Japan Aqueous Polyurethane Dispersion Market Size, Share, and COVID-19 Impact Analysis, By Product (Component Polyurethane, Two-component Polyurethane, & Urethane Modified), By Application (PUD Leather Finishing Agents, PUD Coating Agents, PUD Water-based Glue, Waterborne Wood Coatings, Water-based Paints), and Japan Aqueous Polyurethane Dispersion Market Insights, Industry Trend, Forecasts to 2032

Industry: Chemicals & MaterialsJapan Aqueous Polyurethane Dispersion Market Insights Forecasts to 2032

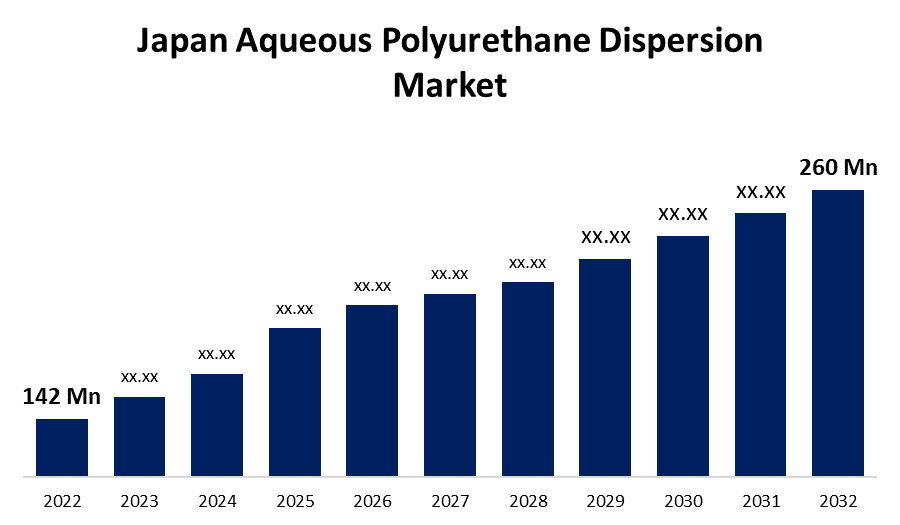

- The Japan Aqueous Polyurethane Dispersion Market Size was valued at USD 142 Million in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032

- The Japan Aqueous Polyurethane Dispersion Market Size is Expected to reach USD 260 Million by 2032.

Get more details on this report -

The Japan Aqueous Polyurethane Dispersion Market Size was valued at USD 142 Million in 2022 and is Expected to Grow to USD 260 Million by 2032, at a CAGR of 6.2% during the forecast period (2022-2032).

Market Overview

Polyurethane dispersion (PUD) is a chemical that is widely utilized in its soluble form, particularly as a flocculating agent in drinking water and wastewater treatment facilities. It is used in the textile dyeing and printing cloth industries in an aqueous form, providing the solution is alkaline. Polyols and isocyanates are the two main basic ingredients used in the production of polyurethane resin. Polyurethane resins are made by combining polyols with isocyanates. Changing raw material costs are projected to have an influence on aqueous polyurethane pricing in Japan throughout the predicted period. The product is manufactured in two steps, with raw components first reacting with each other and then being synthesized under regulated environmental circumstances. The value chain for aqueous polyurethane dispersion includes raw material suppliers, manufacturers, distributors/suppliers, and industrial end-users. Polyurethane resins, polyols, isocyanates, and butanediol are supplied by companies for use in the production of aqueous PUD. Few manufacturers position themselves across the whole value chain, and even fewer get raw materials from other vendors. Because the number of raw material suppliers in Japan is limited, suppliers maintain proximity to manufacturers to decrease shipping costs.

Report Coverage

This research report categorizes the market of Japan aqueous polyurethane dispersion market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan aqueous polyurethane dispersion market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan aqueous polyurethane dispersion market.

Japan Aqueous Polyurethane Dispersion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 142 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 260 Million |

| Historical Data for: | 2020-2022 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Product, By Application and Country Statistics (Demand, Price, Growth, Competitors, Challenges) |

| Companies covered:: | Bayer Material Science (Covestro), DSM, UBE Industries Ltd., Stahl, Chemtura, Lubrizol, BASF SE, Alberdingk Boley GmbH, Hauthaway, Mitsui & Co. Ltd., DIC Corporation, Reichhold, Sanyo Chemical Industries Ltd., Dai Ichi Kogyo Seiyaku, Arakawa Chemical Industries Ltd., Adeka Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the important factors driving market expansion is the advancement of the automobile industry and advancements in the home furnishing & interior sector. Moreover, the market is expected to grow fast due to high demand from the synthetic leather manufacturing industry. This section has additional key uses in industries such as textile finishing, furniture and interiors, natural leather finishing, and vehicles. Strong expansion in Japan's leather sector is projected to drive demand for aqueous polyurethane dispersion. Also, with the rapid expansion of the country's completed leather industry, the market for aqueous PUD is expected to grow in the future years. In addition, the expansion of the luxury goods market, such as jackets and wallets, is likely to translate into increased consumption of aqueous polyurethane dispersion. As opposed to high-end luxury products, affordable luxury firms are concentrating on extending their influence in Japan and other Asian nations by providing more colorful and stylish designs.

Restraining Factors

Fluctuating oil prices may have a direct impact on raw material prices, reducing profit margins for suppliers and product producers. This might stifle the expansion of polyurethane dispersion for the projected period.

COVID 19 Impacts

The COVID-19 pandemic has disrupted supply chains, generating shortages and affecting manufacturing and distribution in the Aqueous Polyurethane Dispersion sector. This has led to changes in customer behavior and demand, and businesses have had to adjust to remain competitive. In addition to the pandemic, political and economic events have influenced the Aqueous Polyurethane Dispersion industry. For example, changes in government policy, and fluctuations in currency rates, can all have an impact on the business.

Market Segment

- In 2022, component polyurethane is influencing the largest market share over the forecast period.

Based on the product, the Japan aqueous polyurethane dispersion market is bifurcated into component polyurethane, two-component polyurethane, & urethane modified. Among these segments, component polyurethane dominates the largest market share during the forecast period. Two-component polyurethane dispersion methods improve the product's hardness, exterior appearance, finishes, and chemical resistance. Multiple crosslinking agents are used, including poly aziridine, carbodiimide, water-dilutable isocyanate, and water-dilutable epoxy. Due to this, In Japan, its market share is expected to grow throughout the predicted period.

Urethane modified is expected to be the fastest-growing sector over the projection period. They are often utilized as reflective coatings in a variety of sectors. For use in the coatings business, urethanes are oil-modified. Modified urethanes offer good abrasion and mar resistance while also increasing flexibility, toughness, and chemical resistance. Industrial floors, gym floors, trim varnishes, timber floors, and a variety of other uses are all possible with these coatings.

- In 2022, water-based paints application is dominating the largest market growth during the forecast period.

Based on application, the Japan aqueous polyurethane dispersion market is classified into several factors such as PUD leather finishing agents, PUD coating agents, PUD water-based glue, waterborne wood coatings, and water-based paints. Among these, water-based paints application held the largest market share during the forecast period. This segment's dominance can be attributed to environmental restrictions such as the Clean Air Act and technical breakthroughs that have made water-based paints an efficient replacement for solvent-based coatings.

Aqueous PUDs have increasingly supplanted solvent-based PU lacquers due to their higher performance and eco-friendliness, aqueous PUDs have rapidly replaced solvent-based PU lacquers. The resemblance between the collagen fiber of leather and polyurethane molecule is the primary cause for the emergence of aqueous PUD as a leather finishing treatment. Japan has a potentially enormous market for finished leather, which is expected to assist the country's market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan protective coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer Material Science (Covestro)

- DSM

- UBE Industries Ltd.

- Stahl

- Chemtura

- Lubrizol

- BASF SE

- Alberdingk Boley GmbH

- Hauthaway

- Mitsui & Co. Ltd.

- DIC Corporation

- Reichhold

- Sanyo Chemical Industries Ltd.

- Dai Ichi Kogyo Seiyaku

- Arakawa Chemical Industries Ltd.

- Adeka Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Japan Aqueous Polyurethane Dispersion Market based on the below-mentioned segments:

Japan Aqueous Polyurethane Dispersion Market Size, By Product

- Component Polyurethane

- Two-component Polyurethane

- Urethane Modified

Japan Aqueous Polyurethane Dispersion Market Share, By Application

- PUD Leather Finishing Agents

- PUD Coating Agents

- PUD Water-based Glue

- Waterborne Wood Coatings

- Water-based Paints

Need help to buy this report?