Japan Bamboo Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Herbaceous Bamboos, Tropical Woody Bamboos, and Temperate Woody Bamboos), By End-Use (Wood and Furniture, Construction, Food, Pulp and Paper, Textile, Agriculture, and Others), and Japan Bamboo Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Bamboo Market Insights Forecasts to 2035

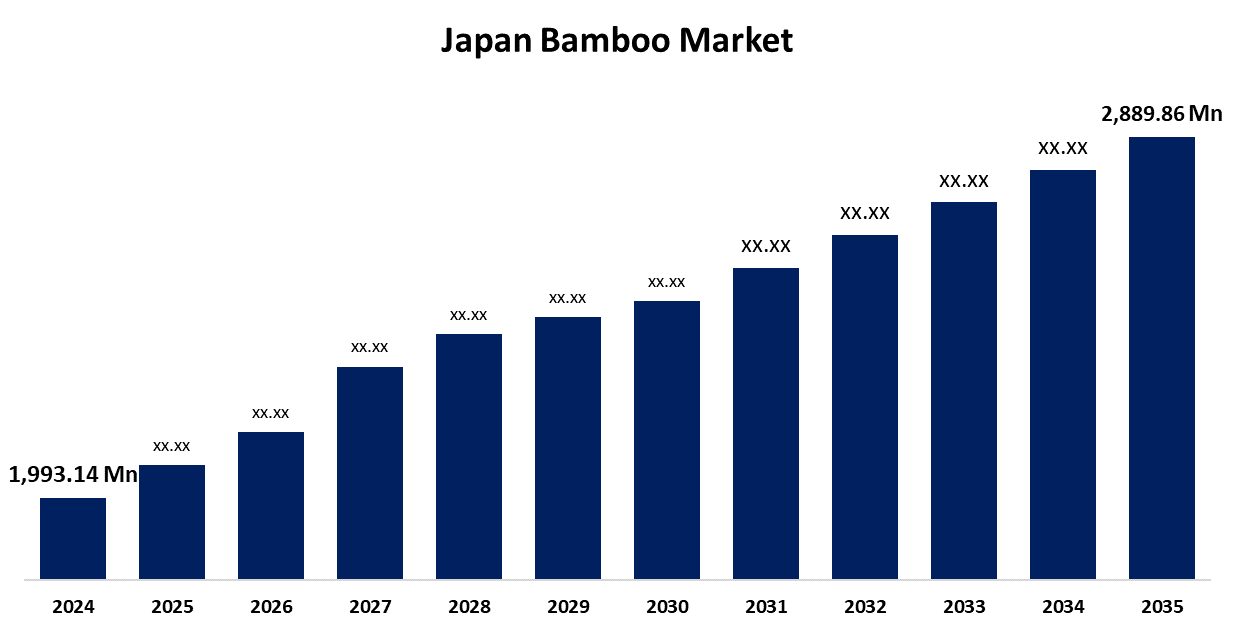

- The Japan Bamboo Market Size Was Estimated at USD 1,993.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.43% from 2025 to 2035

- The Japan Bamboo Market Size is Expected to Reach USD 2,889.86 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Bamboo Market Size is Anticipated to Reach USD 2,889.86 Million by 2035, Growing at a CAGR of 3.43% from 2025 to 2035. The market is driven by Japan’s growing emphasis on sustainable materials, government support for green construction, and the rising popularity of bamboo in modern architecture and lifestyle products.

Market Overview

The Japan bamboo market refers to the cultivation, processing, and application of bamboo across various industries such as construction, furniture, food, and textiles. Bamboo is a fast-growing, renewable, and eco-friendly material deeply rooted in Japanese culture and increasingly valued for its sustainability and versatility. Bamboo's strength and adaptability, together with growing awareness of sustainable materials and their advantages, are major market drivers. The market outlook is also being improved by government programs encouraging the use of sustainable materials in a variety of industries, especially packaging and building. The use of bamboo in creative product lines and its integration into contemporary architectural designs are two trends that support market expansion. The primary driver of this expansion is the rising demand for bamboo goods in a variety of industries, such as paper, furniture, and construction.

Report Coverage

This research report categorizes the market for the Japan bamboo market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bamboo market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bamboo market.

Japan Bamboo Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,993.14 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.43% |

| 2035 Value Projection: | USD 2,889.86 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End-Use and COVID-19 Impact Analysis. |

| Companies covered:: | MOSO International B.V., Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd., Xiamen HBD Industry & Trade Co., Ltd., Dassogroup, Smith & Fong and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bamboo market in Japan is expanding due to rising environmental sustainability awareness. Bamboo has become a popular sustainable substitute for conventional materials as businesses and consumers look to lessen their environmental effect. It is perfect for uses in anything from textiles to architecture because of its quick growth, renewability, and adaptability. Bamboo's attractiveness has increased even more as a result of government programs supporting environmentally beneficial activities. For example, more than 70% of buyers increasingly take sustainability into account when making selections. Bamboo goods are now more in demand across a range of industries as a result of this change in customer behavior. Major construction companies also report a notable increase in requests for bamboo-based building materials. Policies encouraging the use of sustainable materials, such as bamboo, in new construction have also been put in place by the Tokyo Metropolitan Government.

Restraining Factors

The market is subject to a number of limitations. Large-scale bamboo production is restricted by Japan's mountainous geography and a lack of available land. Production costs are raised by high processing costs and the requirement for specialist treatment to guarantee durability. Product availability is impacted by supply chain inefficiencies, such as seasonal harvests and uneven quality. Furthermore, bamboo's market penetration is constrained by competition from conventional and synthetic materials like steel, plastic, and hardwood.

Market Segmentation

The Japan bamboo market share is classified into product type and end-use.

- The tropical woody bamboos segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bamboo market is segmented by product type into herbaceous bamboos, tropical woody bamboos, and temperate woody bamboos. Among these, the tropical woody bamboos segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. These species are favored for their high strength, durability, and suitability for structural and industrial applications, making them ideal for construction and furniture manufacturing in Japan’s urban and rural development projects.

- The wood and furniture segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bamboo market is segmented by end-use into wood and furniture, construction, food, pulp and paper, textile, agriculture, and others. Among these, the wood and furniture segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to bamboo’s aesthetic appeal, strength-to-weight ratio, and eco-friendly profile, which align with Japan’s demand for sustainable interior design and traditional craftsmanship.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bamboo market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MOSO International B.V.

- Bamboo Village Company Limited

- Shanghai Tenbro Bamboo Textile Co., Ltd.

- Xiamen HBD Industry & Trade Co., Ltd.

- Dassogroup

- Smith & Fong

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Bamboo Market based on the below-mentioned segments:

Japan Bamboo Market, By Product Type

- Herbaceous Bamboos

- Tropical Woody Bamboos

- Temperate Woody Bamboos

Japan Bamboo Market, By Application

- Wood and Furniture

- Construction

- Food

- Pulp and Paper

- Textile

- Agriculture

- Others

Need help to buy this report?