Japan Blood Transfusion Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Reagents and Kits, Instruments, and Others), By Application (Blood Grouping and Disease Screening), By End Use (Hospitals, Blood Banks, Diagnostics Laboratories, and Others), and Japan Blood Transfusion Diagnostics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Blood Transfusion Diagnostics Market Size Insights Forecasts to 2035

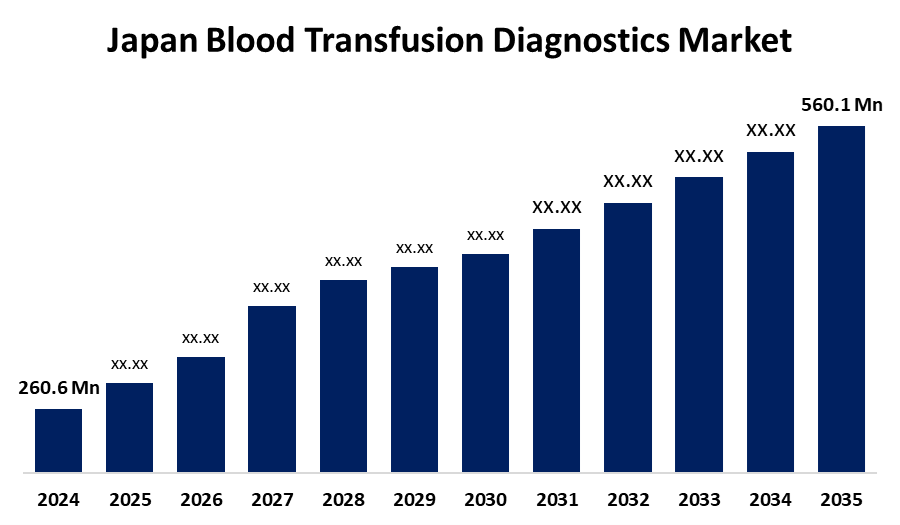

- The Japan Blood Transfusion Diagnostics Market Size Was Estimated at USD 260.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.2% from 2025 to 2035

- The Japan Blood Transfusion Diagnostics Market Size is Expected to Reach USD 560.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Blood Transfusion Diagnostics Market Size is anticipated to reach USD 560.1 million by 2035, growing at a CAGR of 7.2% from 2025 to 2035. The Japan market for blood transfusion diagnostics is growing with an aging population, increased surgical procedures, and the spread of chronic diseases. These factors boost demand for accurate blood typing and compatibility testing that ensures safe transfusions in emergencies and organ transplantations.

Market Overview

The Japan blood transfusion diagnostics market refers to blood grouping, disease screening (HIV, HBV, HCV, syphilis, malaria), compatibility matching, and quality control testing at hospitals, blood banks, and diagnostic laboratories. Japan comparative advantage is found in sophisticated healthcare infrastructure, robust regulatory environments, and advanced technology adoption for automated immunohematology and serologic testing. Opportunities within the market exist with the deployment of innovative technologies, AI implementation in pathology processes, and improvement of reagent and analyzer utilization in driven labs and blood transfusion centers. The market in Japan is driven by increasing blood and blood product demand, spurred by surgery, trauma, chronic disease, and an aging population needing regular transfusions. National regulations are stringent, and strict transfusion safety requirements necessitate thorough infectious disease screening, promoting the use of automated analyzers and highly sensitive molecular testing such as NAT and NGS. Government support through the Japan Blood Products Organization and national blood safety programs also imposes quality standards and stimulates expansion.

Report Coverage

This research report categorizes the market for the Japan blood transfusion diagnostics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan blood transfusion diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan blood transfusion diagnostics market.

Japan Blood Transfusion Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 260.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.2% |

| 2035 Value Projection: | USD 560.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Application, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Sysmex Corporation, Eiken Chemical Co., Ltd., Mindray, Fujirebio, Siemens Healthineers, Abbott Laboratories, Beckman Coulter, Danaher Corporation, Kyowa Kirin Co., Ltd., Agilent Technologies, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Terumo Corporation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan blood transfusion diagnostics market is fuelled by an aging population, an increased number of surgical procedures, and a growing incidence of chronic and infectious diseases necessitating multiple transfusions. Largely strict regulatory requirements for ensuring blood safety foster high adoption of sophisticated diagnostic technologies, such as nucleic acid testing (NAT) and automated screening systems. Moreover, Japan robust healthcare infrastructure, increasing awareness of the risks of transfusion, and government supported measures to guarantee a safe blood supply also accelerate market growth, promoting ongoing innovations in testing precision and efficiency.

Restraining Factors

The Japan blood transfusion diagnostics market is constrained by high installation costs, intricate regulatory specifications, restricted adoption in small facilities, and difficulties in integrating advanced technologies with installed systems, all of which undermine extensive market growth.

Market Segmentation

The Japan blood transfusion diagnostics market share is classified into product, application, and end use.

- The reagents and kits segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan blood transfusion diagnostics market is segmented by product into reagents and kits, instruments, and others. Among these, the reagents and kits segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased population across the world, and improved medical interventions have raised blood transfusions, spurring demand for blood-related products and proper diagnosis. Moreover, increased blood disorders and infectious diseases such as HIV and hepatitis also enhance the demand for effective screening reagents and testing kits.

- The disease screening segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan blood transfusion diagnostics market is segmented by application into blood grouping and disease screening. Among these, the disease screening segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the increased focus on patient safety and avoidance of transfusion-transmitted infections fuels rigorous screening policies for conditions such as HIV, hepatitis B and C, and syphilis. Technological advances have made more precise and cost-effective methods possible, such as nucleic acid amplification and serological assays.

- The blood banks segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan blood transfusion diagnostics market is segmented by end use into hospitals, blood banks, diagnostics laboratories, and others. Among these, the blood banks segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing demand for blood in surgeries, trauma treatment, and chronic disease management triggers the demand for fully equipped blood banks. They provide a safe supply of blood through collection, storage, and delivery. Advances in technology also improve blood typing and compatibility tests, improving accuracy in donor-recipient matching.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan blood transfusion diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sysmex Corporation

- Eiken Chemical Co., Ltd.

- Mindray

- Fujirebio

- Siemens Healthineers

- Abbott Laboratories

- Beckman Coulter

- Danaher Corporation

- Kyowa Kirin Co., Ltd.

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific

- Terumo Corporation

- Others

Recent Developments:

- In November 2024, Terumo BCT partnered with Terumo Medical Products (Hangzhou) to invest in a production facility in Hangzhou’s Qiantang District. The site will manufacture blood and cell separation devices, including Trima Accel™ and Spectra Optia™ systems, to meet growing demand from Chinese hospitals, blood centers, and healthcare providers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan blood transfusion diagnostics market based on the below-mentioned segments:

Japan Blood Transfusion Diagnostics Market, By Product

- Reagents and Kits

- Instruments

- Others

Japan Blood Transfusion Diagnostics Market, By Application

- Blood Grouping

- Disease Screening

Japan Blood Transfusion Diagnostics Market, By End Use

- Hospitals

- Blood Banks

- Diagnostics Laboratories

- Others

Need help to buy this report?