Japan Beauty & Personal Care Products Market Size, Share, COVID-19 Impact Analysis, By Type (Personal Care Products and Cosmetics/Make-up Products), By Distribution Channel (Hypermarkets & Supermarkets, Salons, Direct-to-consumer, E-commerce, Pharmacies, Specialty Stores, Others), and Japan Beauty & Personal Care Products Market Insights Forecasts to 2032

Industry: Consumer GoodsJapan Beauty & Personal Care Products Market Insights Forecasts to 2032

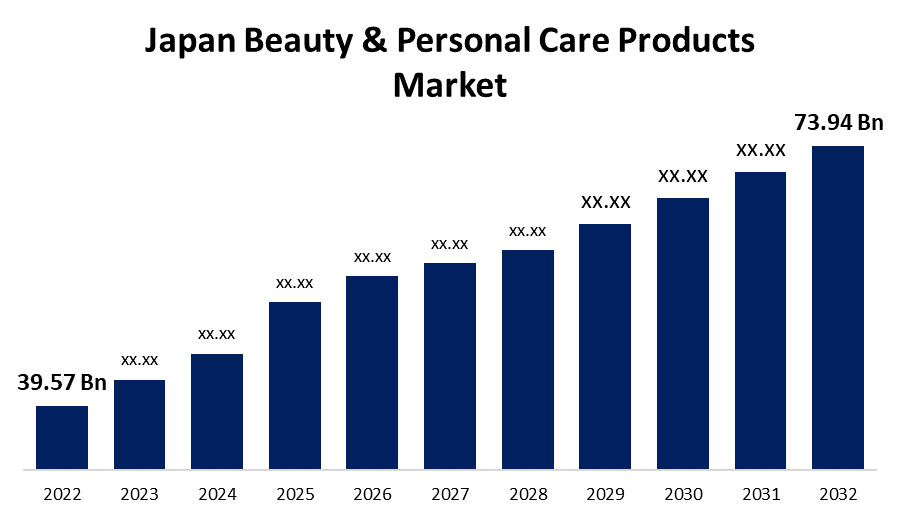

- The Japan Beauty & Personal Care Products Market Size was valued at USD 39.57 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.45% from 2022 to 2032.

- The Japan Beauty & Personal Care Products Market Size is expected to reach USD 73.94 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan Beauty & Personal Care Products Market Size is expected to reach USD 73.94 billion by 2032, at a CAGR of 6.45% during the forecast period 2022 to 2032.

Market Overview

Japan is one of the largest markets for beauty and personal care products. When it comes to chemical formulas in hair products, Japanese customers are exceptionally smart and well-informed. The increased popularity of the application of organic materials in beauty and skin care products has resulted in a variety of product improvements. The advantages of these organic compounds have been identified and used to meet evolving demands from customers. In addition, Japan is home to around 3,000 beauty care enterprises, including global brands Shiseido, Kao, Kosé, and Pola Orbis. Manufacturers such as Unilever, Shiseido, and many others are efficient in the development and testing of new products for clients. One of the causes of the region's cosmetic market's growth is the emergence of e-commerce. Organic cosmetics from various manufacturers are accessible on e-commerce websites such as Amazon, Rakuten, Yahoo, Lahaco, and others. As a result, consumers have more options for beauty products.

Report Coverage

This research report categorizes the market for Japan Beauty & Personal Care Products Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Beauty & Personal Care Products Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Beauty & Personal Care Products Market.

Japan Beauty & Personal Care Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 39.57 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.45% |

| 2032 Value Projection: | USD 73.94 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 146 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Distribution Channel, Country Statistics (Demand, Price, Growth, Competitors, Challenges) and COVID-19 Impact Analysis |

| Companies covered:: | Shiseido, Mandom Corporation, L’Oreal S.A., Kao Corporation, Unilever PLC, POLA Orbis Holdings Inc., Kosé Corporation, Koh Gen Do, Noevir Holdings Co., Ltd., FANCL Corporation, Nippon Menard Cosmetic Co., Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The growing concern of customers regarding their physical appearance is one of the key elements driving Japan beauty and personal care product market expansion. The skin care, color cosmetics, and hair care are among the beauty and personal care products that the younger generation is using on a daily basis. The development of cosmetics including natural, non-toxic, and organic components has also contributed to the expansion of the Japanese market. Furthermore, increased consumer awareness of the benefits of adopting vegan, organic, natural, and environmentally friendly cosmetics has spurred producers to create new products and extend their market reach. Furthermore, Japanese corporations are extremely involved in the marketing and advertising of their products. Market participants are proactively and firmly promoting their products in order to stay competitive and capture customer attention. Instagram, YouTube, Facebook, TikTok, Twitter, Line, and other social media sites are popular among young people in Japan.

Market Segment

- In 2022, the personal care products segment accounted for the largest revenue share of more than 62.8% over the forecast period.

On the basis of type, the Japan Beauty & Personal Care Products Market is segmented into personal care products and cosmetics/make-up products. Among these, the personal care products segment is dominating the market with the largest revenue share of 62.8% over the forecast period. The personal care products segment is further subdivided into skin care, hair care, fragrance, body care, lip care, oral care, color cosmetics, bath & shower, and others. Among these, the skincare segment accounted for the largest market segment. Skincare products can rejuvenate, moisturize and safeguard the skin, remove wrinkles and symptoms of aging, reduce the recurrence of acne and lighten spots, and maintain the skin healthy and young. These advantages continue to boost the skincare market in the personal care products segment.

- In 2022, the specialty store segment accounted for the largest revenue share of more than 39.2% over the forecast period.

On the basis of distribution channels, the Japan Beauty & Personal Care Products Market is segmented into hypermarkets & supermarkets, salons, direct-to-consumer, e-commerce, pharmacies, specialty store, and others. Among these, the specialty store segment is dominating the market with the largest revenue share of 39.2% over the forecast period, owing to the growing presence of such stores in Japan. To attract client interest and give them the opportunity the option of choosing from a variety of brands and types before making a purchase, these retailers have focused on delivering natural and chemical-free beauty and personal care products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Beauty & Personal Care Products Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shiseido

- Mandom Corporation

- L'Oreal S.A.

- Kao Corporation

- Unilever PLC

- POLA Orbis Holdings Inc.

- Kosé Corporation

- Koh Gen Do

- Noevir Holdings Co., Ltd.

- FANCL Corporation

- Nippon Menard Cosmetic Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, KINS, founded in Japan, intends to establish its worldwide headquarters in Singapore as it expands regionally and builds its R&D expertise and skin data to produce goods aimed at Asian consumers. This year, the company will launch its global headquarters in Singapore, as well as its first skin clinic, to collect more data for R&D and to investigate the possibility of personalization. KINS plans to make its products available in Thailand this year through a local distributing partner.

- On February 2023, ORBIS, a Japanese cosmetic brand, plans to expand its skin care range and release products for men in their 40s, a group that is 'increasing significantly'. The new products, which comprise a facial cleanser, lotion, and cream, were created to attain clean, shiny, and translucent skin. Furthermore, the line contains chemicals that combat common acne-related skin issues like roughness. To produce relevant products, the company will continue to explore men's skin care with an emphasis on men in their 40s.

- In August 2023, Mitsui & Co. (U.S.A.), Inc. has established Shik Beauty (www.shikobeauty.com), the only marketplace offering expertly-tested and curated goods that blend timeless Japanese rituals with proven, effective ingredients. Mitsui's Beauty Personal Care Group, based in New York City, provides raw materials, technologies, and innovations to beauty brands through its end-to-end platform, Shik Beauty Collective, as part of an initiative to accelerate Japanese inspired beauty in the United States.

- In July 2021, Shiseido announced the launch of a new ingestible beauty brand called "INRYU," which seeks to improve the entire health of the skin from the inside out to help people achieve distinctive beauty and wellness throughout their life. INRYU is a supplement line that, when taken consistently, distributes beauty components throughout the body, allowing consumers to shine with inner brilliance every day.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Beauty & Personal Care Products Market based on the below-mentioned segments:

Japan Beauty & Personal Care Products Market, By Type

- Personal Care Products

- Skin Care

- Face Creams & Moisturizers

- Shaving Lotions

- Creams

- Others

- Hair Care

- Shampoo

- Conditioner

- Hair Colorants

- Hair Styling Products

- Others

- Fragrance

- Perfumes

- Fine Fragrances

- Essential Oils & Aromatherapy

- Others

- Body Care

- Lip Care

- Oral Care

- Color Cosmetics

- Bath & Shower

- Others

- Skin Care

- Cosmetics/Make-up Products

- Powders

- Gels

- Lotions

- Others

Japan Beauty & Personal Care Products Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Salon

- Direct-to-consumer

- E-commerce

- Pharmacies

- Specialty Store

- Others

Need help to buy this report?