Japan Blockchain in BFSI Market Size, Share, and COVID-19 Impact Analysis, By Type (Private Blockchain, Consortium Blockchain, Public Blockchain), By Application (Smart Contracts, Security, Trade Finance, Digital Currency, Record Keeping, GRC Management, Identity Management & Fraud Detection, Others), and Japan Blockchain in BFSI Market Insights Forecasts to 2033

Industry: Information & TechnologyJapan Blockchain in BFSI Market Size Insights Forecasts to 2033

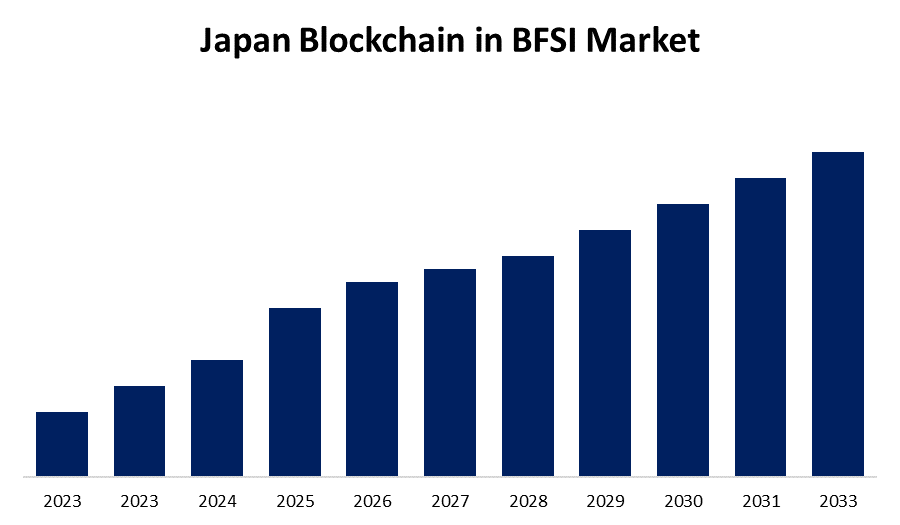

- The Market Size is Growing at a Rapid CAGR from 2023 to 2033.

- The Japan Blockchain in BFSI Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Japan Blockchain in BFSI Market Size is expected to hold a significant share by 2033, at a rapid CAGR during the forecast period 2023 to 2033.

Market Overview

BFSI (banking, financial services, and insurance), blockchain refers to a decentralized and distributed ledger system that securely records and validates transactions over a network of computers. In the financial sector, this technology improves transparency, lowers fraud, and boosts operating efficiency. In BFSI, blockchain is largely applied for secure and tamper-proof record-keeping of financial transactions, including payments, loans, and asset transfers. Smart contracts, self-executing contracts with the terms of the agreement directly put into code, expedite procedures and automate chores, removing the need for middlemen. Blockchain's decentralized structure eliminates the chance of a single point of failure, promotes data integrity, and builds trust among participants. Furthermore, a number of variables are driving the use of blockchain in the Japanese BFSI industry. First, its intrinsic decentralization improves security and transparency, reducing the dangers associated with traditional centralized systems. This decentralization, together with cryptographic encryption, secures the integrity of financial transactions, building trust among stakeholders. In addition, the immutability of blockchain records is a major driver in the BFSI business in Japan.

Report Coverage

This research report categorizes the market for Japan blockchain in BFSI market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan blockchain in BFSI market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan blockchain in BFSI market.

Japan Blockchain in BFSI Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Coinhive, JSECoin, Tidbit, Coinbase, BitPay, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Blockchain adoption in the BFSI sector is driven by a demand for operational efficiency. Smart contracts, which are self-executing codes with established rules, automate procedures, saving time and resources. This efficiency advantage is especially important in the BFSI sector, where quick and accurate transaction processing is essential. Overall, the combination of decentralization, immutability, traceability, and operational efficiency positions blockchain to drive the Japan market in the forecast period.

Restraining Factors

Many fintech companies in Japan are significantly investing in blockchain technology, and governments are adopting strategic measures to standardize the blockchain infrastructure, which is likely to reduce regulatory concerns about blockchain in the BFSI market. Thus, such factors hamper the market growth in Japan.

Market Segment

- In 2023, the public blockchain segment accounted for the largest revenue share over the forecast period.

Based on the type, the Japan blockchain in BFSI market is segmented into private blockchain, consortium blockchain, and public blockchain. Among these, the public blockchain segment has the largest revenue share over the forecast period. Public blockchains are mostly utilized for bitcoin mining and exchange. A public blockchain is decentralized, allowing anybody to run nodes and examine the network's data, giving the blockchain its most significant strength: transparency and openness. Public blockchain provides participants with free access, empowers them by removing regulatory barriers, and allows them to experiment with potential applications, all of which are likely to contribute to the segment's growth throughout the projection period.

- In 2023, the identity management & fraud detection segment accounted for the largest revenue share over the forecast period.

On the basis of application, the Japan blockchain in BFSI market is segmented into smart contracts, security, trade finance, digital currency, record keeping, GRC management, identity management & fraud detection, and others. Among these, the identity management & fraud detection segment has the largest revenue share over the forecast period. Identity management & fraud detection is widespread, and companies are under enormous pressure to protect their consumers' data. Blockchain is a strong tool for solving these difficulties. Account opening and onboarding may be expedited and validated from the start using blockchain. Blockchain enables retail banks to reduce their information verification load by automating the process, increasing blockchain usage in retail banking for KYC and fraud prevention and pushing the segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan blockchain in BFSI market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coinhive

- JSECoin

- Tidbit

- Coinbase

- BitPay

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Japan blockchain in BFSI market based on the below-mentioned segments:

Japan Blockchain in BFSI Market, By Type

- Private Blockchain

- Consortium Blockchain

- Public Blockchain

Japan Blockchain in BFSI Market, By Application

- Smart Contracts

- Security

- Trade Finance

- Digital Currency

- Record Keeping

- GRC Management

- Identity Management & Fraud Detection

- Others

Need help to buy this report?