Japan Automation Testing Market Size, Share, and COVID-19 Impact Analysis, By Testing Type (Static and Dynamic), By Component (Solution and Services), By Interface (Desktop Testing, Web Testing, Mobile Testing, and Test Design), By Vertical (BFSI, IT & Telecom, Manufacturing, Retail, Healthcare, Government, and Others), and Japan Automation Testing Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Automation Testing Market Insights Forecasts to 2035

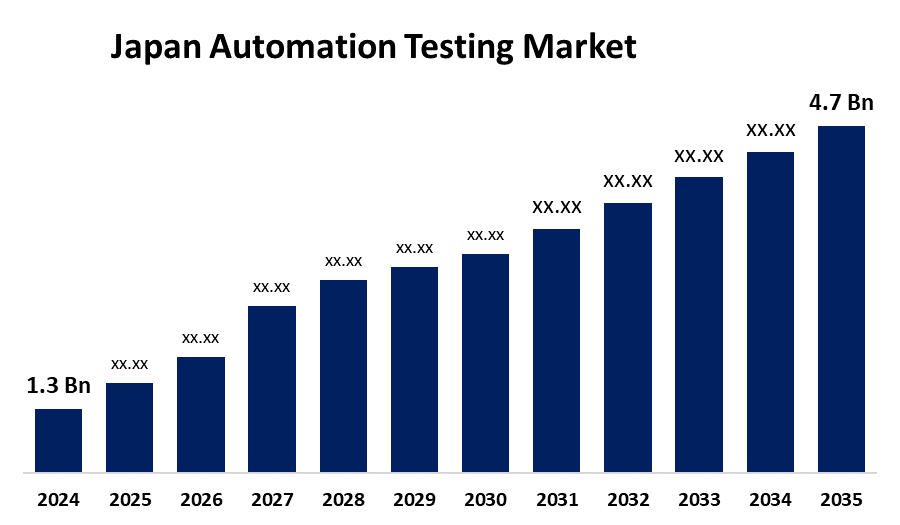

- The Japan Automation Testing Market Size Was Estimated at USD 1.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.39% from 2025 to 2035

- The Japan Automation Testing Market Size is Expected to Reach USD 4.7 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan automation testing market is anticipated to reach USD 4.7 billion by 2035, growing at a CAGR of 12.39% from 2025 to 2035. The growth in the Japan market for automation testing is being driven by a convergence of factors that include the growing complexity of software, the requirement for high-speed time-to-market, and the demand for high-quality software from many sectors.

Market Overview

The Japan automation testing market refers to the utilization of tools specialized in software to automate test execution on software applications, minimizing manual intervention and optimizing testing efficiency, speed, and accuracy. It is highly used in industries like IT, telecommunication, automotive, health care, and finance to guarantee software reliability and performance. The strong IT infrastructure, quality standards, and focus on precision and efficiency of Japan consolidate its position in the automation testing market. Opportunities are arising through the marriage of artificial intelligence, machine learning, and cloud-based testing environments, which boost testing intelligence and scalability. Market expansion is largely propelled by the need for faster cycles of software delivery, increased use of DevOps and Agile methodologies, and increasing dependence on web and mobile-based applications. The Japanese government encourages this digital development through innovation-promoting policies like the Society 5.0 initiative and IT investment support for firms, further boosting market growth.

Report Coverage

This research report categorizes the market for the Japan automation testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automation testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automation testing market.

Japan Automation Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.39% |

| 2035 Value Projection: | USD 4.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Testing Type, By Component, By Interface, By Vertical and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Electric, Keysight Technologies, Yaskawa Electric Corporation, Fanuc Corporation, Advantest Corp., ScienceSoft, Fujitsu Limited, Danaher Corporation, Human Crest Co., Ltd., Omron Corporation, Qualitest, Tokyo Electron Limited, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan automation testing market is fueled by the increasing demand for quicker software development cycles, greater use of DevOps and Agile practices, and rising demand for high-quality digital products. The increased use of mobile and web applications and the advancement in AI and machine learning fuel demand further. Japan's robust IT infrastructure and government support for digital transformation also play a major role in fueling the market growth significantly.

Restraining Factors

The Japan automation testing industry is inhibited by factors like high upfront investment expenses, shortage of experienced professionals, difficulty in automating legacy systems, and the hesitance towards change in traditionally framed development environments.

Market Segmentation

The Japan automation testing market share is classified into testing type, component, interface, and vertical.

- The static segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automation testing market is segmented by testing type into static and dynamic. Among these, the static segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to it allowing users to review the documents and discover errors, redundancies, and vagueness. Further, static testing also improves inter-team member collaboration and encourages quality code, resulting in better and more efficient automation testing processes.

- The services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automation testing market is segmented by component into solution and services. Among these, the services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing adoption of expert consulting and implementation services to help organizations set up and refine their automated testing procedures. Third-party providers or consulting agencies usually offer these services with experience in test automation and best practices in testing.

- The desktop testing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automation testing market is segmented by interface into desktop testing, web testing, mobile testing, and test design. Among these, the desktop testing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the product is implemented in the process of testing applications, particularly on desktop operating systems such as Windows, macOS, and Linux. Thus, it forms a significant part of software testing, particularly for applications that have a mainstay desktop-based setup.

- The healthcare segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automation testing market is segmented by vertical into BFSI, IT & telecom, manufacturing, retail, healthcare, government, and others. Among these, the healthcare segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive digitalization, with increasing dependence on software programs, Electronic Health Records (EHRs), medical devices, and other technologies to maximize patient care, optimize operational effectiveness, and maintain regulatory compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automation testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Electric

- Keysight Technologies

- Yaskawa Electric Corporation

- Fanuc Corporation

- Advantest Corp.

- ScienceSoft

- Fujitsu Limited

- Danaher Corporation

- Human Crest Co., Ltd.

- Omron Corporation

- Qualitest

- Tokyo Electron Limited

- Others

Recent Developments:

- In June 2023, Keysight Technologies broadened its autonomous driving test solutions with the E8717A Lidar Target Simulator (LTS), which is intended for automakers and lidar makers to test sensors for autonomous vehicles. Automated testing software improves sensor design and sensor performance analysis, making testing cost-effective and efficient for mass production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automation testing market based on the below-mentioned segments:

Japan Automation Testing Market, By Testing Type

- Static

- Dynamic

Japan Automation Testing Market, By Component

- Solution

- Services

Japan Automation Testing Market, By Interface

- Desktop Testing

- Web Testing

- Mobile Testing

- Test Design

Japan Automation Testing Market, By Vertical

- BFSI

- IT & Telecom

- Manufacturing

- Retail

- Healthcare

- Government

- Others

Need help to buy this report?