Japan Automotive Motors Market Size, Share, and COVID-19 Impact Analysis, By Motor Type (Stepper Motor, Brushless DC Motor, DC Brushed Motor, and Traction Motor), By Vehicle Type (Heavy Commercial Vehicles, Passenger Cars, Electric Two-Wheeler, Light Commercial Vehicle, Two-Wheeler, Plug-in Hybrid Electric Vehicle, and Battery Electric Vehicle), By Function (Performance, Comfort & Convenience, and Safety & Security), By Application (Power Antenna Motor, Alternator, Electric Parking Brake, Fuel Pump Motor, Sunroof Motor, Wiper Motor, Starter Motor, Electric Power Steering, and Engine Cooling Fan), and Japan Automotive Motors Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Automotive Motors Market Insights Forecasts to 2035

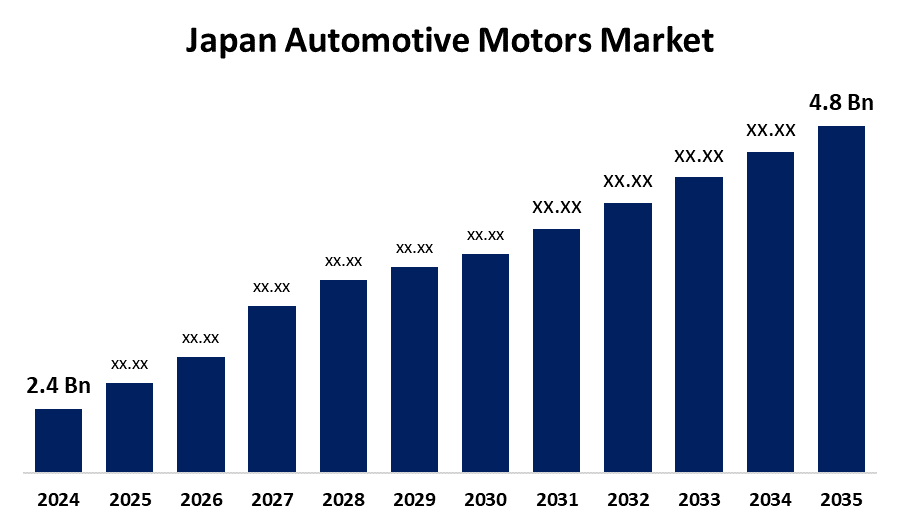

- The Japan Automotive Motors Market Size Was Estimated at USD 2.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Japan Automotive Motors Market Size is Expected to Reach USD 4.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan automotive motors market size is anticipated to reach USD 4.8 Billion by 2035, growing at a CAGR of 6.5% from 2025 to 2035. The Japan automotive motors market is on the rise, with drivers such as growing adoption of electric vehicles (EVs), government incentives for EVs, and HEV dominance. The market also has a boost from technological innovation, including advancements in efficient and compact motors and a shift towards more sustainable ways.

Market Overview

The Japan automotive motors market refers to electric motors used in vehicles, including brushed DC motors, brushless DC motors, stepper motors, and traction motors. Automotive motors are engineered parts of the relevant vehicle systems and are important in respect of their contribution to the vehicle performance, comfort, efficiency and safety. Technological advancement, including the implementation of Internet of Things (IoT) aspects that are included in smart motors that can provide operational efficiency and predictive maintenance, supports industry adoption. Strengths of the Japanese automobile motors market include production capacity and technological advancement, with competitors like Nidec and Mabuchi Motor winning marks for motor manufacturing. Development includes opportunities to grow compact and high-efficiency motors and grow vehicle charging infrastructure for electric vehicles (EVs) and hybrid electric vehicles (HEVs). The emerging drivers for market growth are the growing demand for inclusion of electric vehicles (EVs), with various considerations, including deteriorating environmental impacts and government subsidies, and the recent increase in expectations for technology and features associated with safety and luxury. Government programs and schemes, including subsidies, tax exemptions, and rebates on the sale of electric vehicles (EVs), will help the shift towards electric mobility.

Report Coverage

This research report categorizes the market for the Japan automotive motors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive motors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive motors market.

Japan Automotive Motors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.55% |

| 2035 Value Projection: | USD 4.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Motor Type, By Vehicle Type, By Function and By Application |

| Companies covered:: | Mabuchi Motor Co., Ltd., Mitsuba Corporation, Suzuki Motor Corporation, Toyota Motor Corporation, Nidec Corporation, Minebea Mitsumi Inc., Honda Motor Company, Daihatsu Motor Co., Ltd., Nissan Motor Corporation, Mitsubishi Electric Corporation, Johnson Electric Holdings Limited, Denso Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan automotive motors market is supported by the increasing adoption of electric and hybrid cars due to the increase in awareness of environmental issues and tougher emissions regulations. Improvements in technology concerning the efficiency, compactness, and connection of electric motors to smart systems improve both vehicle performance and consumer attractiveness. Government subsidies, tax credits, and the construction of electric vehicle infrastructure have also enabled the marketplace. Meanwhile, the demand for comfort, safety, and automation arises within vehicles, often including newer motor system costs, with Japan's increasingly influential role in automotive technology and manufacturing.

Restraining Factors

The Japan automotive motors market is restricted from higher levels of growth through costs associated with manufacturing and R&D, not only for electric vehicles which are emerging, but also for dependent rare earth metals and emerging domestic EV charging infrastructure as they exist, along with supply chain interruptions in the international system as well as domestic or emerging country competition.

Market Segmentation

The Japan automotive motors market share is classified into motor type, vehicle type, function, and application.

- The brushless DC motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive motors market is segmented by motor type into stepper motor, brushless DC motor, DC brushed motor, and traction motor. Among these, the brushless DC motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their better efficiency, longer life, and less maintenance than brushed DC motors. They are suitable for new-generation vehicles, particularly electric vehicles, where range and reliability need to be optimized.

- The passenger cars segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive motors market is segmented by vehicle type into heavy commercial vehicles, passenger cars, electric two-wheeler, light commercial vehicle, two-wheeler, plug-in hybrid electric vehicle, and battery electric vehicle. Among these, the passenger cars segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to rising levels of discretionary incomes in the country increases the demand for passenger vehicles, thereby increasing the demand for automotive motors used in passenger vehicles.

- The comfort & convenience segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive motors market is segmented by function into performance, comfort & convenience, and safety & security. Among these, the comfort & convenience segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing consumer desire for convenience and the linking of luxury with comfort, coupled with a rise in disposable incomes, are bringing about high demand in the industry.

- The power antenna motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive motors market is segmented by application into power antenna motor, alternator, electric parking brake, fuel pump motor, sunroof motor, wiper motor, starter motor, electric power steering, and engine cooling fan. Among these, the power antenna motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to antennas being used in the vehicles for radio. Round coil, electrical components, gear assembly, DC motor, and connections are their various things that are necessary in the production of the power antenna.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive motors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mabuchi Motor Co., Ltd.

- Mitsuba Corporation

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Nidec Corporation

- Minebea Mitsumi Inc.

- Honda Motor Company

- Daihatsu Motor Co., Ltd.

- Nissan Motor Corporation

- Mitsubishi Electric Corporation

- Johnson Electric Holdings Limited

- Denso Corporation

- Others

Recent Developments:

- In April 2022, BluE Nexus, Aisin, and Denso collaborated on e-Axles for Toyota's electric SUV bZ4X. These are available in 3 forms for front-wheel and all-wheel drive, providing high torque, long power, and better efficiency with the help of motor design and heat management.

- In June 2024, Nidec Corporation announced the creation of a new air suspension motor by Nidec Motor Ltd, the China subsidiary. The new motor possesses characteristics such as compact size, high power, extended lifetime, and simple start, in addition to response time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automotive motors market based on the below-mentioned segments:

Japan Automotive Motors Market, By Motor Type

- Stepper Motor

- Brushless DC Motor

- DC Brushed Motor

- Traction Motor

Japan Automotive Motors Market, By Vehicle Type

- Heavy Commercial Vehicles

- Passenger Cars

- Electric Two-Wheeler

- Light Commercial Vehicle

- Two-Wheeler

- Plug-in Hybrid Electric Vehicle

- Battery Electric Vehicle

Japan Automotive Motors Market, By Function

- Performance

- Comfort & Convenience

- Safety & Security

Japan Automotive Motors Market, By Application

- Power Antenna Motor

- Alternator, Electric Parking Brake

- Fuel Pump Motor

- Sunroof Motor

- Wiper Motor

- Starter Motor

- Electric Power Steering

- Engine Cooling Fan

Need help to buy this report?