Japan Biologics Market Size, Share, and COVID-19 Impact Analysis, By Source (Microbial, Mammalian, and Others), By Product (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, and Others), By Disease (Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, and Others), and Japan Biologics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Biologics Market Insights Forecasts to 2035

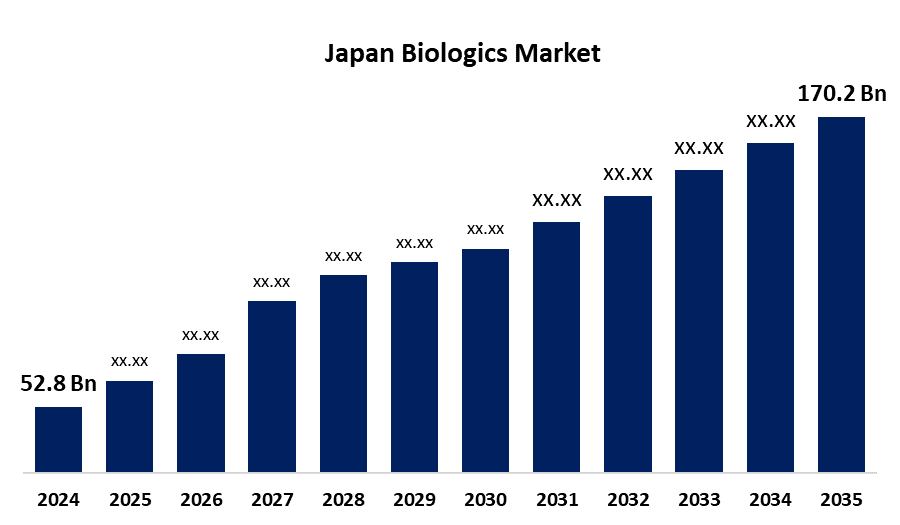

- The Japan Biologics Market Size Was Estimated at USD 52.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.23% from 2025 to 2035

- The Japan Biologics Market Size is Expected to Reach USD 170.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan biologics market is anticipated to reach USD 170.2 billion by 2035, growing at a CAGR of 11.23% from 2025 to 2035. The Japan biologics market is growing due to the rising incidence of chronic diseases, mounting need for cost-effective therapies, growth in biotechnology, and encouragement by the government for innovation. Precisely, demographic aging, increased need for biosimilars, and increased use of precision medicine are important drivers.

Market Overview

The Japan biologics market refers to a multifaceted array of therapeutics that are derived from living organisms, ranging from monoclonal antibodies, vaccines, gene therapies, to cell-based therapies. These biologics play a critical role in the treatment of complex diseases like cancer, autoimmune diseases, and chronic diseases. Moreover, growth in biotechnology and a well-developed healthcare infrastructure also boost the size of the market. The opportunities are in biosimilar development, regenerative medicine, and personalized therapy. The major drivers for market growth are Japan's population aging, which translates into a growing incidence of age-related disease, and the increasing demand for precision medicine. Initiatives by the government, for example, the Bioeconomy Strategy 2030, are intended to spur innovation and make Japan's biopharmaceutical industry more wordwide competitive. The government of Japan has taken various initiatives to aid the biopharmaceutical sector, such as increased funding for R&D, tax benefits, and regulatory policies for streamlining the approval procedure of innovative drugs.

Report Coverage

This research report categorizes the market for the Japan biologics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan biologics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan biologics market.

Japan Biologics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.23% |

| 2035 Value Projection: | USD 170.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Source, By Product, By Disease and COVID-19 Impact Analysis |

| Companies covered:: | Otsuka Holdings, Takeda Pharmaceutical, Astellas Pharma, Mochida Pharmaceutical, Daiichi Sankyo, Pfizer Japan, Chugai Pharmaceutical, Teva Japan, Fujifilm Kyowa Kirin Biologics, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan biologics market is fueled by its aging population, increased prevalence of chronic and autoimmune diseases, and increased demand for targeted, personalized therapies. Technological advancements in biotechnology, robust healthcare infrastructure, and increased acceptance of biosimilars also contribute to market growth. Furthermore, government incentives supporting R&D expenditure, regulatory encouragement, and Japan's focus on innovation in precision medicine are speeding up the development and uptake of biologics within the healthcare sector.

Restraining Factors

The Japan biologics market is constrained by such factors as strict drug price regulation, excessive regulatory approval delays, scant government support for fundamental research, and a lack of qualified experts. These serve to undermine innovation, lower profitability, and affect the worldwide competitiveness of the sector.

Market Segmentation

The Japan biologics market share is classified into source, product, and disease.

- The microbial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biologics market is segmented by source into microbial, mammalian, and others. Among these, the microbial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their ease of affordability, scalability, and high productivity in manufacturing biologics. Microorganisms like yeast and E. coli are highly suitable for generating recombinant proteins, enzymes, and vaccines due to their production at highly rapid growth rates and due to easier genetic manipulation.

- The monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biologics market is segmented by product into monoclonal antibodies, vaccines, recombinant proteins, antisense, RNAi and molecular therapy, and others. Among these, the monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their key function in cancer, autoimmune, and infectious diseases. The precision of the specificity of the target antigens has put them in a position as irreplaceable in personalized medicine. Bispecific antibodies and antibody-drug conjugates are new sites of improvement in antibody engineering, enhancing the efficiency of the therapeutic products.

- The oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biologics market is segmented by disease into oncology, immunological disorders, cardiovascular disorders, hematological disorders, and others. Among these, the oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to an increase in cancer incidence worldwide and the growing use of target therapies. Developments in biologic drugs like monoclonal antibodies, checkpoint inhibitors, and cell-based therapies provide increased survival benefits and quality of life as part of cancer treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan biologics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otsuka Holdings

- Takeda Pharmaceutical

- Astellas Pharma

- Mochida Pharmaceutical

- Daiichi Sankyo

- Pfizer Japan

- Chugai Pharmaceutical

- Teva Japan

- Fujifilm Kyowa Kirin Biologics

- Others

Recent Developments:

- In May 2025, Biocon Biologics, a subsidiary of Biocon, announced today that its commercial partner in Japan, Yoshindo Inc., has launched Ustekinumab BS Subcutaneous Injection [YD], a biosimilar to the reference product Stelara (ustekinumab). The biosimilar ustekinumab, developed and manufactured by Biocon Biologics, is commercialized and marketed in Japan by Yoshindo Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan biologics market based on the below-mentioned segments:

Japan Biologics Market, By Source

- Microbial

- Mammalian

- Others

Japan Biologics Market, By Product

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense

- RNAi and Molecular Therapy

- Others

Japan Biologics Market, By Disease

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

Need help to buy this report?