Japan Bioprocess Analyzers Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments and Consumables & Accessories), By Analysis Type (Substrate Analysis, Metabolite Analysis, and Concentration Detection), By Application (Antibiotics, Recombinant Proteins, Biosimilars, and Other Applications), and Japan Bioprocess Analyzers Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Bioprocess Analyzers Market Insights Forecasts to 2035

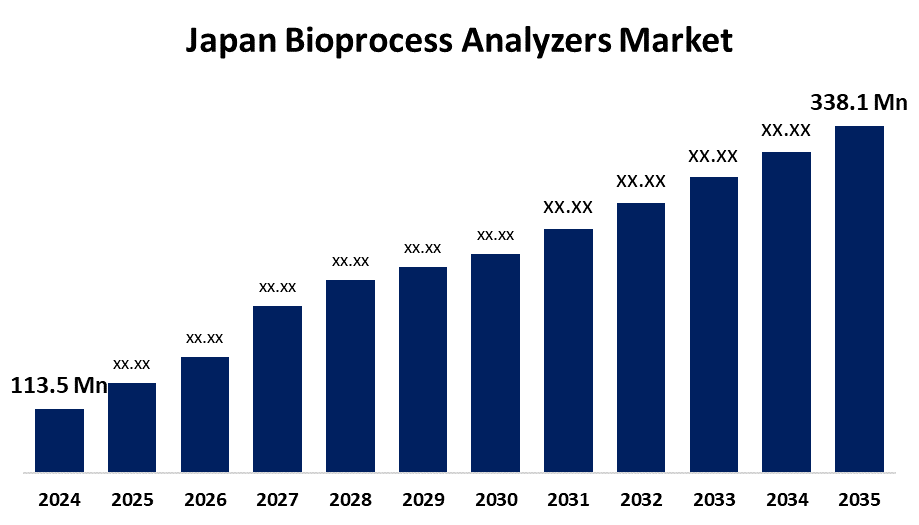

- The Japan Bioprocess Analyzers Market Size Was Estimated at USD 113.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.43% from 2025 to 2035

- The Japan Bioprocess Analyzers Market Size is Expected to Reach USD 338.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Bioprocess Analyzers Market Size is anticipated to reach USD 338.1 Million by 2035, growing at a CAGR of 10.43% from 2025 to 2035. The Japan bioprocess analyzers market is growing due to the increasing need for biologics, advances in bioprocessing technologies, and increased research and development investments. These drives are driving the need for advanced monitoring and control technologies in biopharmaceutical production.

Market Overview

The Japan bioprocess analyzer market refers to equipment, consumables, and accessories used to measure parameters of primary interest, like proteins, metabolites, pH, oxygen, and cell density, of bioprocessing operations like fermentation and cell culture. The analyzers are used in the production of antibiotics, recombinant proteins, biosimilars, and other biologics, ensuring product quality, consistency, and regulatory compliance. The market strength of Japan is its robust automation power, precision engineering, and governmental support through R&D subsidies, industrial clusters like the Greater Tokyo Bio community, and programs under the Bioeconomy Strategy 2030. The opportunities come from the adoption of single-use technology, allowing flexibility and cost savings for rapid deployment in biologics, and growth in biosimilars and mainstream microfluidic systems. Key drivers include Japan's expanding biopharmaceutical industry, rising demand for biologics and personalized medicine, adoption of continuous real-time processing, and the need to increase production efficiency. Government efforts are, inter alia, enhancing regulatory adherence (MHLW/PMDA, GMP), modernizing biosimilar approval, public–private drug innovation councils, conditional regenerative medicine strategies, and financing of biotech clusters/support hubs.

Report Coverage

This research report categorizes the market for the Japan bioprocess analyzers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bioprocess analyzers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bioprocess analyzers market.

Japan Bioprocess Analyzers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 113.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.43% |

| 2035 Value Projection: | USD 338.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Analysis Type, By Application |

| Companies covered:: | Tokyo Chemical Industry Co., Ltd., Agilent Technologies Japan, Ltd., Thermo Fisher Scientific, 4BioCell, Shimadzu Corporation, Danaher Corporation, Nova Biomedical, Sartorius, F. Hoffmann-La Roche, Solida Biotech, Merck KGaA, Bruker Japan K.K., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major drivers of Japan's bioprocess analyzers market are the growth in the demand for biopharmaceuticals, such as biosimilars and personalized medicines, and real-time monitoring and optimization of processes during biologics production. Advanced automation technologies, growing adoption of single-use technologies, and a shift toward continuous bioprocessing also lead the market. Government support through R&D funds, regulatory changes, and the development of biotech clusters also contributes significantly to innovation and the expansion of bioprocessing facilities across the country.

Restraining Factors

The bioprocess analyzers market is held back by restricted adoption, with high acquisition and maintenance costs, stringent regulatory compliance demands, and the complexity of sophisticated analysis techniques. Staffing shortages pose additional complexities to operation and maintenance. Additionally, downstream processing challenges like scale-up limitations and purification difficulties limit market growth.

Market Segmentation

The Japan bioprocess analyzers market share is classified into product, analysis, and application.

- The instruments segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioprocess analyzers market is segmented by product into instruments and consumables & accessories. Among these, the instruments segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are required for the consistency and quality of the products, identifying the urgent need for precise monitoring and control in production processes. Furthermore, progress in biotechnology and bioprocessing technologies provides an opportunity for innovations, which introduce new and better analyzer instruments.

- The substrate analysis segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioprocess analyzers market is segmented by analysis type into substrate analysis, metabolite analysis, and concentration detection. Among these, the substrate analysis segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to attaining the optimal conditions for product yield and cell growth. Bioprocess parameter fine-tuning is enabled by precise analysis of the substrate, thereby enhancing the yield and reproducibility of biopharmaceutical products. In addition, advances in biotechnology have triggered demand for progressively more sophisticated and high-throughput analyzers with capacities to analyze complex substrates as well as undertake real-time measurement.

- The antibiotics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioprocess analyzers market is segmented by application into antibiotics, recombinant proteins, biosimilars, and other applications. Among these, the antibiotics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to giving accurate control and optimization of fermentation. As resistance to antibiotics becomes increasingly severe, Japanese pharmaceutical companies face huge pressures to increase the efficiency and predictability of their antibiotic production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bioprocess analyzers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tokyo Chemical Industry Co., Ltd.

- Agilent Technologies Japan, Ltd.

- Thermo Fisher Scientific

- 4BioCell

- Shimadzu Corporation

- Danaher Corporation

- Nova Biomedical

- Sartorius

- F. Hoffmann-La Roche

- Solida Biotech

- Merck KGaA

- Bruker Japan K.K.

- Others

Recent Developments:

- In November 2024, Agilent Technologies Inc., which is the Japan-based subsidiary of the US company Agilent Technologies, debuted with a new liquid chromatograph. The new product automates multiple analytical processes, thereby easing the burden of researchers. The product is intended for the pharmaceutical and food industry, academia, and CDMOs.

- In May 2023, Cytiva acquired Pall's life sciences business, adding Allegro and Supor brands to its bioprocess portfolio. This bolstered Danaher's strength, speeding up therapeutic development and solidifying its position of leadership in the global life sciences industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bioprocess analyzers market based on the below-mentioned segments:

Japan Bioprocess Analyzers Market, By Product

- Instruments

- Consumables & Accessories

Japan Bioprocess Analyzers Market, By Analysis Type

- Substrate Analysis

- Metabolite Analysis

- Concentration Detection

Japan Bioprocess Analyzers Market, By Application

- Antibiotics

- Recombinant Proteins

- Biosimilars

- Other Applications

Need help to buy this report?