Japan Bottled Tea Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Black Tea, Green Tea, Red Tea, Oolong Tea, Herbal Tea, Jasmine Tea, and Fruit Tea), By Product (Sparkling and Still), By Distribution Channel (HORECA, Departmental Stores, Online Stores, Convenience Stores, Drug Stores, Specialty Stores, and Others), and Japan Bottled Tea Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Bottled Tea Market Insights Forecasts to 2035

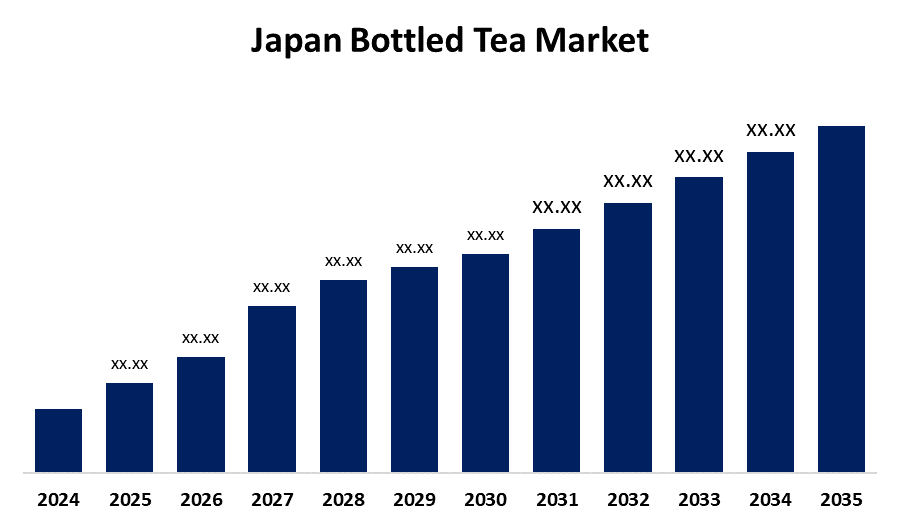

- The Japan Bottled Tea Market Size is Expected to Grow at a CAGR of 4.8% from 2025 to 2035

- The Japan Bottled Tea Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Bottled Tea Market Size is expected to hold a significant share by 2035, at a CAGR of 4.8% during the forecast period 2025-2035. The Japan bottled tea market is growing as a result of several factors, such as the popularity of tea culture, growing health consciousness, and RTD popularity. Additionally, the developments in flavors and packaging, premium and organic focus, and the convenience offered by RTD drinks are also driving the growth of the market.

Market Overview

The Japan market for bottled tea refers to ready-to-drink tea drinks, green, oolong, barley, and specialty blends, conveniently packaged and consumed widely. Used for hydration, refreshment, and well-being, the teas are used by all age groups at work, during travel, or at leisure. Strengths are rich tea culture in Japan, top-quality tea leaf procurement, and state-of-the-art bottling technology ensuring freshness and taste. Opportunities include growing functional and flavor tea varieties, environmentally friendly package innovation, and reaching out to younger consumers through online marketing. Drivers of the market are increasing health consciousness, a choice for natural ingredients, and hectic lifestyles with preferences for on-the-go beverages. Government programs encourage tea drinking and sustainable farming by implementing projects that aid tea farmers and research on the health benefits of tea constituents.

Report Coverage

This research report categorizes the market for the Japan bottled tea market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bottled tea market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bottled tea market.

Japan Bottled Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Flavor, By Product and By Distribution Channel |

| Companies covered:: | Ito En, Ltd., Asahi Soft Drinks Co., Ltd., Harada Seicha, Asuka Tea Factory, Hojicha Co., Kirin Beverages Company, Suntory Beverage & Food Ltd., Fukujuen Co., Ltd., Tenzo, Nestle SA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan bottled tea market is fueled by growth in health awareness, growth in demand for convenient and ready-to-drink beverages, and the robust tea culture of Japan. Bottled tea is favored by consumers due to its natural ingredients and functional advantages, such as antioxidants. Flavour and package innovation also increases attraction, and hectic lifestyles spur on-the-go consumption. Greater awareness about wellness and sustainable products also drives growth in Japan's bottled tea market.

Restraining Factors

The Japan bottled tea market is confronted by stiff competition from energy drinks and flavored waters, health issues regarding high sugar levels, volatile raw material prices, and increasing environmental concerns over plastic waste, all impacting consumer behavior and manufacturing costs.

Market Segmentation

The Japan Bottled Tea Market Share is classified into flavor, product, and distribution channel.

- The green tea segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bottled tea market is segmented by flavor into black tea, green tea, red tea, oolong tea, herbal tea, jasmine tea, and fruit tea. Among these, the green tea segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its rich cultural heritage, extensive health attributes such as antioxidants, natural ingredients, preference of customers, and increasing demand for wellness-promoting functional beverages, propelling its leading market position.

- The still segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bottled tea market is segmented by product into sparkling and still. Among these, the still segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the preference of consumers for non-carbonated beverages. It's natural flavor, health effects, and consistency with conventional tea drinking. Consumers prefer its original taste and functional benefits, which are more sought-after than sparkling forms when consumed daily.

- The online stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bottled tea market is segmented by distribution channel into HORECA, departmental stores, online stores, convenience stores, drug stores, specialty stores, and others. Among these, the online stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing penetration of the internet, home delivery convenience, extensive product offerings, price competitiveness, and increased consumer preference for contactless shopping, particularly among busy and technology-literate customers looking for convenient access to health-oriented beverages.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bottled tea market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ito En, Ltd.

- Asahi Soft Drinks Co., Ltd.

- Harada Seicha

- Asuka Tea Factory

- Hojicha Co.

- Kirin Beverages Company

- Suntory Beverage & Food Ltd.

- Fukujuen Co., Ltd.

- Tenzo

- Nestle SA

- Others

Recent Developments:

- In January 2022, Asahi Soft Drinks Co., Ltd. debuted a new product, Japanese Black Tea Unsweetened Straight, with domestic tea leaves to address increasing consumer demand for high-quality ingredients. It hoped to sell 2 million cases a year in 500 ml PET bottles for convenience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bottled tea market based on the below-mentioned segments:

Japan Bottled Tea Market, By Flavor

- Black Tea

- Green Tea

- Red Tea

- Oolong Tea

- Herbal Tea

- Jasmine Tea

- Fruit Tea

Japan Bottled Tea Market, By Product

- Sparkling

- Still

Japan Bottled Tea Market, By Distribution Channel

- HORECA

- Departmental Stores

- Online Stores

- Convenience Stores

- Drug Stores

- Specialty Stores

- Others

Need help to buy this report?