Japan Bakery Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bread, Cakes and Pastries, Biscuits and Cookies, and Other Bakery Products), By Product Range (Specialty and Conventional), By Form (Frozen and Fresh), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Others), and Japan Bakery Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Bakery Products Market Insights Forecasts to 2035

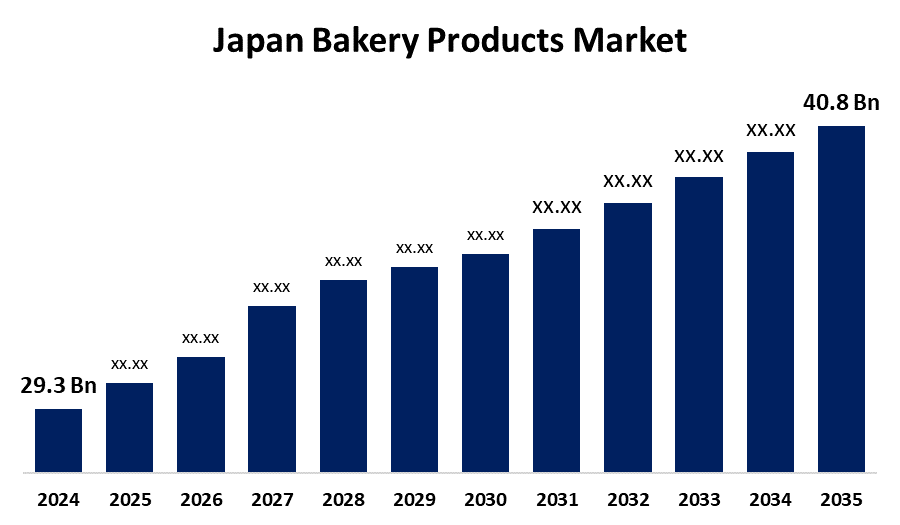

- The Japan Bakery Products Market Size Was Estimated at USD 29.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.06% from 2025 to 2035

- The Japan Bakery Products Market Size is Expected to Reach USD 40.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan bakery products market size is anticipated to reach USD 40.8 Billion by 2035, growing at a CAGR of 3.06% from 2025 to 2035. The market is expanding in Japan for bakery products due to increasing convenience needs, a liking towards western-style baked foods, health concerns, and functional ingredients. Flavour innovation, packaging innovation, and the rising popularity of artisan bakery products are also among the factors contributing to this growth.

Market Overview

Japan bakery products market refers to a highly varied range of baked products such as bread, cakes, pastries, and cookies that are for both conventional and contemporary consumer markets. The bakery business in Japan is dominated by strict quality standards, innovative products, and a huge retail infrastructure platform in the form of convenience stores and internet-based platforms. There is high potential to enlarge the frozen bakery products segment, tap into online selling platforms to expand target customers, and incorporate healthier offerings to catch up with changing dietary patterns. The primary drivers of this growth include the availability of high cultural affinity towards baked food, the increase in artisanal and specialty product popularity, and the health awareness of consumers. There is an increasing demand for organic, gluten-free, and functional bakery products, led by dietary tendencies and health needs. The Japanese government has favorable policies for the bakery sector to increase food safety, food quality standards, and innovation in providing a favorable environment for market development.

Report Coverage

This research report categorizes the market for the Japan bakery products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bakery products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bakery products market.

Japan Bakery Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.06% |

| 2035 Value Projection: | USD 40.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Product Range, By Form and By Distribution Channel |

| Companies covered:: | Fuji Baking Co., Ltd., Yamazaki Baking Co., Ltd, Lotte Group, Kobeya Baking Co., Ltd., Shikishima Baking Co., Ltd., Fujiya Co., Ltd., Nisshin Seifun Group Inc., Morozoff Ltd., Sanko Co., Ltd., Kameda Seika Co., Ltd., Shirohato Co., Ltd., Nippon Flour Mills, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for bakery products in Japan is led by changing lifestyles of consumers, growing needs for convenience foods, and robust demand for high-quality, artisanal breads. Health-consciousness trends are increasing demand for gluten-free, low-sugar, and organic products. Additionally, Western-style bakery products' popularity, increasing disposable income, and increasing retail networks like convenience stores and online retailing contribute to the growth of the market. Flavor innovation and product diversification also draw a diverse group of consumers, supporting the consistent demand nationwide.

Restraining Factors

The Japanese bakery products market is affected by factors like high cost of production, an aging population with evolving nutritional requirements, and increasing health concerns over carbohydrates and sugar. Also, high competition and rising raw material costs limit profit margins and growth.

Market Segmentation

The Japan bakery products market share is classified into product type, product range, form, and distribution channel.

- The bread segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bakery products market is segmented by product type into bread, cakes and pastries, biscuits and cookies, and other bakery products. Among these, the bread segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its heavy consumption by people of different age groups. The high nutrient content, cost, and easy accessibility are the main reasons that increase the consumption of bread in diets. Additionally, today there are several categories of bread available, including gluten-free, whole grain, and high-fiber breads.

- The conventional segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bakery products market is segmented by product range into specialty and conventional. Among these, the conventional segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased availability of assorted product portfolios in the market. Traditional bakery items like bread and others are daily foods.

- The fresh segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bakery products market is segmented by form into frozen and fresh. Among these, the fresh segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the considerable nutritional content involved with the consumer's penchant for newly prepared food. Freshly baked products are products prepared in bakeries and consist of bread, baguettes, cookies, muffins, pastries, and other products.

- The supermarkets/hypermarkets segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bakery products market is segmented by distribution channel into supermarkets/hypermarkets, specialty stores, convenience stores, and others. Among these, the supermarkets/hypermarkets segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the accessibility, affordability, and proximity offered by this segment to consumers. convenient shopping experience for the customers by offering a wide variety of products, including bakery items, under one roof. This convenience attracts a vast number of customers who wish to fulfill their grocery and bakery needs in a single visit.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bakery products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fuji Baking Co., Ltd.

- Yamazaki Baking Co., Ltd

- Lotte Group

- Kobeya Baking Co., Ltd.

- Shikishima Baking Co., Ltd.

- Fujiya Co., Ltd.

- Nisshin Seifun Group Inc.

- Morozoff Ltd.

- Sanko Co., Ltd.

- Kameda Seika Co., Ltd.

- Shirohato Co., Ltd.

- Nippon Flour Mills

- Others

Recent Developments:

- In February 2024, Japan's oldest bakery, Kimuraya, released a partnership with Japanese electronics company NEC Corp to bring out bread and cakes whose flavor is created by artificial intelligence. With the brand name Ren AI Pan, or "AI romance bread," the new products' flavor was created by AI using more than 35,000 songs with fruit and sweet mentions in the lyrics and 15 hours of clip footage from a Japanese reality dating show.

- In June 2023, Brooklyn Brands, which is a New York specialty artisanal baking subsidiary of Astor Group, was acquired by Japanese bakery Taguchi & Co., Ltd. The financial details of the deal were not disclosed.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bakery products market based on the below-mentioned segments:

Japan Bakery Products Market, By Product Type

- Bread

- Cakes and Pastries

- Biscuits and Cookies

- Other Bakery Products

Japan Bakery Products Market, By Product Range

- Specialty

- Conventional

Japan Bakery Products Market, By Form

- Frozen

- Fresh

Japan Bakery Products Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Others

Need help to buy this report?