Japan Bioactive Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Polyphenols, Carotenoids, Prebiotics, Probiotics, Fatty Acids, Proteins & Amino Acids, Vitamins, Minerals, Fibres, and Others), By Source (Plant Based, Animal Based, Microbial, Marine, and Others), By Application (Food & Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Animal Nutrition, and Others), and Japan Bioactive Ingredients Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Bioactive Ingredients Market Size Insights Forecasts to 2035

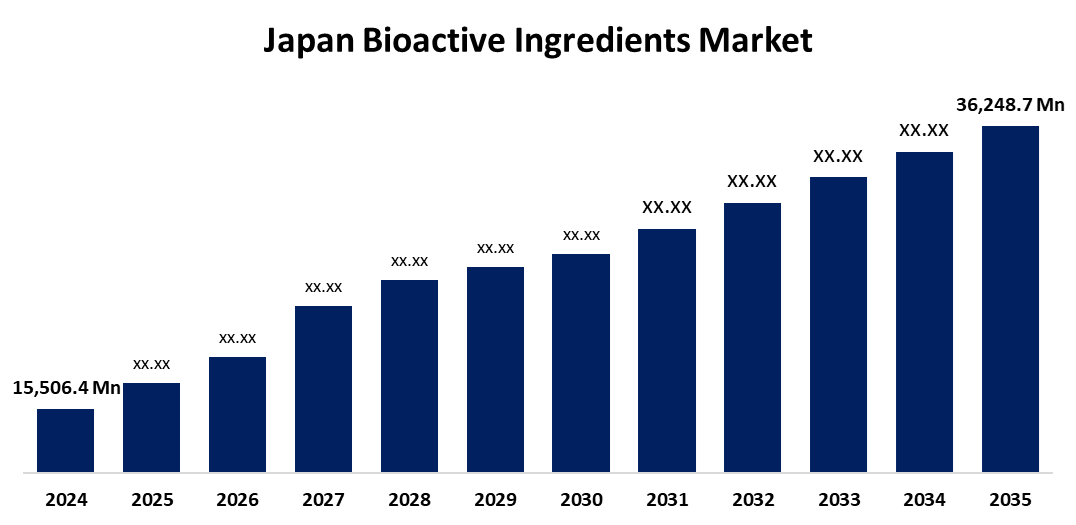

- The Japan Bioactive Ingredients Market Size Was Estimated at USD 15,506.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.03% from 2025 to 2035

- The Japan Bioactive Ingredients Market Size is Expected to Reach USD 36,248.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan bioactive ingredients market Size is anticipated to reach USD 36,248.7 million by 2035, growing at a CAGR of 8.03% from 2025 to 2035. The market for bioactive ingredients in Japan is developing due to the high demand for health and wellness products from consumers being high, the presence of big drug and food companies, and increasing demand for functional foods as well as dietary supplements.

Market Overview

The Japan bioactive ingredients marekt refers to vitamins, minerals, plants extracts, fibers, antioxidants, probiotis, and omega-3s, and is addressed to leading segments like functional foods, nutraceuticals, pharmaceuticals, cosmetics, and animal nutrition. Learning application are the immune system, gastrointestinal health, and skin care, with sustained R&D and consumer confidence in functional food items, Japans establised pharmaceutical sector and increasing R&D strength, encompassing API manufacturing, also boos demand. Opportunities include growing demand for immune-active(e.g. beta-glucans), gut-benefit ingredients, and personalized nutrition provide opportunities for innovation in functional foods, beverages, and supplements. Market growth in japan is stimulated by an aging population, increased health consciousness, and the desire for preventive healthcare. Government initiatives are to ensure regulatory support through FOSHU/FHC/FNFC systems, alog with stricter quality controls and reporting provision, that increase products credibility and saftery.

Report Coverage

This research report categorizes the market for the Japan bioactive ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bioactive ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bioactive ingredients market.

Japan Bioactive Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15,506.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.03% |

| 2035 Value Projection: | USD 36,248.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product Type, By Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto Co., Inc., Otsuka Pharmaceutical, Kirin Holdings, Meiji Holdings, Kyowa Hakko Bio, BASF SE, Nippon Shinyaku, Morinaga Milk Industry, Cargill, Archer Daniels Midland Company, and DHC Corporation and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan bioactive ingredients market is propelled by its aging demographic, growing public focus on health and wellness, and a deep-rooted cultural preference for preventive healthcare solutions. High demand for functional food products, supplements, and clean-label products propels industry growth. Evolving pharmaceutical and nutraceutical industries in the nation, along with robust R&D in plant and natural ingredients, also fuel innovation. Platforms like FOSHU and growing interest in immunity, gut wellness, and nutrition personalization similarly propel the consumption of bioactive ingredients in food, beverage, and wellness categories.

Restraining Factors

The intensive production and formulation costs, stringent regulatory approvals, and poor customer knowledge of certain newer bioactive ingredients are market restraints for the Japan bioactive ingredients industry. Additionally, the availability of stable-quality raw materials is challenging for manufacturers to achieve the scalability and standardization of products.

Market Segmentation

The Japan bioactive ingredients market share is classified into product type, source, and application.

- The fatty acid segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioactive ingredients market is segmented by product type into polyphenols, carotenoids, probiotics, prebiotics, fatty acid, protein & amino acid, vitamins, minerals, fibres, and others. Among these, the fatty acid segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the surging demand for Omega-3 and Omega-6 fatty acids due to their heart, brain, and anti-inflammatory properties. The post-COVID changes in lifestyle have seen more health conditions such as obesity and diabetes, and consumers have turned to preventive healthcare and functional nutrition.

- The plant based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioactive ingredients market is segmented by source into plant based, animal based, microbial, marine, and others. Among these, the plant based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rising worldwide demand for natural, clean-label, and vegan foods, especially in functional foods, supplements, and personal care. Fruits & vegetables, cereals & grains, herbs & spices, and oilseeds & pulses are a few of the sources of plant-based bioactives.

- The food & beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bioactive ingredients market is segmented by application into food & beverages, dietary supplements, pharmaceuticals, cosmetics & personal care, animal nutrition, and others. Among these, the food & beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to consumers increasingly looking for foods and drinks that provide health benefits beyond general nutrition. Functional foods typically contain probiotics, prebiotics, omega-3s, vitamins, and plant polyphenols, which frequently occur in dairy, fermented beverages, energy drinks, nutrition bars, fortified breakfast cereals, functional juices, and ready-to-drink teas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bioactive ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc.

- Otsuka Pharmaceutical

- Kirin Holdings

- Meiji Holdings

- Kyowa Hakko Bio

- BASF SE

- Nippon Shinyaku

- Morinaga Milk Industry

- Cargill

- Archer Daniels Midland Company

- DHC Corporation

- Others

Recent Developments:

- In January 2025, Otsuka Pharmaceutical Factory launched ENOSOLID Semi Solid for Enteral Use, a semi-solid nutritional preparation customized to Japanese eating habits. Containing 900 kcal, it supplies necessary vitamins and trace elements, and contains L-carnitine for fat metabolism and inulin as a source of dietary fiber.

- In October 2022, Cargill partnered with Japan-based Unitec Foods and Fuji Nihon Seito to enhance innovation and market reach for food ingredient solutions across Japan and the Asia-Pacific. The collaboration aims to strengthen business relationships by leveraging the unique expertise and capabilities of all three companies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bioactive ingredients market based on the below-mentioned segments:

Japan Bioactive Ingredients Market, By Product Type

- Polyphenols

- Carotenoids

- Prebiotics

- Probiotics

- Fatty Acids

- Proteins & Amino Acids

- Vitamins

- Minerals

- Fibres

- Others

Japan Bioactive Ingredients Market, By Source

- Plant Based

- Animal Based

- Microbial

- Marine

- Others

Japan Bioactive Ingredients Market, By Application

- Food & Beverages

- Dietary Supplements

- Pharmaceuticals

- Cosmetics & Personal Care

- Animal Nutrition

- Others

Need help to buy this report?