Japan Black Mass Recycling Market Size, Share, and COVID-19 Impact Analysis, By Material Source (Lithium-ion Batteries, Nickel-metal Hydride Batteries, Lead-acid Batteries, and Others), By Process Type (Pyrometallurgical, Hydrometallurgical, and Mechanical), By Application (Battery Manufacturing, Electronics, Automotive, and Others), and Japan Black Mass Recycling Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Black Mass Recycling Market Insights Forecasts to 2035

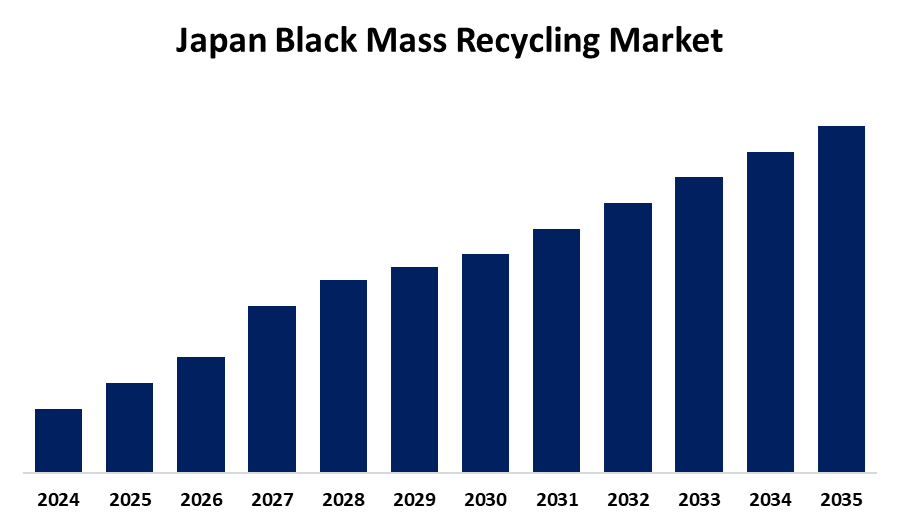

- The Japan Black Mass Recycling Market Size is Expected to Grow at a CAGR of 19.2% from 2025 to 2035

- The Japan Black Mass Recycling Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Black Mass Recycling Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 19.2% during the forecast period 2025-2035. The Japan black mass recycling market is growing due to a combination of factors, led by the accelerating number of electric vehicles (EVs) and the resulting growth in spent lithium-ion batteries. This is also boosted by the environmental pressures, government policies, and improving technologies used in recycling operations.

Market Overview

The Japan black mass recycling market refers to the recycling of used lithium-ion batteries, commonly from EVs, portable electronics, and energy storage systems, to recover valuable cathode metals such as lithium, nickel, cobalt, copper, and manganese. The recovered material can be used in manufacturing batteries, minimizing virgin mining dependency and mitigating environmental footprints. Strengths lie in Asia-Pacs leadership in recycling infrastructure, advanced hydrometallurgical and pyrometallurgical processes, and institutionalized relationships between automakers and recyclers. Opportunities come from technological innovation, growth in EV battery waste streams, and circular partnerships for closed-loop reuse of resources. Growth in the market comes from growing EV adoption, increasing environmental regulation, and battery material shortages, all of which increase demand for circular economy solutions and recycled metals. Japan has strong battery manufacturing and e-waste benefits from high-tech recycling technology and policy incentives such as Eco-Town subsidies and R&D funding for new recovery techniques. Government initiatives, e.g., Japans 3R (reduce, reuse, recycle) policy, waste-cycle legislation, Eco-Town initiatives, and subsidies, also add strength to infrastructure and adoption.

Report Coverage

This research report categorizes the market for the Japan black mass recycling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan black mass recycling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan black mass recycling market.

Japan Black Mass Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 19.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Material Source, By Process Type |

| Companies covered:: | Mitsui & Co., Umicore, VOLTA INC., Nissan Chemical, SMFL, Tenova S.p.A., Sumitomo Metal Mining, BASF SE, Mitsubishi Materials Corporation, Panasonic, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan black mass recycling market is fueled by the growth of electric vehicles, rising battery waste, and growing demand for key metals such as lithium, cobalt, and nickel. Japans initiative for a circular economy, self-sufficiency in resources, and lower raw material import dependence increase the market. Regulations to protect the environment, innovation in metal recycling technology, and corporate ESG initiatives drive adoption further. Government programs like Eco-Town initiatives and 3R policies also encourage environmentally friendly recycling infrastructure development and facilitate the growth of black mass processing facilities.

Restraining Factors

The Japan black mass recycling industry is restrained by high technology and operation costs, intricacy of battery chemistries, lower volume of end-of-life batteries, and regulatory issues in hazardous waste management, all of which impair large-scale, cost-effective recycling processes.

Market Segmentation

The Japan black mass recycling market share is classified into material source, process type, and application.

- The lithium-ion batteries segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan black mass recycling market is segmented by material source into lithium-ion batteries, nickel-metal hydride batteries, lead-acid batteries, and others. Among these, the lithium-ion batteries segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to these batteries are used predominantly in consumer electronics, electric vehicles, and energy storage systems. High-growth trends in these markets have resulted in explosive lithium-ion battery waste generation, fueling the need for effective recycling methods to reclaim precious metals such as lithium, cobalt, and nickel.

- The pyrometallurgical segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan black mass recycling market is segmented by process type into pyrometallurgical, hydrometallurgical, and mechanical. Among these, the pyrometallurgical segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they can recover precious metals such as nickel and cobalt from spent batteries efficiently. These processes tend to be criticized on account of high energy use and emissions, leading industry participants to think creatively about emission-lowering and efficiency.

- The battery manufacturing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan black mass recycling market is segmented by application into battery manufacturing, electronics, automotive, and others. Among these, the battery manufacturing segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to supplying a renewable source of vital materials like lithium, cobalt, and nickel. With ever-increasing demand for lithium-ion batteries in several industries, recycling is necessary to reduce the threats in the supply chain due to raw material shortages and geopolitical factors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan black mass recycling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui & Co.

- Umicore

- VOLTA INC.

- Nissan Chemical

- SMFL

- Tenova S.p.A.

- Sumitomo Metal Mining

- BASF SE

- Mitsubishi Materials Corporation

- Panasonic

- Others

Recent Developments:

- In May 2024, the new joint venture company, J-Cycle Inc., was formed to begin operations at a battery recycling plant in Ibaraki Prefecture, Japan. By September of the same year, subject to necessary permits and approvals. J Cycle Inc. would produce and market black mass from spent batteries as well as scrap produced during battery manufacturing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan black mass recycling market based on the below-mentioned segments:

Japan Black Mass Recycling Market, By Material Source

- Lithium-ion Batteries

- Nickel-Metal Hydride Batteries

- Lead-acid Batteries

- Others

Japan Black Mass Recycling Market, By Process Type

- Pyrometallurgical

- Hydrometallurgical

- Mechanical

Japan Black Mass Recycling Market, By Application

- Battery Manufacturing

- Electronics

- Automotive

- Others

Need help to buy this report?