Japan Automated Storage and Retrieval Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Unit Load ASRS, Mini Load ASRS, Vertical Lift Modules (VLMs), Horizontal Carousels, Vertical Carousels, and Robotic ASRS), By Function (Storage, Order Picking Distribution, and Assembly), By End-User (Automotive, Food & Beverages, Retail & E-commerce, Pharmaceuticals, Electronics, and Others), and Japan Automated Storage and Retrieval Systems Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Automated Storage and Retrieval Systems Market Insights Forecasts to 2035

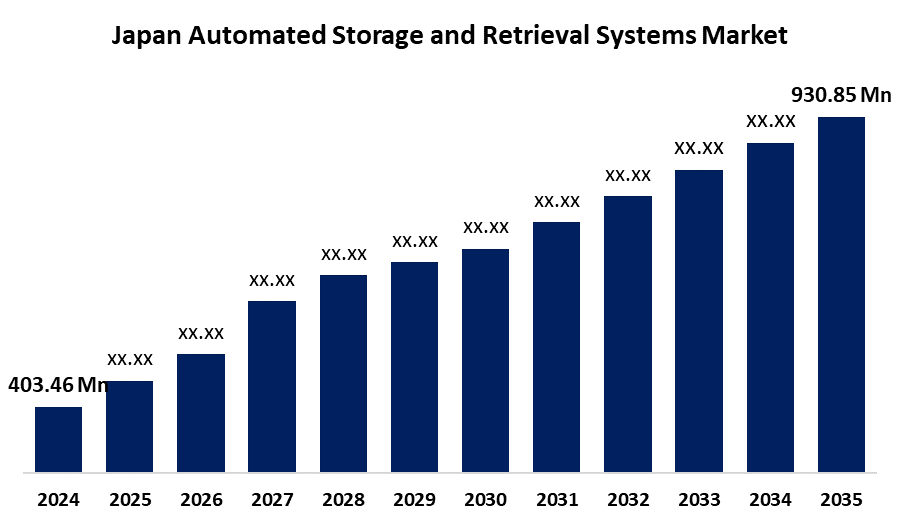

- The Japan Automated Storage and Retrieval Systems Market Size Was Estimated at USD 403.46 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.9% from 2025 to 2035

- The Japan Automated Storage and Retrieval Systems Market Size is Expected to Reach USD 930.85 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan automated storage and retrieval systems market is anticipated to reach USD 930.85 million by 2035, growing at a CAGR of 7.9% from 2025 to 2035. The automated storage and retrieval systems market is growing due to labor shortages, increasing costs, operational efficiency requirements, advanced manufacturing, automation emphasis, high population density, and limited availability of warehouse space, leading to the universal utilization of automated storage systems.

Market Overview

The automated storage and retrieval systems market refers to a programmable material handling system for automatically placing and retrieving items from determined locations and delivering high throughput, density, and accuracy for industries with high volume or limited space. in Japan, ASRS is utilized in the automotive, digital marketplace, retail, food & beverage, healthcare, and logistics sectors for inventory management, order fulfillment, and warehouse optimization. Key strengths of the Japanese ASRS market are strong industrial automation capabilities, convergence of AI, IoT, and robotics, and players like Daifuku, Murata Machinery, and Toyota Industries. Opportunities exist in growing online retailing and timely manufacturing deployments, micro fulfilment centers, cold chain logistics, and average modular deployments. Key drivers are labour shortage and increased labor costs due to an aging population in Japan, driving companies to automate routine tasks to ensure productivity and efficiency. Government programs under the Society 5.0 initiative encourage industrial automation through subsidies, grants, and the integration of smart manufacturing platforms, improving supply chain resiliency and workplace safety.

Report Coverage

This research report categorizes the market for the Japan automated storage and retrieval systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automated storage and retrieval systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automated storage and retrieval systems market.

Japan Automated Storage and Retrieval Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 403.46 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.9% |

| 2035 Value Projection: | USD 930.85 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Function, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Toyota Industries Corporation, Murata Machinery, Ltd., KNAPP AG, Daifuku Co., Ltd., Kardex Remstar Japan, SSI Schaefer Japan, IHI Corporation, BEUMER GROUP, Rapyuta Robotics Co., Ltd., Mecalux, S.A., System Logistics S.p.A., TGW Logistics Group Japan, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan automated storage and retrieval systems (ASRS) market is driven by labor shortages that result from an aging workforce, increasing labor expenses, and a requirement for operational efficiency. Quick expansion of online retailing, urbanization, and high real estate prices further drive the needs for compact, automated solutions. Technological breakthroughs in robotics, AI, and IoT also continue to add capabilities to systems. Government initiatives promoting smart manufacturing under the Society 5.0 vision further promote the adoption of ASRS across industries.

Restraining Factors

The Japan ASRS market is constrained by the high initial investment levels, intricacies of integrating systems, and maintenance costs. The shortfalls of skilled labor to handle advanced technologies and resistance to change on the part of old-line industries also hinder the adoption of automated storage solutions at a mass level.

Market Segmentation

The Japan automated storage and retrieval systems market share is classified into type, function, and end-user.

- The unit load ASRS segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated storage and retrieval systems market is segmented by type into unit load ASRS, mini load ASRS, vertical lift modules (VLMs), horizontal carousels, vertical carousels, and robotic ASRS. Among these, the unit load ASRS segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its use in the management of big, heavy loads, particularly in manufacturing and automotive industries. Robotic ASRS is also becoming increasingly popular, thanks to technological progress in robotics and AI, which provides higher flexibility and efficiency in warehouses.

- The storage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated storage and retrieval systems market is segmented by function into storage, order picking, distribution, and assembly. Among these, the storage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the increasing operational efficiency through automating the process of warehousing goods in a more optimized and structured form. ASRS storage systems automate the depositing of products into specified locations, minimizing human error, space usage, and overall retrieval time.

- The automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated storage and retrieval systems market is segmented by end-user into automotive, food & beverages, retail & E-commerce, pharmaceuticals, electronics, and others. Among these, the automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their use of it for effective part management, integration with the assembly line, and managing inventory. As the demand for precision and rapid turnaround increases, ASRS used in the automobile industry supports the reduction of manufacturing processes and lowering operational costs. Faster inventory retrieval and storage solutions are advantageous for automobile businesses, thereby improving production efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automated storage and retrieval systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Industries Corporation

- Murata Machinery, Ltd.

- KNAPP AG

- Daifuku Co., Ltd.

- Kardex Remstar Japan

- SSI Schaefer Japan

- IHI Corporation

- BEUMER GROUP

- Rapyuta Robotics Co., Ltd.

- Mecalux, S.A.

- System Logistics S.p.A.

- TGW Logistics Group Japan

- Others

Recent Developments:

- In December 2023, Daifuku Co., Ltd. launched to started operational testing of its latest high-speed, high-rise automated storage and retrieval system (AS/RS) stacker cranes at a newly constructed high-rise testing facility within its primary manufacturing site, Shiga Works, to evaluate performance and efficiency.

- In July 2022, Murata Machinery signed a contract with Alpen Co., Ltd. to build Japan’s first 3D robot warehousing system, ALPHABOT, at the Alpen Komaki Distribution Center. The system aims to improve storage capacity and reduce picking, sorting, and packaging operations by about 60%.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automated storage and retrieval systems market based on the below-mentioned segments:

Japan Automated Storage and Retrieval Systems Market, By Type

- Unit Load ASRS

- Mini Load ASRS

- Vertical Lift Modules (VLMs)

- Horizontal Carousels

- Vertical Carousels & Robotic ASRS

Japan Automated Storage and Retrieval Systems Market, By Function

- Storage

- Order Picking

- Distribution & Assembly

Japan Automated Storage and Retrieval Systems Market, By End-User

- Automotive

- Food & Beverages

- Retail & E-commerce

- Pharmaceuticals

- Electronics

- Others

Need help to buy this report?