Glass, Polycarbonate, Glass-Clad Polycarbonate, Ballistic Insulated Glass, and Others), By End Use (Automotive, Military, Banking and Finance, Building and Construction, and Others), and Japan Bulletproof Glass Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Bulletproof Glass Market Insights Forecasts to 2035

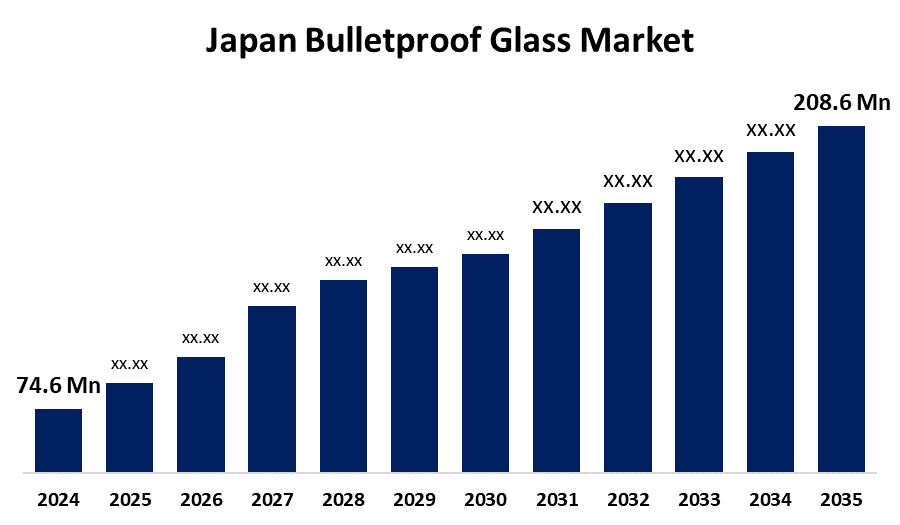

- The Japan Bulletproof Glass Market Size Was Estimated at USD 74.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.8% from 2025 to 2035

- The Japan Bulletproof Glass Market Size is Expected to Reach USD 208.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Bulletproof Glass Market Size is anticipated to reach USD 208.6 Million by 2035, growing at a CAGR of 9.8% from 2025 to 2035. The Japan bulletproof glass market is growing due to the rising security concerns in urban areas and continuous technological advancements. Lighter, stronger, and aesthetic glass is being widely applied to vehicles, buildings, and infrastructure, providing improved safety in commercial, governmental, and critical markets.

Market Overview

The Japan bulletproof glass market refers to the transparent armor produced by laminating glass with materials such as polycarbonate to provide ballistic resistance. These products are used extensively in automotive (VIP/military), banking, defense, and high-security buildings. The advantage of Japan's industry lies in technological superiority, high quality requirements, and high precision manufacturing. AGC Inc. and Nippon Sheet Glass are firms that use robust R&D capabilities. Opportunities exist in broadening applications in public infrastructure, resilience structures, and exclusive real estate developments. Key demand arises from the automotive industry, with armored transport and VIP movement necessitating sophisticated glazing for protection and risk reduction. Growing security consciousness, urbanization, and increased application in governmental buildings further drive demand. Government programs encouraging public safety and infrastructure resilience, like country safety standards requiring impact resistance in public buildings, also foster bulletproof glass uptake.

Report Coverage

This research report categorizes the market for the Japan bulletproof glass market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bulletproof glass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bulletproof glass market.

Japan Bulletproof Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 74.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.8% |

| 2035 Value Projection: | USD 208.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type and By End Use |

| Companies covered:: | Asahi Glass Co., Ltd, Ohara Corporation, Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd, Schott AG, Guardian Industries, PPG Industries, Inc., Consolidated Glass Holdings, Inc., Taiwan Glass Industry Corporation, Smartglass International Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan bulletproof glass market is fueled by growing security issues among the government, military, and commercial markets, as well as rising demand for armored vehicles and secured infrastructure. Performance improvements are enabled by technology advances in light, multi-layered glass composites without reducing visibility or aesthetics. Expanding urbanization and high-value property also stimulate demand for secure glazing in banks, embassies, and high-end buildings. Moreover, state policies ensuring public safety and resilience further foster the use of bulletproof glass in all major infrastructure and transportation sectors.

Restraining Factors

The Japan bulletproof glass market is restrained by the high manufacturing and installation costs, weight and thickness constraints, complex production requiring skilled labor, limited public awareness, and growing competition from more affordable security alternatives like surveillance systems, all of which hinder wider adoption and market expansion.

Market Segmentation

The Japan bulletproof glass market share is classified into type and end use.

- The acrylic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bulletproof glass market is segmented by type into acrylic, traditional laminated glass, polycarbonate, glass-clad polycarbonate, ballistic insulated glass, and others. Among these, the acrylic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its light weight, high impact resistance, and optical clarity. Its high durability, UV resistance, and economic viability make it suitable for use in banks, government offices, and retail outlets. Widespread use in the automobile and defense industries, combined with formulation improvements, increases its security applications.

- The military segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bulletproof glass market is segmented by end use into automotive, military, banking and finance, building and construction, and others. Among these, the military segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing defense expenditures and expanding threats from terrorism and cross-border war push demand for bullet-resistant glass in armored vehicles, bases, and aircraft. Advances in lightweight, multi-layered composites improve protection and mobility. Expanded use in naval ships and helicopters also increases military dominance in market share and innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bulletproof glass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Glass Co., Ltd

- Ohara Corporation

- Saint-Gobain S.A.

- Nippon Sheet Glass Co., Ltd

- Schott AG

- Guardian Industries

- PPG Industries, Inc.

- Consolidated Glass Holdings, Inc.

- Taiwan Glass Industry Corporation

- Smartglass International Ltd.

- Others

Recent Developments:

- In January 2023, Guardian Glass agreed to acquire Miami-based Vortex Glass, improving its offerings of tempered glass products for residential and commercial construction, including shower doors, office partitions, and glass railings, providing customers with comprehensive glass fabrication solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bulletproof glass market based on the below-mentioned segments:

Japan Bulletproof Glass Market, By Type

- Acrylic

- Traditional Laminated Glass

- Polycarbonate

- Glass-Clad Polycarbonate

- Ballistic Insulated Glass

- Others

Japan Bulletproof Glass Market, By End Use

- Automotive

- Military

- Banking and Finance

- Building and Construction

- Others

Need help to buy this report?