Japan Biomaterials Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Metallic, Ceramic, Polymer, Natural, and Others), By Application (Cardiovascular, Orthopedics, Plastic Surgery, Ophthalmology, Dental, Neurology, Tissue Engineering, and Others), and Japan Biomaterials Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Biomaterials Market Insights Forecasts to 2035

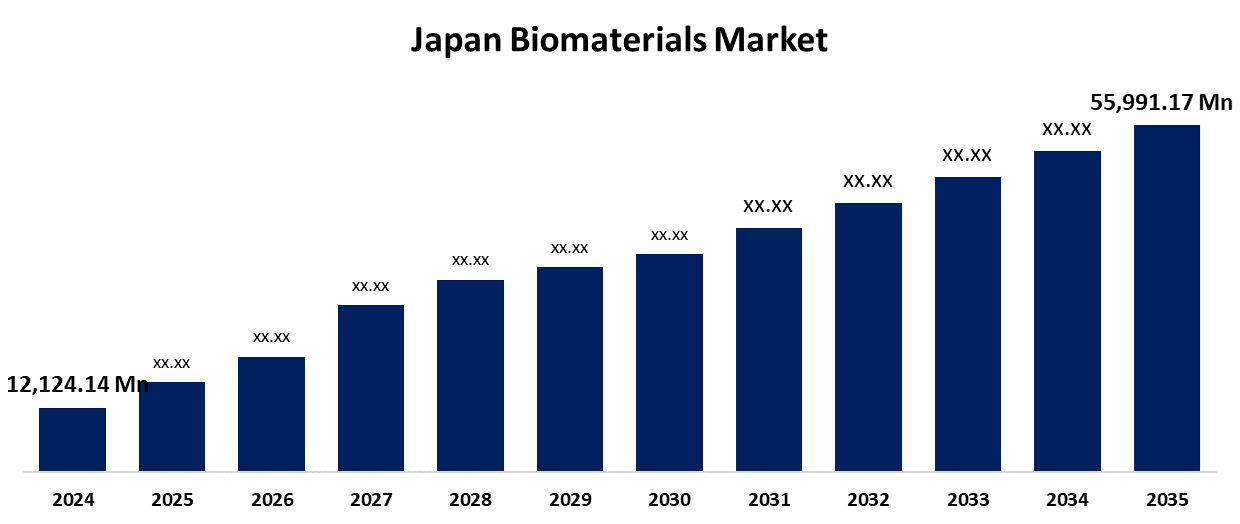

- The Japan Biomaterials Market Size Was Estimated at USD 12,124.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.92% from 2025 to 2035

- The Japan Biomaterials Market Size is Expected to Reach USD 55,991.17 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Biomaterials Market is anticipated to reach USD 55,991.17 million by 2035, growing at a CAGR of 14.92% from 2025 to 2035. The Japan biomaterials market is driven by increasing demand for advanced medical technologies, aging population, and innovations in tissue engineering and regenerative medicine.

Market Overview

The Japan biomaterials market refers to the industry focused on materials designed to interact with biological systems for medical or therapeutic purposes. Japan is a leader in medical innovation and technology, investing heavily in R&D to advance the field of biomaterials. This covers state-of-the-art developments in tissue engineering, regenerative medicine, and the creation of more effective biomaterials for use in medicine. Innovative materials that offer improved biocompatibility and lower the risk of difficulties, like biopolymers, ceramics, and biodegradable polymers, are being investigated by Japanese research institutes and businesses. The market is growing as a result of this continuous innovation, which encourages the development of next-generation biomaterials that satisfy the changing needs of contemporary healthcare.

Report Coverage

This research report categorizes the market for the Japan biomaterials market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan biomaterials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan biomaterials market.

Japan Biomaterials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12,124.14 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.92% |

| 2035 Value Projection: | USD 55,991.17 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Chemical Corporation, Shinyei Kaisha, Terumo Corporation, Nippon Steel Corporation, Kyocera Corporation, Takeda Pharmaceutical Co. Ltd., Astellas Pharma Inc. and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population, rising healthcare needs, and technological breakthroughs in medicine are some of the major drivers propelling the biomaterials market in Japan. The need for biocompatible materials in tissue engineering, implants, and prosthetics is increasing as personalized medicine gains more attention. The market is also expanding as a result of Japan's strong regenerative medicine research and development as well as its cutting-edge biomaterials. Accelerated uptake of environmentally friendly biomaterials is also greatly aided by government assistance for healthcare innovation and sustainability. The efficiency and functionality of medical applications are further improved by trends like the incorporation of nanotechnology and 3D printing in biomaterial research, which draw substantial investment. All of these elements work together to propel the biomaterials market's growth and establish Japan as a global leader in the healthcare materials industry.

Restraining Factors

Regulatory issues also pose serious obstacles to the expansion of the biomaterials business in Japan. Although medical materials and devices are governed by a well-established regulatory framework in Japan, the clearance process for novel biomaterials can be drawn out and difficult. To guarantee the safety and efficacy of biomaterials, the Pharmaceuticals and Medical Devices Agency (PMDA) and other regulatory agencies demand a great deal of clinical data and testing prior to their commercialization.

Market Segmentation

The Japan biomaterials market share is classified into product type and application.

- The metallic system segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biomaterials market is segmented by product type into metallic, ceramic, polymer, natural, and others. Among these, the metallic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their strength, resilience to corrosion, and durability, metallic biomaterials such as stainless steel, gold, magnesium, and silver are frequently utilized in cardiovascular, dental, and orthopedic implants.

- The orthopedics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biomaterials market is segmented by application into cardiovascular, orthopedics, plastic surgery, ophthalmology, dental, neurology, tissue engineering, and others. Among these, the orthopedics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Biomaterials are utilized in orthopedics, one of the biggest fields, for fracture repair, bone grafting, and joint replacement. Growing demand in this field is a result of Japan's aging population.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan biomaterials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation

- Shinyei Kaisha

- Terumo Corporation

- Nippon Steel Corporation

- Kyocera Corporation

- Takeda Pharmaceutical Co. Ltd.

- Astellas Pharma Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan biomaterials market based on the below-mentioned segments:

Japan Biomaterials Market, By Product Type

- Metallic

- Ceramic

- Polymer

- Natural

- Others

Japan Biomaterials Market, By Application

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Need help to buy this report?