Japan Beverage Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Bottles, Cans, Pouches, Cartons, and Others), By Material (Plastic, Metal, Glass, Paperboard, and Others), By Application (Alcoholic Beverages, Non-Alcoholic Beverages), and Japan Beverage Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Beverage Packaging Market Insights Forecasts to 2035

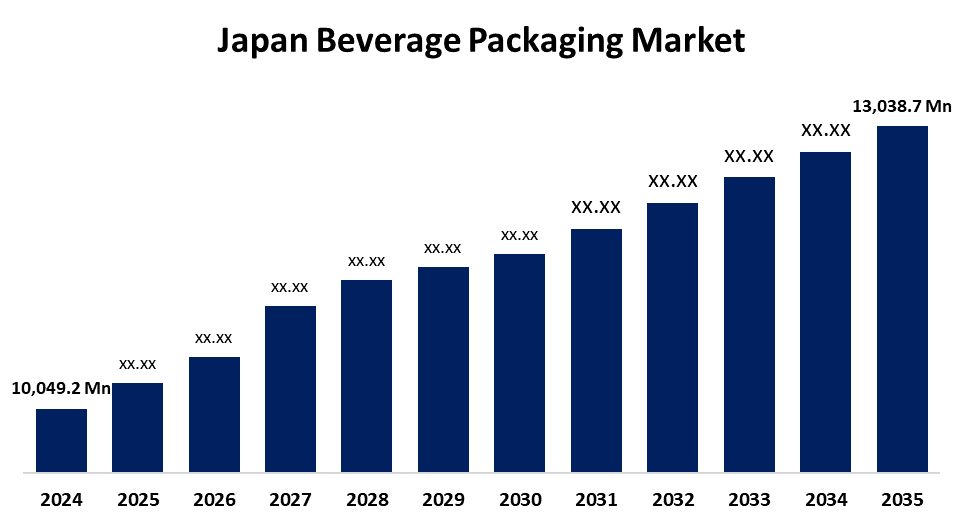

- The Japan Beverage Packaging Market Size was Estimated at USD 10,049.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.4% from 2025 to 2035

- The Japan Beverage Packaging Market Size is Expected to Reach USD 13,038.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan beverage packaging market Size is anticipated to reach USD 13,038.7 Million by 2035, growing at a CAGR of 2.4% from 2025 to 2035. The Japan beverage packaging market is experiencing substantial growth due to the intersection of multiple drivers, including demand for convenience, healthy beverages, and sustainable packaging solutions.

Market Overview

The Japan beverage packaging market refers to the industry of designing, producing, and supplying packaging solutions for different beverages such as soft drinks, juices, water, and alcohol. It is the industry that consists of companies that manufacture and sell packaging materials such as glass containers, aluminum cans, paper cartons, and plastic bottles for use in the beverage sector. Strengths consist of an aging market with well-established players and a wide array of packaging choices, while opportunities are in taking advantage of the trend toward sustainable materials, functional packaging, and high-end finishes. The market is driven by drivers such as increasing on-the-go consumption, wellness and health trends, growing sustainability issues, and fast-moving e-commerce platforms. The government of Japan is actively encouraging sustainable action in the market for beverage packaging, with schemes such as the Act on Promotion of Resource Circulation for Plastics and the Containers and Packaging Recycling Law.

Report Coverage

This research report categorizes the market for the Japan beverage packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan beverage packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan beverage packaging market.

Japan Beverage Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10,049.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 2.4% |

| 2035 Value Projection: | USD 13,038.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Material and By Application |

| Companies covered:: | Mitsubishi Chemical Holdings Corporation, Toyo Seikan Group Holdings, Ltd., Asahi Group Holdings, Ltd., Oji Holdings Corporation, Nihon Yamamura Glass Co., Ltd., Tokan Kogyo Co., Ltd., Showa Denko K.K., Dai Nippon Printing Co., Ltd., Toyo Ink SC Holdings Co., Ltd., Toppan Printing Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese market for beverage packaging is driven by rising demand for on-the-go consumption, trends for health and wellness, sustainability, and rapid expansion of e-commerce. Consumers are seeking beverages with functional benefits like probiotics, vitamins, and antioxidants, pushing for packaging solutions that preserve these ingredients, such as aseptic. The rise of online shopping is influencing packaging design, requiring stronger, more tamper-resistant materials for product integrity during delivery. Government regulations and policies regarding plastic waste and recycling are also encouraging the adoption of more sustainable packaging practices.

Restraining Factors

The Japan beverage packaging market faces several restraining factors, including fluctuating raw material prices, intense competition, environmental concerns, and stringent regulations. Additionally, pressure to reduce costs while maintaining quality, complex packaging processes, and resistance to sustainable alternatives further challenge the market.

Market Segmentation

The Japan Beverage Packaging Market share is classified into product, material, and application.

- The bottles segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan beverage packaging market is segmented by product into bottles, cans, pouches, cartons, and others. Among these, the bottles segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they offer several advantages, including durability, transparency (for product visibility), and recyclability. Bottles are a ubiquitous and versatile packaging choice for a wide range of beverages, including carbonated soft drinks, bottled water, juices, and alcoholic beverages.

- The glass segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan beverage packaging market is segmented by material into plastic, metal, glass, paperboard, and others. Among these, the glass segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its usage being preferred for wine, spirits, craft beers, and specialty juices, among other beverages. Glass containers are a good barrier to oxygen and UV light, which means they protect the flavour and integrity of the product over time.

- The non-alcoholic beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan beverage packaging market is segmented by application into alcoholic beverages, non-alcoholic beverages. Among these, the non-alcoholic beverages segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to maintaining product freshness, conveying nutritional information, and catering to consumer preferences for convenience and sustainability. This category includes familiar favorites such as carbonated soft drinks, bottled water, fruit and vegetable juices, milk, energy drinks, and the increasingly popular plant-based alternatives like almond and oat milk.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan beverage packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Holdings Corporation

- Toyo Seikan Group Holdings, Ltd.

- Asahi Group Holdings, Ltd.

- Oji Holdings Corporation

- Nihon Yamamura Glass Co., Ltd.

- Tokan Kogyo Co., Ltd.

- Showa Denko K.K.

- Dai Nippon Printing Co., Ltd.

- Toyo Ink SC Holdings Co., Ltd.

- Toppan Printing Co., Ltd.

- Others

Recent Developments:

- In February 2025, Dai Nippon Printing Co., Ltd. agreed to acquire Resonac Packaging Co., Ltd. from Resonac Corporation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan beverage packaging market based on the below-mentioned segments:

Japan Beverage Packaging Market, By Product

- Bottles

- Cans

- Pouches

- Cartons

- Others

Japan Beverage Packaging Market, By Material

- Plastic

- Metal

- Glass

- Paperboard

- Others

Japan Beverage Packaging Market, By Application

- Alcoholic Beverages

- Non-Alcoholic Beverages

Need help to buy this report?