Japan Antibody Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Monoclonal Antibodies (mAbs) and Antibody-drug Conjugates (ADCs)), By Source (Human mAb, Murine mAb, Humanized mAb, and Chimeric mAb), By Application (Cancer, Inflammatory Diseases, Infectious Diseases, Autoimmune Diseases, and Others), and Japan Antibody Therapeutics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Antibody Therapeutics Market Insights Forecasts to 2035

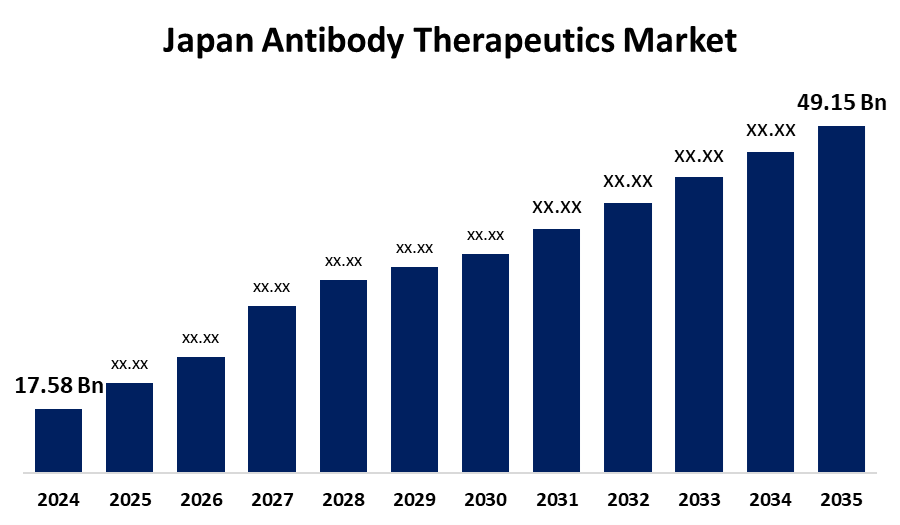

- The Japan Antibody Therapeutics Market Size Was Estimated at USD 17.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.8% from 2025 to 2035

- The Japan Antibody Therapeutics Market Size is Expected to Reach USD 49.15 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Antibody Therapeutics Market Size is anticipated to Reach USD 49.15 Billion by 2035, Growing at a CAGR of 9.8% from 2025 to 2035. The market for antibody therapeutics in Japan increases at an aggressive pace as a result of an aging population, increased chronic diseases, improved techniques in antibody engineering, and encouraging government policies, fueling high demand for targeted drugs, particularly monoclonal antibodies in oncology and autoimmune disease therapies.

Market Overview

The Japan Market Size for Antibody Therapeutics refers to the development and application of monoclonal and polyclonal antibodies for the management of numerous diseases such as cancer, autoimmune disorders, and neurological disorders. These biologics provide more precise targeted treatments with less toxicity than conventional therapies. The Japan market key strengths are a solid healthcare infrastructure, high research and development capabilities, and a supportive regulatory regime. Horizons for opportunities include broader application of antibody therapeutics to new disease spaces, including neurological conditions and infectious diseases, and the creation of subcutaneous formulations with improved patient convenience and lower costs of healthcare. Drivers of the market are an aging population, a growing incidence of chronic diseases, and biotechnology advancements. Government support for the expansion of Japans antibody therapeutics market comes in the form of expanded research and development funding, tax incentives, and the streamlining of approval procedures.

Report Coverage

This research report categorizes the market for the Japan antibody therapeutics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan antibody therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan antibody therapeutics market.

Japan Antibody Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.58 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.8% |

| 2035 Value Projection: | USD 49.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | AbbVie Inc., Takeda Pharmaceutical Company Ltd., Johnson & Johnson Services Inc., Chugai Pharmaceutical, AstraZeneca, Bristol-Myers Squibb Co., Mitsubishi Tanabe Pharma, Merck KGaA, Daiichi Sankyo, Amgen Inc., Hoffmann-La Roche Ltd., Novartis AG, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan antibody therapeutics market is fueled by an aggressively aging populace and the burgeoning incidence of conditions such as cancer and autoimmune diseases. Improved biotechnology makes it possible to create highly targeted, more effective, and safer therapies. Government support through financing, accelerated approvals, and beneficial regulations also spurs expansion. Collaborations between pharmaceutical companies and biotech firms also accelerate the pace of innovation. Increased patient demand for personalized and potent treatments also drives market growth.

Restraining Factors

The Japan antibody therapeutics market is restrained by high development and production costs, strict regulatory demands, limited insurance coverage, and shifting pricing policies, all of which reduce patient accessibility and slow product launches, thereby limiting the broad adoption of these therapies.

Market Segmentation

The Japan antibody therapeutics market share is classified into product type, source, and application.

- The monoclonal antibodies (mAbs) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan antibody therapeutics market is segmented by product type into monoclonal antibodies (mAbs) and antibody-drug conjugates (ADCs). Among these, the monoclonal antibodies (mAbs) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing need for targeted therapies in the treatment of cancer, autoimmune, and inflammatory disorders, propel the market. Monoclonal antibodies (mAbs) have transformed treatment by targeting disease-inducing antigens specifically, providing high specificity and enhanced therapeutic responses in numerous medical conditions.

- The human mAb segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan antibody therapeutics market is segmented by source into human mAb, murine mAb, humanized mAb, and chimeric mAb. Among these, the human mAb segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to an increasing inclination for fully human monoclonal antibodies, which have advantages such as lower immunogenicity and fewer side effects, making them highly suitable for long-term therapy and enhancing patient safety and therapeutic efficacy.

- The cancer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan antibody therapeutics market is segmented by application into cancer, inflammatory diseases, infectious diseases, autoimmune diseases, and others. Among these, the cancer segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing cancer incidence and expanding need for successful targeted therapies. Monoclonal antibodies now play a crucial role in treating cancer, with increased specificity and fewer side effects than conventional chemotherapy, offering better patient outcomes and quality of life.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan antibody therapeutics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Takeda Pharmaceutical Company Ltd.

- Johnson & Johnson Services Inc.

- Chugai Pharmaceutical

- AstraZeneca

- Bristol-Myers Squibb Co.

- Mitsubishi Tanabe Pharma

- Merck KGaA

- Daiichi Sankyo

- Amgen Inc.

- Hoffmann-La Roche Ltd.

- Novartis AG

- Others

Recent Developments:

- In August 2023, ImmunoGen partnered exclusively with Takeda to develop and commercialize ELAHERE, an ADC targeting FRα-positive, platinum-resistant ovarian cancer, in Japan. ImmunoGen received USD 34 million upfront, with potential milestone payments and royalties, highlighting Takedas dedication to advancing innovative cancer treatments in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan antibody therapeutics market based on the below-mentioned segments:

Japan Antibody Therapeutics Market, By Product Type

- Monoclonal Antibodies (mAbs)

- Antibody-Drug Conjugates (ADCs)

Japan Antibody Therapeutics Market, By Source

- Human mAb

- Murine mAb

- Humanized mAb

- Chimeric mAb

Japan Antibody Therapeutics Market, By Application

- Cancer

- Inflammatory Diseases

- Infectious Diseases

- Autoimmune Diseases

- Others

Need help to buy this report?