Japan Automotive Appearance Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Polishes, Windshield Water Fluids, Soaps, Coating, and Car Wax), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs)), and Japan Automotive Appearance Chemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Automotive Appearance Chemicals Market Insights Forecasts to 2035

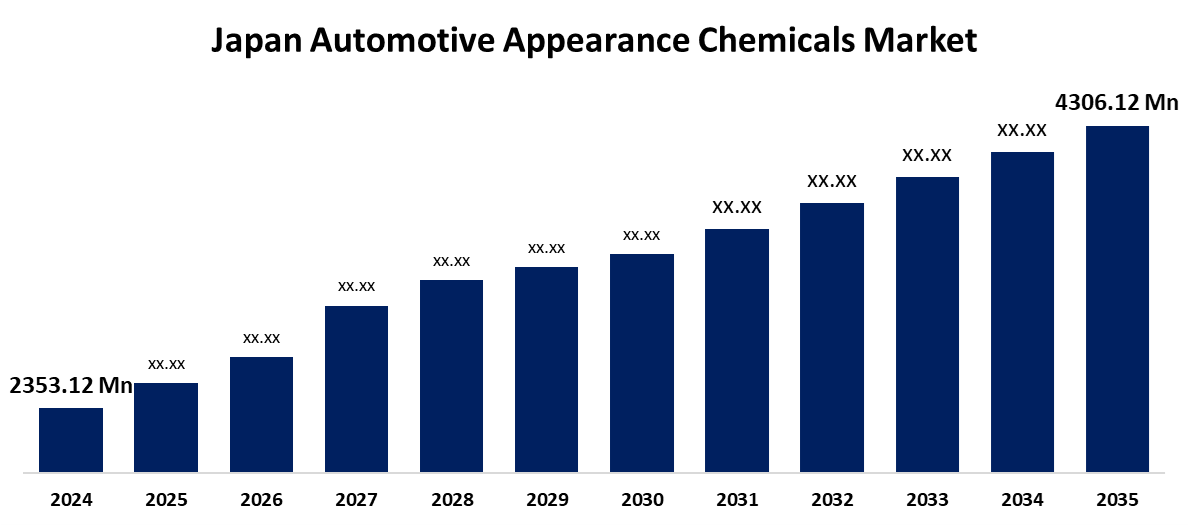

- The Japan Automotive Appearance Chemicals Market Size Was Estimated at USD 2,353.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.65% from 2025 to 2035

- The Japan Automotive Appearance Chemicals Market Size is Expected to Reach USD 4,306.12 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Automotive Appearance Chemicals Market Size is anticipated to Reach USD 4,306.12 Million by 2035, Growing at a CAGR of 5.65% from 2025 to 2035. The market size is driven by rising consumer demand for high-quality vehicle finishes, increasing automotive production, and technological advancements in chemical formulations that improve durability and appearance

Market Overview

The Japan Automotive Appearance Chemicals Market Size refers to the industry focused on products like polishes, waxes, coatings, and cleaners designed to enhance and protect vehicle aesthetics. The need for automotive cosmetic chemicals rises as Japan's fleet of vehicles ages and maintenance requirements increase. To preserve their look and functionality, older cars may need more frequent washing, polishing, and preventive treatments. Additionally, a car's look can have a big influence on its resale value, which is why owners spend money on items that maintain and improve the car's visual appeal. The market's steady need for beauty chemicals is fueled by these maintenance requirements.

Innovation in high-performance appearance chemicals is being driven by the growing customer preference for long-lasting, glossy coatings and the growing demand for premium vehicle finishes. Furthermore, the development of sophisticated, environmentally friendly, water-borne, and low-VOC formulations is being encouraged by more stringent environmental restrictions.

Report Coverage

This research report categorizes the market for the Japan automotive appearance chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive appearance chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive appearance chemicals market.

Japan Automotive Appearance Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,353.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.65% |

| 2035 Value Projection: | USD 4,306.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product, By Vehicle Type |

| Companies covered:: | Kao Corporation, Mitsui Chemicals, Inc., Sumitomo Chemical, Zeon Corporation, Dow, Ashai Kasei Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising need for premium vehicle protection and aesthetics, which is being driven by rising auto production and consumer preferences for aesthetically pleasing cars, is propelling the Japanese automotive appearance chemicals market. Vehicle durability and appearance have been improved by the development of superior treatments, including advanced coatings, waxes, and cleansers, which are the result of technological breakthroughs in chemical formulas. The market has grown as a result of manufacturers adopting eco-friendly chemical solutions in response to growing environmental sustainability consciousness. The need for automotive appearance chemicals is also being driven by the move toward electric vehicles (EVs) and the expanding aftermarket industry.

Restraining Factors

The competition from alternative vehicle protection systems, rising raw material costs, and strict environmental restrictions that restrict the use of specific chemical formulations are some of the constraining factors. Demand may also be impacted by changes in auto sales and economic uncertainty, while consumer preferences for durable, low-maintenance products may result in fewer purchases.

Market Segmentation

The Japan automotive appearance chemicals market share is classified into product and vehicle type.

- The polishes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive appearance chemicals market is segmented by product into polishes, windshield water fluids, soaps, coating, and car wax. Among these, the polishes segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polishes dominate the market because they give car owners a simple and efficient way to improve their vehicle's shine and shield the surface from the elements.

- The passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive appearance chemicals market is segmented by vehicle type into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Among these, the passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because there are so many private automobiles in Japan, and passenger cars account for a large portion of the market. With an emphasis on improving vehicle looks and maintaining resale value, this market segment gains from the expanding trend of auto detailing and maintenance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive appearance chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kao Corporation

- Mitsui Chemicals, Inc.

- Sumitomo Chemical

- Zeon Corporation

- Dow

- Ashai Kasei Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Automotive Appearance Chemicals Market based on the below-mentioned segments:

Japan Automotive Appearance Chemicals Market, By Product

- Polishes

- Windshield Water Fluids

- Soaps

- Coating

- Car Wax

Japan Automotive Appearance Chemicals Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

Need help to buy this report?