Japan Automotive Infotainment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Navigation Unit, Display Audio, Audio, and Others), By Vehicle Type (Passenger Cars and Commercial vehicles), By Operating System (QNX, LINUX, Microsoft, and Others), By Sales Channel (OEM and Aftermarket), and Japan Automotive Infotainment Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Automotive Infotainment Market Insights Forecasts to 2035

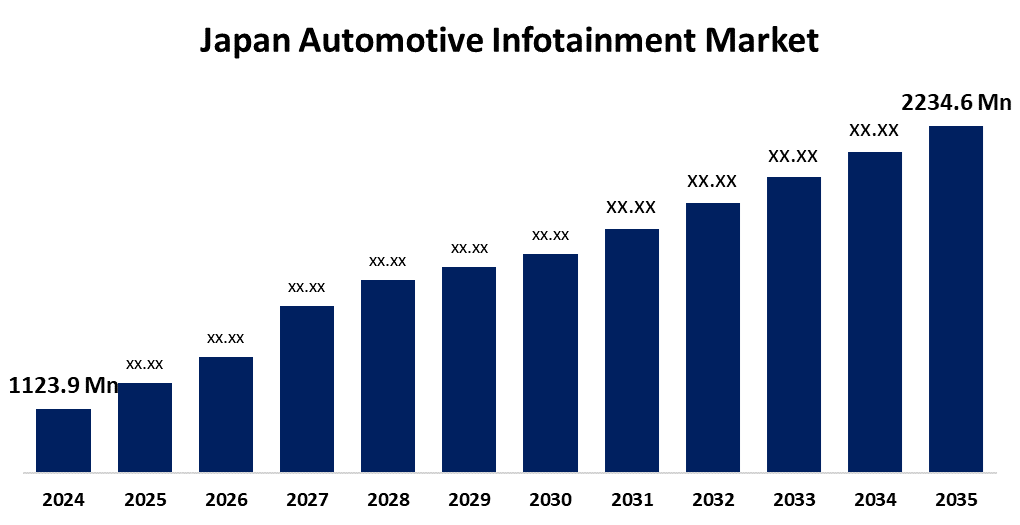

- The Japan Automotive Infotainment Market Size Was Estimated at USD 1123.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.45% from 2025 to 2035

- The Japan Automotive Infotainment Market Size is Expected to Reach USD 2234.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan automotive infotainment market is anticipated to reach USD 2234.6 million by 2035, growing at a CAGR of 6.45% from 2025 to 2035. The Japan automotive infotainment market is growing consumer demand for more sophisticated in-car connectivity and entertainment options, along with new tech adoption such as AI and 5G.

Market Overview

The in-vehicle information and entertainment systems' demand and supply constitute the Japan automotive infotainment market. Infotainment for cars is an in-vehicle system that combines hardware and software systems to integrate entertainment and information presentation for passengers and drivers. It consists of components such as media players, radio, navigation, Bluetooth connectivity, smartphone integration, and voice control, usually on a central display or touchscreen. Japan has a well-established automobile industry that encourages innovation and innovation in infotainment systems. The integration of 5G connectivity and IoT technology in automobiles is creating new avenues for interactive infotainment experiences, such as cloud gaming and streaming of HD videos. The government's focus on environmental sustainability, along with issues of air pollution and climate change, has boosted the demand for Japan automotive infotainment market. Japan is leading the way in emerging technologies like AI, machine learning, and IoT, driving innovation in state-of-the-art automobile electronics, e.g., ADAS, infotainment, and autonomous driving. The focus of Japan on networked ecosystems and intelligent cities is further driven by the development of networked automobile technology, driving demands for next-generation infotainment systems. The Japan automotive infotainment market is powered mainly by increasing consumer need for connectivity, entertainment, and new technologies, supplemented by the presence of a strong domestic automobile sector. The major drivers are the adoption of AI, voice recognition, 5G, and more smartphone integration with in-car systems.

Report Coverage

This research report categorizes the market for the Japan automotive infotainment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive infotainment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive infotainment market.

Japan Automotive Infotainment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1123.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.45% |

| 2035 Value Projection: | USD 2234.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Vehicle Type, By Operating System, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Panasonic Corporation, Mitsubishi Electric Corporation, Ken Wood Corporation, Pioneer Corporation, Alpine Electronics, Inc., Denso Corporation, Fujitsu Ten Limited, Clarion, Pacific Industrial Co., Ltd., Lexus and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The convergence of Advanced Driver Assistance Systems (ADAS) and infotainment systems is also fueling the Japan automotive infotainment market growth. OEMs have come up with applications that provide customers with a continuous experience across the cloud, car, and mobile phone. The automotive segment, the automotive infotainment space to be specific, is moving toward ease-of-use trends, and cloud technology is a key driver playing a significant role in innovations around in-vehicle infotainment. The convergence of smartphones with car infotainment systems enables effortless connectivity, access to a broad suite of applications, and increased functionality, driving Japan automotive infotainment market growth. The major driver of growth is the increasing requirement for personalized and interactive infotainment experiences.

Restraining Factors

The Japan automotive infotainment market is restricted by regulatory compliance, safety requirements, and cost. Limited connectivity infrastructure and rapid technological obsolescence present challenges, and cybersecurity threats erode consumer confidence. The extra expense of yearly service subscriptions and software, and subscription model-related upgrade costs, is one of the key constraints seen for the Japan automotive infotainment market.

Market Segmentation

The Japan automotive infotainment market share is classified into product type, vehicle type, operating system, and sales channel.

- The navigation unit segment held the largest share of the Japan automotive infotainment market in 2024 and is anticipated to grow at a substantial pace during the forecast period.

The Japan automotive infotainment market is segmented by product type into navigation unit, display audio, audio, and others. Among these, the navigation unit segment held the largest share of the Japan automotive infotainment market in 2024 and is anticipated to grow at a substantial pace during the forecast period. This is attributed to the increase of onboard features such as 3D navigation, hands-free calling, satellite radio, and media streaming are increasingly attracting consumers. This trend prompts automotive manufacturers to integrate communication units into even their basic car models. Additionally, the proliferation of 5G networks raises the real-time data collection speed and communication unit accuracy, further driving the adoption of infotainment devices in vehicles.

- The passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive infotainment market is segmented by vehicle type into passenger cars and commercial vehicles. Among these, the passenger car segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high demand for passenger cars among urban and suburban commuters; infotainment for passenger cars is estimated to witness higher demand. Passenger cars are often associated with a more premium and feature-rich experience, with infotainment being a key element as it offers extra functionalities. Passenger cars offer features, such as navigation, hands-free communication, driver assistance features including ADAS, and music & entertainment integration, propelling the market growth.

- The QNX segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive infotainment market is segmented by operating system into QNX, LINUX, Microsoft, and others. Among these, the QNX segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The QNX having a high demand for its ability and support to construct a wide range of reliable infotainment systems that keep up with modern enhancements in the mobile device market.

- The OEM segment held the largest share of the Japan automotive infotainment market in 2024 and is anticipated to grow at a substantial pace during the forecast period.

The Japan automotive infotainment market is segmented by sales channel into OEM and aftermarket. Among these, the OEM segment held the largest share of the Japan automotive infotainment market in 2024 and is anticipated to grow at a substantial pace during the forecast period. This is due to the superior reliability and performance provided by OEM automotive infotainment systems over aftermarket counterparts, resulting in a greater market share. This prevalence is owed to the widespread practice of manufacturers embedding high-end infotainment systems into new cars directly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive infotainment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Ken Wood Corporation

- Pioneer Corporation

- Alpine Electronics, Inc.

- Denso Corporation

- Fujitsu Ten Limited

- Clarion

- Pacific Industrial Co., Ltd.

- Lexus

- Others

Recent Developments:

- In March 2025, Pioneer Corporation launched its research and development facility in 2023, and by 2026, it intends to begin producing in-car entertainment systems in India. The goal of this action is to increase its presence in the rapidly growing Indian automobile industry. In keeping with its dedication to innovation and regionally based manufacturing, the company will collaborate with local contractors for production, initially concentrating on Display Audio systems for automakers.

- In August 2024, Pioneer, the Japanese car audio and entertainment system maker, plans to expand its business with Indian automakers. While it has primarily focused on the aftermarket segment in India for 16 years, the company now aims to enter the OEM sector as part of its growth strategy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automotive infotainment market based on the below-mentioned segments:

Japan Automotive Infotainment Market, By Product Type

- Navigation Unit

- Display Audio

- Audio

- Others

Japan Automotive Infotainment Market, By Vehicle Type

- Passenger Cars

- Commercial vehicles

Japan Automotive Infotainment Market, By Operating System

- QNX

- LINUX

- Microsoft

- Others

Japan Automotive Infotainment Market, By Sales Channel

- OEM

- Aftermarket

Need help to buy this report?