Japan Anti-Corrosion Coatings Market Size, Share, and COVID-19 Impact Analysis, By Type (Water-based, Solvent-based, Powder, and Others), By Material (Polyurethane, Epoxy, Acrylic, Alkyd, Zinc, and Others), and Japan Anti-Corrosion Coatings Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsJapan Anti-Corrosion Coatings Market Insights Forecasts to 2033

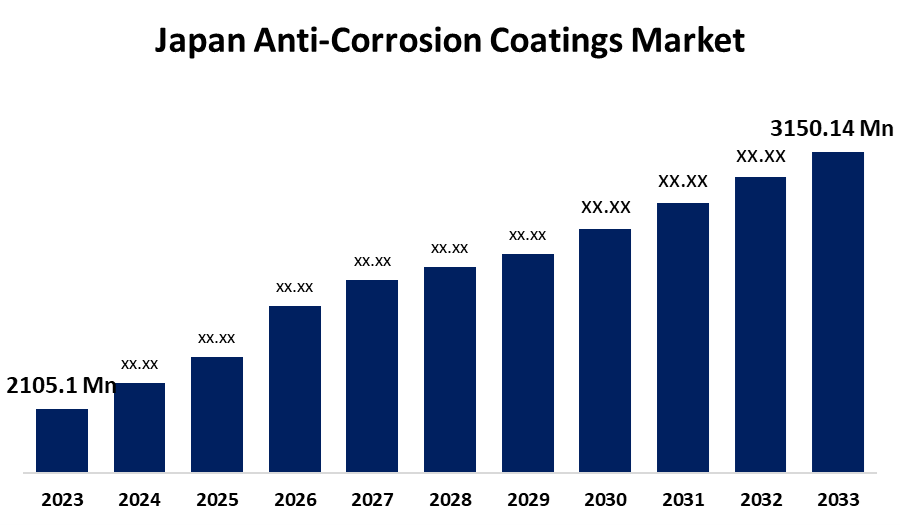

- The Japan Anti-Corrosion Coatings Market Size was valued at USD 2,105.1 million in 2023.

- The Market is Growing at a CAGR of 4.11% from 2023 to 2033

- The Japan Anti-Corrosion Coatings Market Size is expected to reach USD 3,150.14 million by 2033

Get more details on this report -

The Japan Anti-Corrosion Coatings Market Size is anticipated to reach USD 3,150.14 million by 2033, growing at a CAGR of 4.11% from 2023 to 2033.

Market Overview

Specialized films that are applied to surfaces to prevent corrosion are known as anti-corrosion coatings. They are made from a variety of materials, including acrylic, zinc, epoxy, and polyurethane. There are several varieties of anti-corrosion coatings, such as hybrid, inorganic, and organic coatings. Their special qualities, such as superior adhesion, waterproofing, and resistance to chemicals define them. Applications for anti-corrosion coatings are numerous and include construction, power production, petroleum and natural gas, automobiles maritime, and industrial gear. They have many advantages, such as longer equipment life, lower maintenance expenses, and better appearance. Furthermore, anti-corrosion coatings are renowned for their adaptability, environmental friendliness, affordability, and effectiveness under harsh circumstances. Additionally, the market in Japan has expanded gradually due to the country's growing industrial activity, expanding infrastructure, and growing demand for high-performance and environmentally friendly coatings. Eco-friendly coatings with minimal or no volatile organic compounds (VOCs) are becoming more and more popular in Japan as environmental regulations become more stringent. In Japan, technological advancements are making it possible to create smart coatings that can self-heal and detect corrosion in real time.

Report Coverage

This research report categorizes the market for the Japan anti-corrosion coatings market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan anti-corrosion coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan anti-corrosion coatings market.

Japan Anti-Corrosion Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2,105.1 million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.11% |

| 2033 Value Projection: | USD 3,150.14 million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material |

| Companies covered:: | AkzoNobel, PPG Industries, Sherwin-Williams, BASF, Kansai Paint, Nippon Paint Holdings Co., Ltd., RPM International Inc., and Other Key Players. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The Japan automotive industry's growing need for anti-corrosion coatings to prolong the life of automobiles and their parts is fostering a favorable environment for market expansion. Japan's growing shipping and marine industry is another factor propelling market expansion, as it facilitates the widespread adoption of goods for protecting ships and submerged infrastructure from corrosive saltwater. In addition, Japan's fast urbanization and modernization are driving up the use of anti-corrosion coatings in the building sector, which is supporting market expansion. Japan's reliance on water is enormous because it is an island nation. Its dependable and effective shipping has also made it one of the greatest marine traders in the world. Building ships is Japan's primary area of expertise, accounting for 17.6% of global production. The anti-corrosion market in Japan is being driven by the expanding maritime sector and the requirement for cutting-edge anti-corrosion solutions to shield infrastructure and ships from hostile waters.

Restraining Factors

Heavy metals, volatile organic compounds (VOCs), and other hazardous substances that can harm the environment are present in a lot of anti-corrosion coatings. During the application and curing procedures, these coatings commonly release toxic vapors that endanger the health of nearby communities and employees.

Market Segmentation

The Japan anti-corrosion coatings market share is classified into type and material.

- The solvent-based segment is expected to hold a significant market share through the forecast period.

The Japan anti-corrosion coatings market is segmented by type into water-based, solvent-based, powder, and others. Among these, the solvent-based segment is expected to hold a significant market share through the forecast period. This is attributed to the solvent-based corrosion prevention coatings have improved temperature, scratch resistance, moisture, and reduced drying times.

- The acrylic segment is expected to dominate the Japan anti-corrosion coatings market during the forecast period.

Based on the material, the Japan anti-corrosion coatings market is divided into polyurethane, epoxy, acrylic, alkyd, zinc, and others. Among these, the acrylic segment is expected to dominate the Japan anti-corrosion coatings market during the forecast period. This is attributed to the primarily water-based, acrylic coatings offer greater performance in a variety of applications, including wall and roof coating, ease of handling, and lower costs as compared to alternative materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan anti-corrosion coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- BASF

- Kansai Paint

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Anti-Corrosion Coatings Market based on the below-mentioned segments:

Japan Anti-Corrosion Coatings Market, By Type

- Water-based

- Solvent-based

- Powder

- Others

Japan Anti-Corrosion Coatings Market, By Material

- Polyurethane

- Epoxy

- Acrylic

- Alkyd

- Zinc

- Others

Need help to buy this report?