Japan Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Product (Bioherbicides, Bioinsecticides, Biofungicides), By Formulation (Liquid, Dry), and Japan Biopesticides Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Biopesticides Market Insights Forecasts to 2035

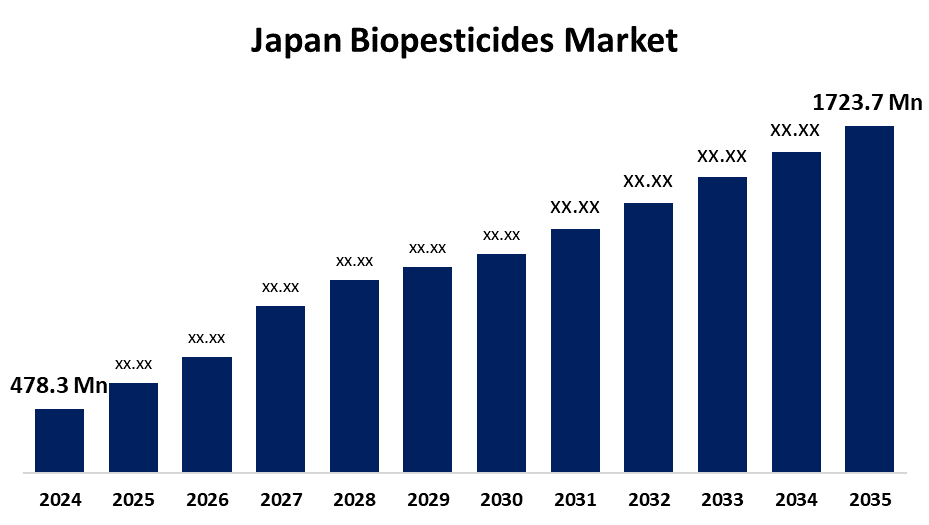

- The Japan Biopesticides Market Size Was Estimated at USD 478.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.36% from 2025 to 2035

- The Japan Biopesticides Market Size is Expected to Reach USD 1723.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Biopesticides Market Size is anticipated to reach USD 1723.7 Million by 2035, growing at a CAGR of 12.36% from 2025 to 2035. There are multiple drivers contributing to the expansion of the Japan biopesticides market. This market is growing primarily because of increased consumer interest in obtaining organic food, increased awareness of the harmful impacts of chemical pesticides, and increasing government support for sustainable agricultural practices.

Market Overview

The biopesticides market contains environmentally-conscious pest control products that include natural raw materials (i.e., plants, microorganisms, and minerals). These products will provide the public with an environmentally-sustainable alternative to synthetic pesticides that have greater harmful effects to both the environment and human health, thus creating some risk with synthetic pesticide use. Biopesticides can provide more environmentally sustainable alternatives to chemical pesticides used in conventional agriculture, organic agriculture, and many other areas. Major regulations and restrictions on chemicals and a sustainable environmental focus, along with shifting customer preference, all play a role in evolving the growth trajectory of the market in biopesticides.

Moreover, incentives and subsidies related to biopesticide use will generate demand by allowing more farmers to use biopesticides. Because of increasing concerns regarding the environmental impact of chemicals, biopesticides are often employed by farmers in integrated pest management (IPM) programs that provide strategies of pest control practices to help improve sustainability in agriculture. Ongoing technological innovations in biotechnology research will continue to develop new and effective biopesticide products to meet the various needs of Japanese agriculture. Within the biopesticides market in Japan, the opportunity for market expansion is endless, including opportunities to develop unique formulations, capitalize on the increasing demand for organic and residue-free products, and use biopesticides in combination with precision agricultural practices to target their application. Market share expansion will be dependent on collaborations, mergers and acquisitions, and research and development spending on new biopesticides.

Japan's government is promoting biopesticides with a strong commitment to organic farming, sustainability, and modifications to lower the reliance on conventional pesticides. One of the government targets is to promote 25% of Japanese farmland to organic farming by 2050. In addition, the government also supports organic farming through programs like the "Green Food System Strategy," which set targets for lowering CO2 emissions, risk of agrochemicals, and chemicals from fertilizer. This myriad of pathways will promote the development and use of biopesticides.

Report Coverage

This research report categorizes the market for the Japan biopesticides market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan biopesticides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan biopesticides market.

Japan Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 478.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.36% |

| 2035 Value Projection: | USD 1723.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 279 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product and By Formulation |

| Companies covered:: | Valent Biosciences Corporation, Emery Oleochemicals, Ishihara Sangyo Kaisha Ltd, BASF, Bayer CropScience, Ishihara Sangyo Kaisha Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Sustainable agricultural practices and the minimization of toxic pesticide use are promoted through the Japanese government, which is the primary factor for market growth. The direct use of biopesticides as an alternative to chemical pesticides is on the increase through government subsidies and regulations that encourage farmers to navigate towards more ecologically friendly agricultural practices. Organic farming is gaining momentum in Japan with increasing knowledge of the adverse effects from agricultural chemical use. The sales of biopesticides are also increasing based on shifting consumer preferences towards organic food items and health knowledge. Consumer awareness of environmental sustainability and health is a further driver for the biopesticides market in Japan. This awareness has caused agricultural producers to seek pest management approaches that are better for the environment and safer in general. In a survey conducted in 2023 by the Japan Organic Agriculture Association, 68% of Japanese consumers reported that they prefer vegetables that use the least amount of chemicals possible. Japan's high-tech infrastructure is also aiding the development of biopesticides. The advancement of new biologicals with better efficacy and specificity from advances in genetic engineering and biotechnology is also driving the market.

Restraining Factors

The Primary restraining factor for market growth is high cost. Biopesticides, particularly those based on natural organisms, can have a higher cost than traditional chemical pesticides. The cost of extraction and creating active biological ingredients can lead to a high cost of goods sold. Higher costs can prohibit farmers from using biopesticides, like small and poor farmers in Japan. Biopesticide efficacy can also be affected by environmental temperatures and humidity, as well as pest complexity. Many farmers are not aware of the advantages of biopesticides and it is expected during the anticipated time to hinder demand for biopesticides due to this lack of farmer awareness. The ignorance of farmers to new products is considered a constraint to biopesticide sales in japan.

Market Segmentation

The Japan Biopesticides Market share is classified into product and formulation.

- The bioinsecticides segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biopesticides market is segmented by product into bioherbicides, bioinsecticides, and biofungicides. Among these, the bioinsecticides segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increased usage of bioinsecticides to control various pests on food crops (e.g., fruits, vegetables, grains) is the primary growth driver of the segment. Bioinsecticides can be produced in a shorter time frame and at a lower total cost (including R&D) than pesticides. This gives businesses a direct financial benefit over competing products. Demand for bioinsecticides stemmed from the demand for biological agents like Beauveria bassiana and Bacillus thuringiensis as they were considered to be more effective, specific, and less environmental load than chemical pesticides.

- The liquid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biopesticides market is segmented by formulation into liquid, dry. Among these, the liquid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its advantages of lowered nozzle clogging and improved field performance, liquid formulations are increasingly popular. Liquid formulations are favorable because they are simpler to use, especially in larger-scale farming operations. The product could also benefit market share during the forecast period due to its repetitive, easy-to-apply methodology. Liquid can comprise any combination of oil, polymer, water, or a combination of two, which is likely to drive market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan biopesticides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valent Biosciences Corporation

- Emery Oleochemicals

- Ishihara Sangyo Kaisha Ltd

- BASF

- Bayer CropScience

- Ishihara Sangyo Kaisha Ltd.

- Others

Recent Developments:

- In March 2024, BASF invests in a new fermentation plant for biological and biotechnology-based crop protection products at its Ludwigshafen facility. This reinforces the portfolio of biological and biotech-based crop protection products. The plant will manufacture products that add value for farmers including biological fungicides and biological seed treatment.

- In February 2023, Bayer and Kimitec have announced a new strategic agreement focused on accelerating the development and commercialization of biological crop-protection products and biostimulants. As part of a ratified deal, both companies will become key partners to advance and establish biological solutions based on natural sources: crop protection products managing pests, diseases and weeds, and biostimulants promoting plant growth.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Biopesticides Market based on the below-mentioned segments:

Japan Biopesticides Market, By Product

- Bioherbicides

- Bioinsecticides

- Biofungicides

Japan Biopesticides Market, By Formulation

- Liquid

- Dry

Need help to buy this report?