Japan Auto Loan Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (Individuals, Enterprises), and Japan Auto Loan Market Insights Forecasts to 2032

Industry: Banking & FinancialJapan Auto Loan Market Insights Forecasts to 2032

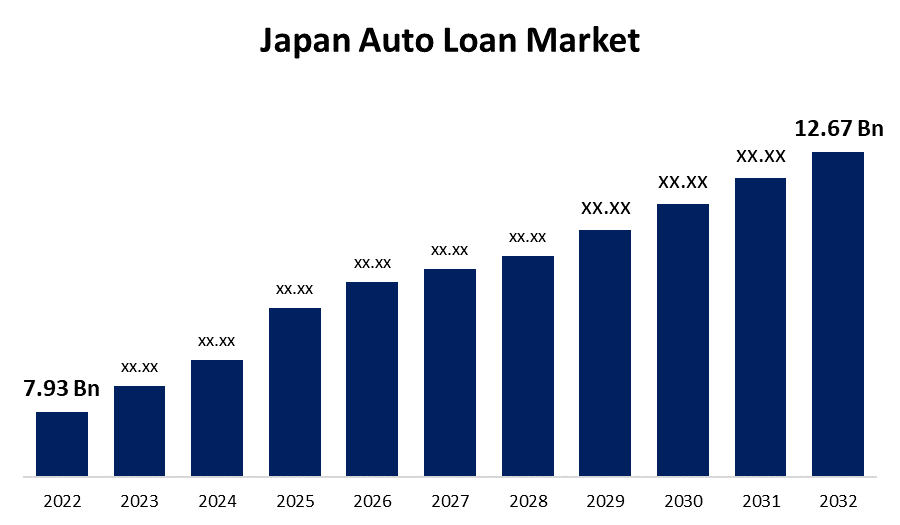

- The Japan Auto Loan Market Size was valued at USD 7.93 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.80% from 2022 to 2032.

- The Japan Auto Loan Market Size is Expected to Reach USD 12.67 Billion by 2032.

Get more details on this report -

The Japan Auto Loan Market Size is Expected to Reach USD 12.67 Billion by 2032, at a CAGR of 4.80% during the forecast period 2022 to 2032.

Market Overview

An auto loan is a loan that allows the consumer to buy a desired four-wheeler, and pay the vehicle off in equated monthly instalments for a set tenure instead of having to pay the full price upfront. The terms of an auto loan depend on various factors, including income and credit history. In Japan, the amount of outstanding loans has been steadily increasing over time, indicating a rise in the number of loan policies taken out, including auto loans. Due to the greater market share held by medium-sized cars and minivans in the nation's passenger vehicle segment, lending companies have chosen to concentrate on specific segments of the auto loan market. The country's lower current loan interest rates have caused lenders to concentrate primarily on the growing cost of cars, which has led to consumers choosing auto loans as a means of financing their vehicles and boosting the business of auto lenders. Manufacturers of automobiles are establishing their own finance companies to streamline the purchasing process for consumers.

Report Coverage

This research report categorizes the market for Japan auto loan market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan auto loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan auto loan market.

Japan Auto Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.93 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.80% |

| 2032 Value Projection: | USD 12.67 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Vehicle Type, By End-User, and COVID-19 Impact Analysis. |

| Companies covered:: | Toyota Financial Services, Nissan Financial Services, Maruhan Japan Bank, SMBC Trust Bank, HDB Financial Service, Bank of Kyoto, Orient Corporation, Orient Corporation, Mitsubishi UFJ Financial Group, Volkswagen Financial Services Japan and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of cab service financing, which seeks to create a financing program that offers prospective drivers flexible leases, weekly rentals, and discounts on the purchase of new cars, is propelling the Japan auto loan market. The growth of financing for taxi services is driving the expansion of the auto finance industry. Additionally, the auto loan industry is growing as a result of rising costs associated with autonomous vehicles. Many end-users have invested in R&D because they like the ease and safety that autonomous vehicles provide for drivers. Banks, credit unions, and dealers must provide funding for investments in autonomous vehicles, which increases demand for auto financing. The forecast period would see growth in the auto loan market as a result of an increase in cab service financing as well as increased investments in autonomous vehicles, such factors will boost the market growth in the forecast period in Japan.

Restraining Factors

The interest rate rises as the loan repayment period expands which hampers the market for auto loans in Japan.

Market Segment

- In 2022, the passenger vehicles segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the Japan auto loan market is segmented into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment has the largest revenue share over the forecast period. The high price associated with passenger vehicles mostly consumers take auto loans for that, such factors boost the market growth in the forecast period.

- In 2022, the individuals segment accounted for the largest revenue share over the forecast period.

Based on end users, the Japan auto loan market is segmented into individuals, and enterprises. Among these, the individuals segment has the largest revenue share over the forecast period. Buying a car on loan and investing the available funds in a mutual fund having a higher return than the cost of a loan might help consumers to pan out an advantageous situation, so individuals prefer to buy vehicles on loan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Auto Loan Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Financial Services

- Nissan Financial Services

- Maruhan Japan Bank

- SMBC Trust Bank

- HDB Financial Service

- Bank of Kyoto

- Orient Corporation

- Orient Corporation

- Mitsubishi UFJ Financial Group

- Volkswagen Financial Services Japan

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, as part of the Dutton Group, Albert Automotive Holdings Pty Ltd is a wholesale and retail used car business. Sojitz Corporation, a pre-owned car dealer, acquired this business to expand its reach into both domestic and foreign markets.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan auto loan market based on the below-mentioned segments:

Japan Auto Loan Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Japan Auto Loan Market, By End User

- Individuals

- Enterprises

Need help to buy this report?