Japan Automotive Foam Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyurethane (PU) Foam, Polyolefin (PO) Foam, and Others), By End Use (Passenger Cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)), and Japan Automotive Foam Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Automotive Foam Market Insights Forecasts to 2035

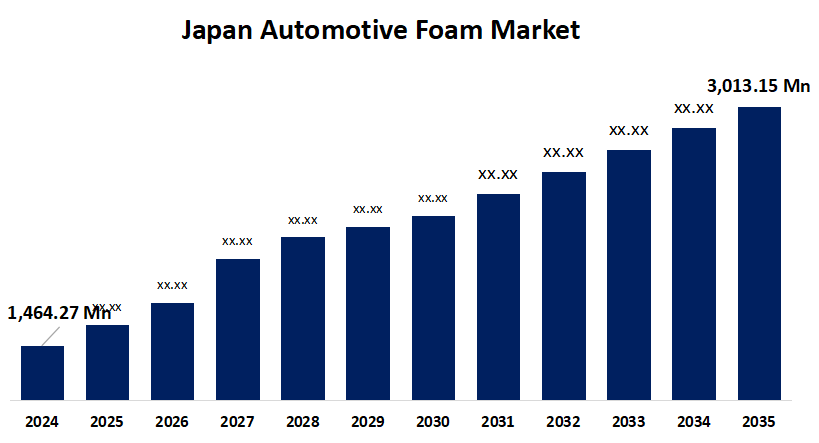

- The Japan Automotive Foam Market Size Was Estimated at USD 1,464.27 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.78% from 2025 to 2035

- The Japan Automotive Foam Market Size is Expected to Reach USD 3,013.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Automotive Foam Market is anticipated to reach USD 3,013.15 million by 2035, growing at a CAGR of 6.78% from 2025 to 2035. The rise of electric and hybrid passenger vehicles further boosts demand for advanced foam materials that offer thermal management and noise reduction.

Market Overview

The Japan automotive foam market refers to the industry focused on producing foam materials—primarily Polyurethane (PU) and Polyolefin (PO)—used in vehicle interiors, seating, insulation, and structural components. The market for automotive foam in Japan is also significantly influenced by the rise in EV production. As the global automobile industry transitions to electrification, Japan is becoming a significant EV production base. For example, the Japan Automobile Manufacturers Association (JAMA) reports that within the last five years, Japan's output of electric vehicles has surged by 150%. In order to improve the performance and efficiency of electric vehicles, automotive foams are vital since they offer thermal insulation, noise reduction, and lightweight alternatives. The performance and range of EV batteries have increased by 20% as a result of the adoption of modern insulating materials, such as automobile foams, according to the New Energy and Industrial Technology Development Organization (NEDO).

Report Coverage

This research report categorizes the market for the Japan automotive foam market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive foam market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive foam market.

Japan Automotive Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,464.27 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.78% |

| 2035 Value Projection: | USD 3,013.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type ,By End Use |

| Companies covered:: | BASF SE, Dow Chemical Co., Adient Plc., Saint-Gobain SA, Lear Corp, Bridgestone Corp, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling the Japanese automotive foam market is the need for strong, lightweight materials. Advanced materials that provide excellent performance without adding undue weight to vehicles are becoming more and more popular among automakers as they work to increase fuel efficiency and lower emissions. For example, more than 70% of Japanese automakers are giving priority to the use of lightweight materials in their vehicle designs, according to a survey done by the Japan Automobile Manufacturers Association (JAMA). Excellent strength-to-weight ratios make automotive foams—especially polyurethane and polyethylene foams—perfect for a range of vehicle uses, such as soundproofing, seating, and insulation.

Restraining Factors

The market faces several restraints. Volatility in raw material prices, especially for petroleum-based PU foam, can impact production costs. Environmental concerns are pushing manufacturers toward bio-based alternatives, which are still costly and less scalable. Additionally, integration challenges with new EV architectures, limited recycling infrastructure, and intense competition from global foam suppliers create pressure on domestic players.

Market Segmentation

The Japan automotive foam market share is classified into type and end use.

- The polyurethane (PU) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive foam market is segmented by type into polyurethane (PU) foam, polyolefin (PO) foam, and others. Among these, the polyurethane (PU) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. PU foam is widely used due to its excellent cushioning, thermal insulation, and durability, making it ideal for seats, headliners, and door panels.

- The passenger cars segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive foam market is segmented by end use into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). Among these, the passenger cars segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Japan’s strong domestic car production, export-oriented automotive industry, and consumer preference for high-comfort, low-emission vehicles fuel this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive foam market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Dow Chemical Co.

- Adient Plc.

- Saint-Gobain SA

- Lear Corp

- Bridgestone Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Automotive Foam Market based on the below-mentioned segments:

- Japan Automotive Foam Market, By Type

- Polyurethane (PU) Foam

- Polyolefin (PO) Foam

- Others

- Japan Automotive Foam Market, By End Use

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

Need help to buy this report?