Japan Bio-Based Construction Polymer Market Size, Share, and COVID-19 Impact Analysis, By Product (Chitosan Market, Epoxies, Polyethylene Terephthalate, and Polyurethane), By Application (Insulation, Pipe, Profile, and Others), and Japan Bio-Based Construction Polymer Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Bio-Based Construction Polymer Market Size Insights Forecasts to 2035

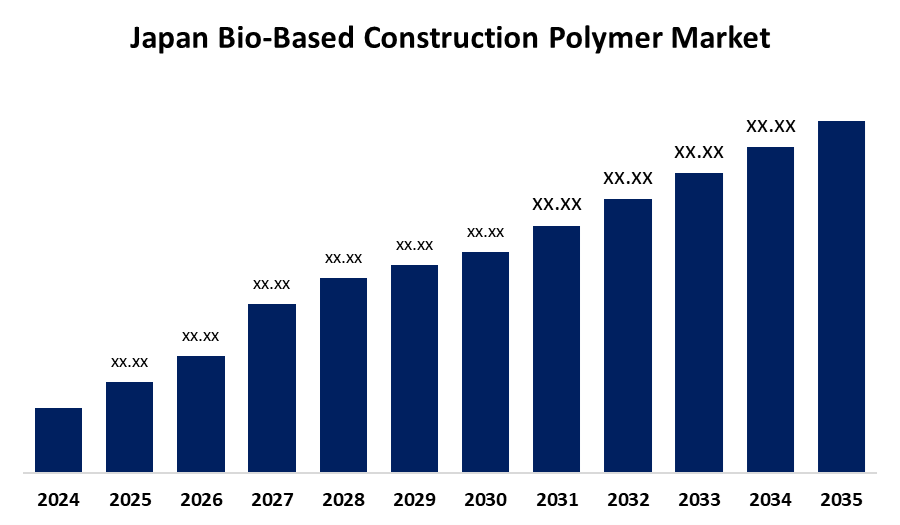

- The Japan Bio-Based Construction Polymer Market Size is Expected to Grow at a CAGR of 5.5% from 2025 to 2035

- The Japan Bio-Based Construction Polymer Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Bio-Based Construction Polymer Market Size is expected to hold a significant share by 2035, at a CAGR of 5.5% during the forecast period 2025-2035. The Japan market for bio-based construction polymers is growing due to a combination of factors, including increasing environmental awareness to policy encouragement by the government towards sustainable materials, as well as the inherent benefits of bio-based polymers in terms of biodegradable capability and reduced carbon footprint.

Market Overview

The Japan Bio-Based Construction Polymer Market Size refers to those produced from renewable biomass (for example, plants, agricultural residues), giving environmentally sound alternatives to petroleum-based plastics. They are used in insulation, pipes, cladding panels, floor coverings, adhesives, coatings, and structural elements, valued for energy efficiency, extended service life, and reduced carbon footprint. Bio-based polyurethanes and epoxies increasingly compete with or replace fossil-based products for thermal insulation and structural robustness. The Japanese domestic led champions like Asahi Kasei, Mitsui Chemicals, and Mitsubishi Gas Chemical accelerate capabilities on the basis of carbon dioxide based and vegetable-oil feedstocks. Upgrading aging infrastructure in earthquake-prone regions drives the need for durable, lightweight, high-performance materials. Urbanization and smart cities promote sustainable polymers for prefabricated construction. Japanese regulation and carbon-neutrality targets (2050) generate demand. Certifications like CASBEE for green buildings promote the use of sustainable materials. Government Policies, including Japans Bioplastics Roadmap, aims to replace 20 % of plastics by 2030. In addition, CASBEE links the use of green materials to building permits.

Report Coverage

This research report categorizes the market for the Japan bio-based construction polymer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bio-based construction polymer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bio-based construction polymer market.

Japan Bio-Based Construction Polymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Gas Chemical Company, Kaneka Corporation, Evonik Industries, Teijin Plastics, NatureWorks LLC, Asahi Kasei, SK Chemicals, Kuraray Co. Ltd., Toray Industries, Daicel Corporation, Unitika Ltd., BASF SE, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Demand in Japans bio-based construction polymers market is driven by increasing environmental consciousness, strict carbon neutrality goals, and the higher cost of petroleum-based products. Government policies favoring sustainable construction and initiatives like the "Bioplastics Roadmap" promote greater adoption. Energy-efficient, earthquake-resistant buildings likewise ensure demand for high-performance bio-based products. Green building criteria such as CASBEE also ensure that developers use environmentally friendly polymers, in line with the broader strategy of sustainability and innovation in Japanese construction.

Restraining Factors

The Japan bio-based building polymer market is faced with challenges, including production costs that are too high, limited ability to scale up, and competition from well-established petroleum-based products. Technical challenges, including inconsistency in performance and an absence of awareness among consumers, also pose hindrances to extensive use across the building sector.

Market Segmentation

The Japan bio-based construction polymer market share is classified into product and application.

- The polyurethane segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bio-based construction polymer market is segmented by product into chitosan market, epoxies, polyethylene terephthalate, and polyurethane. Among these, the polyurethane segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the use of bio-based polyurethanes as insulators in the building and construction sectors. polyurethane is applied in thermal insulation, spray foams, and sealants. Its high energy-saving properties and flexibility across temperature zones render it most sought after in green buildings.

- The pipe segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bio-based construction polymer market is segmented by application into insulation, pipe, profile, and others. Among these, the pipe segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the widespread use of plastics in the construction industry for various purposes, pipe connections. Plastic mixes are becoming increasingly popular, big time, for pipes and fittings. They are cheap to make, will not rust, and will not weigh on. Builders prefer using sustainable polymers for door parts, window frames, drains, gutters, flooring, glass, wall panels, insulation, adhesives, cement, and roofs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bio-based construction polymer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Gas Chemical Company

- Kaneka Corporation

- Evonik Industries

- Teijin Plastics

- NatureWorks LLC

- Asahi Kasei

- SK Chemicals

- Kuraray Co. Ltd.

- Toray Industries

- Daicel Corporation

- Unitika Ltd.

- BASF SE

- Others

Recent Developments:

- In June 2024, Kaneka Corporation announced that its Green Planet biodegradable film and foam products have been embraced by Suzuki Motor Corporation as packaging for outboard motors. The film is applied to dust covers and parts bags, and the foam for cushioning, encouraging environmentally friendly options in marine equipment packaging.

- In February 2023, Mitsui Chemicals and Mitsubishi Gas Chemical jointly announced a collaborative project to make biomass polycarbonate resin, in line with their carbon neutrality vision by 2050. Mitsui Chemicals will provide biomass-originated BPA under its BePLAYER™ name, which will be used as feedstock by MGC to make its Iupilon™ polycarbonate resin.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bio-based construction polymer market based on the below-mentioned segments:

Japan Bio-Based Construction Polymer Market, By Product

- Chitosan Market

- Epoxies

- Polyethylene Terephthalate

- Polyurethane

Japan Bio-Based Construction Polymer Market, By Application

- Insulation

- Pipe

- Profile

- Others

Need help to buy this report?