Japan Balsa Wood Market Size, Share, and COVID-19 Impact Analysis, By Product (Grade A, Grade B, and Grade C), By End Use (Aerospace & Defence, Marine, Wind Energy, and Others), and Japan Balsa Wood Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Balsa Wood Market Size Insights Forecasts to 2035

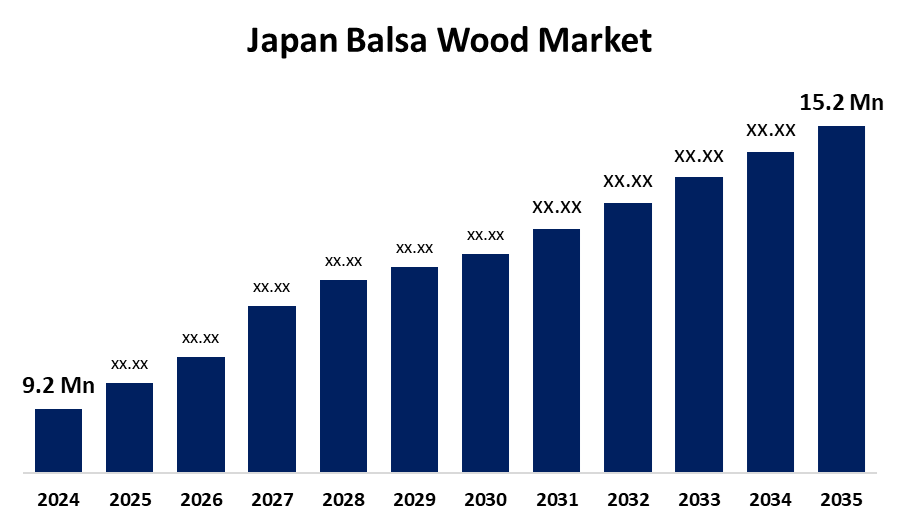

- The Japan Balsa Wood Market Size Was Estimated at USD 9.2 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.67 % from 2025 to 2035

- The Japan Balsa Wood Market Size is Expected to Reach USD 15.2 million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Balsa Wood Market Size is anticipated to reach USD 15.2 million by 2035, growing at a CAGR of 4.67 % from 2025 to 2035. The balsa wood market in Japan is driven by various factors, including growing demand in the aerospace, automotive, and marine industries, increasing focus on renewable energy and sustainable construction materials, and rising environmental awareness.

Market Overview

Balsa wood is a lightweight, softwood derived primarily from the Ochroma pyramidale tree. The market refers to the production, processing, distribution, and trade of basala wood. Balsa wood has a high strength-to-weight ratio, excellent thermal and acoustic insulation, good buoyancy, and easy machinability and bonding. Balsa wood is recognized for its lightweight, strength, and versatility; hence, it is used in various industries such as aerospace & defence, marine, and wind energy. A key factor propelling the market is the growing demand for lightweight materials across the aviation, automotive, and construction sectors. As Japan invests heavily in innovation within these fields, balsa wood’s low density and high strength make it an attractive choice for manufacturers aiming to enhance fuel efficiency and promote sustainability. Additionally, the rising popularity of DIY home improvement projects is boosting balsa wood demand, as consumers look for cost-effective and easy-to-use materials. The rising inclination towards sustainable materials is a key trend in this market. The expanding wind energy sector presents a major growth opportunity for the balsa wood market. As demand for renewable energy rises, lightweight and durable materials like balsa are increasingly preferred. Its use as a core material in wind turbine blades enhances efficiency and performance.

Report Coverage

This research report categorizes the market for the Japan balsa wood market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan balsa wood market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan balsa wood market.

Japan Balsa Wood Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.67 % |

| 2035 Value Projection: | USD 15.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Takahashi Kenzai Co., Ltd., Mitsui & Co., Ltd., Ube Material Industries Ltd, Daiken Corporation, Kaneka Corporation, Kyoei Sangyo, Nippon Steel Corporation, Marubeni Corporation, Sumitomo Forestry Co., Ltd., Yamazaki Sangyo Co., Ltd., Hokuetsu Corporation, Kansai Paint Co., Ltd., Oji Holdings Corporation, Tateyama Co., Ltd., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan balsa wood market is growing due to rising demand from the model building sector, driven by hobbyists and professionals. Sales of plastic models have increased by 15% over the past three years, reflecting strong consumer interest. Balsa wood’s light weight and ease of use, along with support from educational institutions and associations, further fuel this demand. The market for balsa wood in Japan is also being driven by the growing emphasis on environmentally friendly products and sustainable forestry. Additionally, advances in balsa wood processing methods are producing higher-quality products and new uses, which have major impacts on the Japanese balsa wood market.

Restraining Factors

Changes in weather patterns or extreme weather events can affect their growth and quality of balsa trees, since the cultivation of balsa wood is susceptible to these factors is one of the notable restraints in this market. Additionally, the competition from alternative materials like synthetic foams and composites further limits the market expansion.

Market Segmentation

The Japan balsa wood market share is classified into product and end use.

- The grade A segment held the largest share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan balsa wood market is segmented by product into grade A, grade B, and grade C. Among these, the grade A held the largest share of the market in 2024 and is anticipated to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its superior density uniformity, minimal defects, and excellent strength-to-weight ratio. Additionally, increasing demand for high-quality, lightweight materials across critical industries such as marine and wind energy is propelling the market.

- The wind energy segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan balsa wood market is segmented by end use into aerospace & defence, marine, wind energy, and others. Among these, the wind energy segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the natural stiffness and high strength-to-weight ratio of the balsa wood render it a superior core material in the manufacturing of wind turbine blades, where light and strong structures are of supreme importance to provide maximum performance and efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan balsa wood market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takahashi Kenzai Co., Ltd.

- Mitsui & Co., Ltd.

- Ube Material Industries Ltd

- Daiken Corporation

- Kaneka Corporation

- Kyoei Sangyo

- Nippon Steel Corporation

- Marubeni Corporation

- Sumitomo Forestry Co., Ltd.

- Yamazaki Sangyo Co., Ltd.

- Hokuetsu Corporation

- Kansai Paint Co., Ltd.

- Oji Holdings Corporation

- Tateyama Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan balsa wood market based on the below-mentioned segments:

Japan Balsa Wood Market, By Product

- Grade A

- Grade B

- Grade C

Japan Balsa Wood Market, By End Use

- Aerospace & Defense

- Marine

- Wind Energy

- Others

Need help to buy this report?