Japan Automated Cell Counting Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Consumables & Accessories and Instruments), By Application (Cell Line Development, Blood Analysis, Stem Cell Research, and Others), By End-use (Hospitals & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, and Others), and Japan Automated Cell Counting Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Automated Cell Counting Market Insights Forecasts to 2035

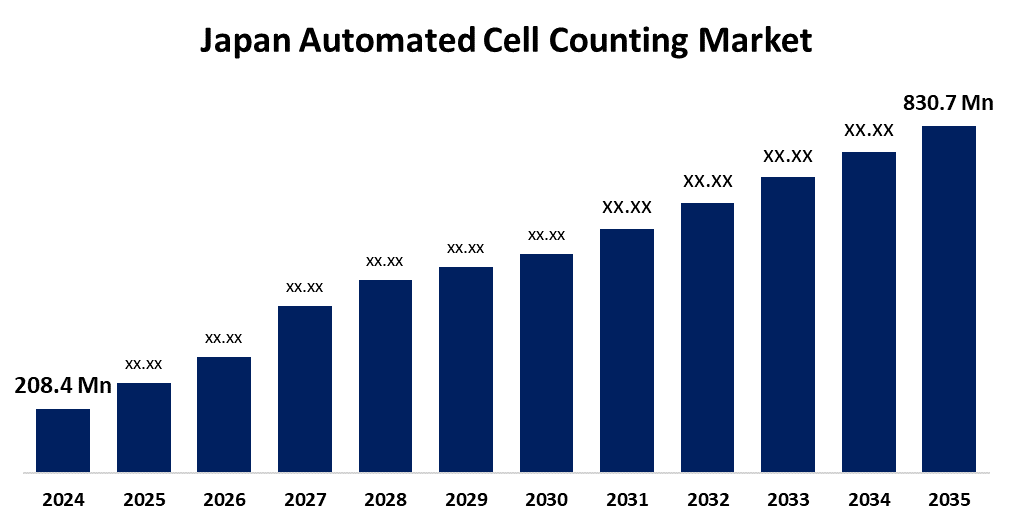

- The Japan Automated Cell Counting Market Size Was Estimated at USD 208.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.4% from 2025 to 2035

- The Japan Automated Cell Counting Market Size is Expected to Reach USD 830.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Automated Cell Counting Market Size is Anticipated to Reach USD 830.7 Million by 2035, Growing at a CAGR of 13.4% from 2025 to 2035. The Japan market for automated cell counting is expanding due to innovations in regenerative medicine, preventive healthcare, and AI implementation. Effective healthcare infrastructure, governmental support for R&D activities, and emphasis on precision research further increase market growth and innovation.

Market Overview

The Japan automated cell counting market refers to advanced technologies for accurate, efficient cell counting and analysis in healthcare and research. Automated cell counting systems utilize artificial intelligence (AI) and machine learning to improve the speed, accuracy, and efficiency of cell analysis, replacing traditional manual methods prone to human error. Key market strengths include Japan’s advanced technological infrastructure, a strong emphasis on research and development, and a well-established healthcare industry. Such players as Sysmex Corporation and Sony Biotechnology are leading the way, incorporating AI into their cell counting technology to increase data integrity and workflow efficiency. Opportunities exist in the increasing need for personalized medicine, stem cell research advancements, and rising instances of chronic diseases. Government programs, including backing of regenerative medicine and strict regulation by the Pharmaceuticals and Medical Devices Agency (PMDA), contribute further to market expansion.

Report Coverage

This research report categorizes the market for the Japan automated cell counting market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automated cell counting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automated cell counting market.

Japan Automated Cell Counting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 208.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 13.4% |

| 2035 Value Projection: | USD 830.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Sony Biotechnology, Tosoh Corporation, Merck KGaA, Agilent Technologies Japan, Ltd., Beckman Coulter Japan K.K., Nikon Corporation, Beckman Coulter, Thermo Fisher Scientific, Sysmex Corporation, Nexcelom Bioscience, Olympus Corporation, Fujifilm Wako Pure Chemical Corporation and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The automated cell counting market in Japan is fueled by the growing need for precise and effective cell analysis in biomedical research, regenerative medicine, and drug discovery. Developments in AI and machine learning improve accuracy and eliminate human error. Increasing incidence of chronic conditions and the increasing importance of personalized medicine further drive demand. Besides, Japan's well-established healthcare system, sound R&D infrastructure, and government backing for regenerative medicine and biotechnology drive market growth and the adoption of technology.

Restraining Factors

The Japan automated cell counting market is challenged by the high costs of equipment, intricate regulatory demands, and limited exposure among smaller healthcare organizations. Technical complications and specialized personnel requirements also slow adoption in general, especially in smaller research and clinical practices.

Market Segmentation

The Japan automated cell counting market share is classified into product type, application, and end user.

- The consumables & accessories segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated cell counting market is segmented by product type into consumables & accessories and instruments. Among these, the consumables & accessories segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased need for auxiliary products such as reagents, filters, and counting slides is propelling adoption in automated cell counting. Consumables are mandatory for guaranteeing the precision, reliability, and smooth functioning of automated cell counting devices, enhancing their overall performance and efficiency.

- The cell line development segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated cell counting market is segmented by application into cell line development, blood analysis, stem cell research, and others. Among these, the cell line development segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the increasing significance of cell lines in drug development and biotechnology research, particularly for cancer and genetic diseases, which fuels demand for high-quality, reproducible cell lines. Automated cell counting plays a crucial role in the process, allowing researchers to track constant cell growth, maximize culture conditions, and accurately measure cell proliferation.

- The pharmaceutical & biotechnology companies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automated cell counting market is segmented by end user into hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies, research & academic institutes, and others. Among these, the pharmaceutical & biotechnology companies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing dependence on automated systems in drug discovery, quality control, and clinical studies. Firms are embracing automated cell counting to increase efficiency, minimize errors, and maintain accuracy. Increasing incidence of chronic diseases and focus on biologics, gene therapies, and personalized medicine further drive demand for sophisticated cell counting technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automated cell counting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony Biotechnology

- Tosoh Corporation

- Merck KGaA

- Agilent Technologies Japan, Ltd.

- Beckman Coulter Japan K.K.

- Nikon Corporation

- Beckman Coulter

- Thermo Fisher Scientific

- Sysmex Corporation

- Nexcelom Bioscience

- Olympus Corporation

- Fujifilm Wako Pure Chemical Corporation

- Others

Recent Developments:

- In October 2023, Sony launched the FP7000 spectral cell sorter, supporting high-speed sorting with over 44 colors. Featuring up to 6 lasers and 182 detectors, it offers real-time spectral unmixing, multi-nozzle compatibility, and up to 6-way sorting at 25,000 events/second, enabling advanced, efficient analysis of diverse cell populations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automated cell counting market based on the below-mentioned segments:

Japan Automated Cell Counting Market, By Product Type

- Consumables & Accessories

- Instruments

Japan Automated Cell Counting Market, By Application

- Cell Line Development

- Blood Analysis

- Stem Cell Research

- Others

Japan Automated Cell Counting Market, By End-use

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research & Academic Institutes

- Others

Need help to buy this report?