Japan Automotive Lead Acid Battery Market Size, Share, and COVID-19 Impact Analysis, By Product (SLI and Micro-Hybrid Batteries), By Type (Flooded, Enhanced Flooded, and VRLA), By Customer Segment (OEM and Aftermarket), By End Users (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and The Japan Automotive Lead Acid Battery Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Automotive Lead Acid Battery Market Insights Forecasts to 2035

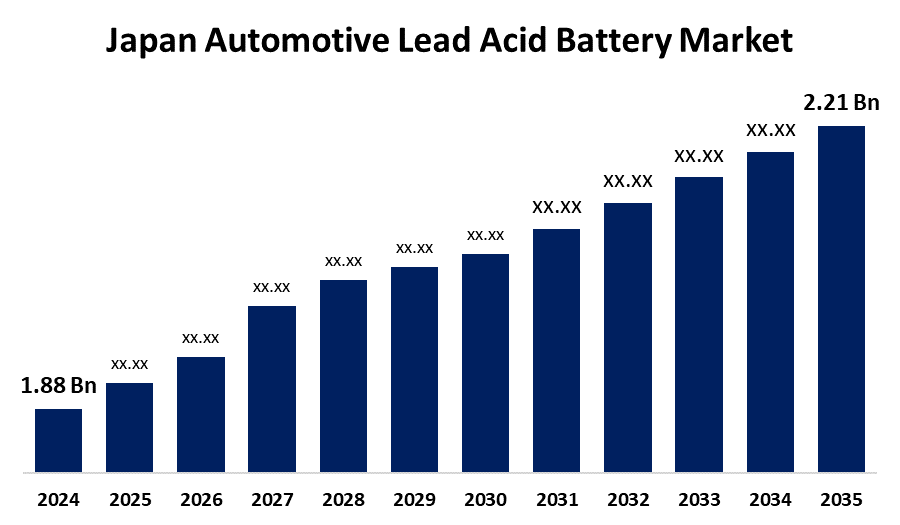

- The Japan Automotive Lead Acid Battery Market Size was estimated at USD 1.88 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.48% from 2025 to 2035

- The Japan Automotive Lead Acid Battery Market Size is Expected to Reach USD 2.21 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan automotive lead acid battery market Size is anticipated to reach USD 2.21 Billion by 2035, growing at a CAGR of 1.48% from 2025 to 2035. The market is experiencing tremendous growth due to the growing trend towards electric vehicles, enhanced car ownership, the readily available range of lead-acid batteries, and major technological innovation. Furthermore, demand for Japan automotive lead acid batteries is also increasing since these are less costly compared to emerging battery technologies, such as lithium-ion, and have been an automotive norm for decades.

Market Overview

The Japan automotive lead-acid battery market refers to the demand for lead-acid batteries used in automobiles and similar applications. An auto lead-acid battery, or starting, lighting, and ignition (SLI) battery, is a rechargeable battery utilized mainly to start up an automobile engine and drive it. The batteries are constructed from varying materials, such as lithium-ion, zinc-dioxide, and lead-acid. The primary purpose of automotive lead-acid batteries is to drive the starter in the vehicle, which starts the engine. Battery design improvements also increase charge acceptance, prolong lifespan, and lower maintenance, and hence they become a more appealing choice both for automakers and consumers. Technologies in recycling have also improved, and thus lead-acid batteries have become environmentally friendly and cheaper, which further promotes their use. Improvements in lead-acid battery technology are creating new opportunities for growth in the automotive industry. These include next-generation Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB), which can provide better charge acceptance, cycle life, and efficiency. The government initiated extensive recycling legislation so that car lead-acid batteries are effectively recycled, which minimizes environmental concerns and aids in the sustainable market for car lead-acid batteries. Moreover, government programs frequently include logistic and economic incentives for car lead acid battery correct disposal and recycling. Government subsidies for green technologies and energy efficiency, ongoing technological advancements in novel lead-acid battery technologies, rapid urbanization, and increasing concern for the sustainable environment are driving the growth of the automatic lead-acid battery market.

Report Coverage

This research report categorizes the market for the Japan automotive lead acid battery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive lead-acid battery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive lead acid battery market.

Japan Automotive Lead-Acid Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.88 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 1.48% |

| 2035 Value Projection: | USD 2.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Type, By Customer Segment and By End Users |

| Companies covered:: | Hitachi, Ltd., Furukawa Battery Co., Ltd., Energy with Co., Ltd., GS Yuasa Corporation, Panasonic Corporation, KYOCERA Corporation, Exide Technologies S.A.S., Mitsubishi Electric Corporation, Nippon Chemi-Con Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market expansion is driven by such factors as demand for new cars, replacement demand in the aftermarket, advances in battery technology (such as VRLA batteries), and growing use of hybrid and electric vehicles. Businesses and firms are increasing their fleets of vehicles for transport, logistics, and delivery purposes, further driving the demand for efficient and technologically advanced automotive lead-acid batteries. Moreover, the reliance on personal cars is greater in suburban and rural areas, as modes of transport are limited, causing higher demand for batteries. Players in the market are developing the automotive lead acid battery technology to improve performance and longevity, which makes them more desirable by consumers and businesses, driving the demand for the Japan automotive lead acid battery market. The government of Japan creates strict environmental policies and strong recycling campaigns, driving the market's growth.

Restraining Factors

The Japanese automotive lead-acid battery market is confronted with some limiting factors, such as the increasing use of alternative battery technologies, such as lithium-ion, environmental concerns, and the comparative disadvantage of lead-acid batteries as far as capacity, cycle life, and performance against lithium-ion are concerned.

Market Segmentation

The Japan automotive lead acid battery market share is classified into product, type, customer segment, and end users.

- The SLI segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period.

The Japan automotive lead acid battery market is segmented by product into SLI and micro-hybrid batteries. Among these, the SLI segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period. This is attributed as they are the prime power source for starting the internal combustion engines of conventional vehicles. SLI batteries are used to drive important vehicle functions such as engine starts, electricity for lighting circuits, and assist electrical accessories. The batteries provide the high cranking currents required to initiate the engine reliably. SLI batteries are also less expensive than their substitutes, hence becoming the most preferred option in markets where cost is still a primary factor for customers. This dominance is due to the huge presence of ICE vehicles on the roads, particularly passenger automobiles, which are the biggest segment in the automobile industry.

- The flooded lead-acid battery segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is expected to grow substantially during the forecast period.

The Japan automotive lead acid battery market is segmented by type into flooded, enhanced flooded, and VRLA. Among these, the flooded lead-acid battery segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is expected to grow substantially during the forecast. This battery is commonly used in motor vehicles due to its inexpensive, high energy density, and effectiveness. The submerged lead-acid battery is also readily available and readily replaced, thus favoured by drivers. They are famous for their strength, high rate of discharge, and fast delivery of high power, which renders them very suitable for automobile use.

- The OEM segment held the highest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period.

The Japan automotive lead acid battery market is segmented by customer segment into OEM and aftermarket. Among these, the OEM segment held the highest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period. This is attributed to they have been the leading suppliers of batteries to auto makers at the point of manufacturing. They therefore have long-term contracts, bulk purchase orders, and preferred supplier status, with a dominating market share. It is convenient for customers, such as vehicle manufacturers, to deal with OEMs due to they have a proven history of offering consistent, high-quality products, where it easy for them to incorporate them into their cars.

- The passenger cars segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period.

The Japan automotive lead acid battery market is segmented by end users into passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheeler, and three-wheeler. Among these, the passenger cars segment held the largest share of the Japan automotive lead-acid battery market in 2024 and is anticipated to grow substantially during the forecast period. Passenger cars are the most significant market for lead-acid batteries due to they have high demand, more and more vehicles are on the roads, and reliable power sources for vehicles are necessary. Stimulated by the demand for more and more vehicles and the necessity for reliable power sources in vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive lead acid battery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi, Ltd.

- Furukawa Battery Co., Ltd.

- Energy with Co., Ltd.

- GS Yuasa Corporation

- Panasonic Corporation

- KYOCERA Corporation

- Exide Technologies S.A.S.

- Mitsubishi Electric Corporation

- Nippon Chemi-Con Corporation

- Others

Recent Developments:

- In September 2024, the Japanese government made subsidy announcements of USD 2.4 billion to subsidize domestic manufacturers' electric vehicle battery projects to increase the production of batteries yearly and advance electrification initiatives.

- In May 2024, GS Yuasa Corporation, a top-tier Japanese firm, recently launched its ECO.R HV auxiliary VRLA battery series, specifically for use in Toyota hybrid cars.

- In October 2022, Japan's Toyota Motor Corporation and the local electricity utility behemoth JERA Group jointly announced the inauguration of a second-life battery storage system that utilizes lithium-ion, nickel-metal-hydride, and lead-acid chemistries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automotive lead acid battery market based on the below-mentioned segments:

The Japan Automotive Lead Acid Battery Market, By Product

- SLI

- Micro-Hybrid Batteries

The Japan Automotive Lead Acid Battery Market, BY Type

- Flooded

- Enhanced Flooded

- VRLA

The Japan Automotive Lead Acid Battery Market, By Customer Segment

- OEM

- Aftermarket

The Japan Automotive Lead Acid Battery Market, By End Users

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two-Wheeler

- Three-Wheeler

Need help to buy this report?