Japan Angiography Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Angiography Systems, Catheters, Guidewire, Balloons, Contrast Media, Vascular Closure Devices, and Angiography Accessories), By Procedure (Coronary, Endovascular, and Neurovascular), By Application (Diagnostic and Therapeutic), and Japan Angiography Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Angiography Equipment Market Insights Forecasts to 2035

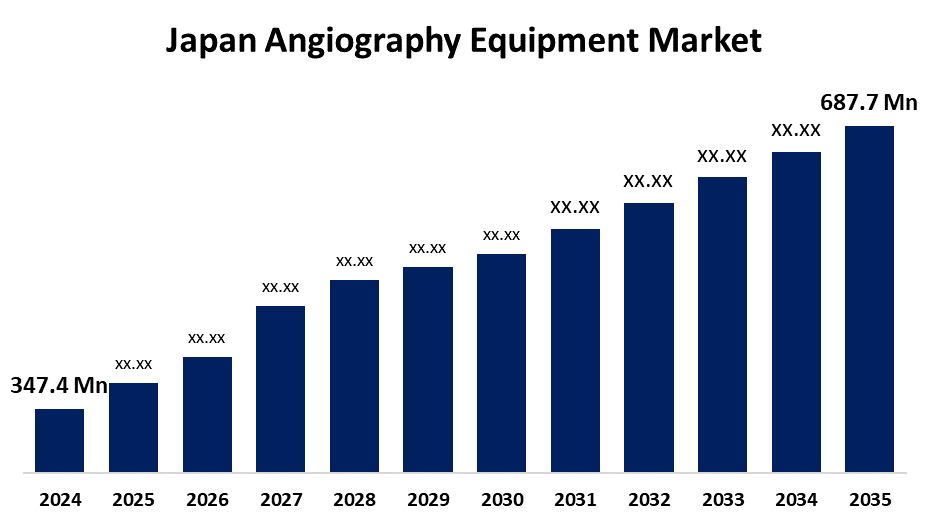

- The Japan Angiography Equipment Market Size Was Estimated at USD 347.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.4% from 2025 to 2035

- The Japan Angiography Equipment Market Size is Expected to Reach USD 687.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan angiography equipment market is anticipated to reach USD 687.7 million by 2035, growing at a CAGR of 6.4% from 2025 to 2035. The Japan angiography equipment market is expanding due to rising cardiovascular disease cases, an aging population, and advances in medical technology. These factors are driving the demand for sophisticated diagnostic instruments and minimally invasive treatments to enhance patient outcomes and productivity.

Market Overview

The Japan angiography equipment market refers to imaging systems to make blood vessels visible by injecting contrast agents to help diagnose and treat cardiovascular diseases. In Japan, the leading application is the detection and management of heart and vascular disorders. Market expansion comes with an aging population, growing cases of cardiovascular diseases, and advances in technology. Growing demand for minimally invasive interventions and improved accuracy in imaging further powers the uptake of angiography equipment in healthcare centers. Technological competencies include superior, small dose, AI-improved imaging systems, as evident with Shimadzu's Trinias and with spectral CT and AI software integration. Opportunities exist in growing minimally invasive procedures, dose-reduction technologies, hybrid operating rooms, and new robotics and bi-plane systems. Government and industry policies, infrastructure spending, regulatory environments through PMDA, reimbursement incentives, data-security provisions, and patient-oriented care further contribute to growth.

Report Coverage

This research report categorizes the market for the Japan angiography equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan angiography equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan angiography equipment market.

Japan Angiography Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 347.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.4% |

| 2035 Value Projection: | USD 687.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Procedure and COVID-19 Impact Analysis |

| Companies covered:: | Shimadzu Corporation, Medtronic, Terumo Corporation, Canon Medical Systems, Boston Scientific, Nihon Kohden Corporation, Siemens Healthineers, AngioDynamics Inc., Nipro Corporation, Abbott Laboratories, Hamamatsu Photonics, GE Healthcare, Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan angiography equipment market is fueled by a fast-growing population aged 65 and above, at more than 30%, leading to a high incidence of cardiovascular disease. Increased demand for minimally invasive procedures like percutaneous coronary interventions (PCI) also drives growth. Advances in technology, for example, AI-enabled imaging and low-dose radiation technology, improve diagnostic precision and safety. Moreover, robust healthcare infrastructure, growing healthcare expenditure, and favorable government policies also support market growth and the use of sophisticated angiography solutions.

Restraining Factors

The high prices of devices and procedures, unpredictable reimbursement policies, strict regulatory approval, fears of radiation dosage to the patient and the staff, limited availability in smaller hospitals, and a lack of qualified operators restrict Japan's angiography equipment market.

Market Segmentation

The Japan angiography equipment market share is classified into product, procedure, and application.

- The angiography systems segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan angiography equipment market is segmented by product into angiography systems, catheters, guidewire, balloons, contrast media, vascular closure devices, and angiography accessories. Among these, the angiography systems segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing use of sophisticated imaging technologies, improved diagnostic precision, and an increase in cardiovascular procedures worldwide are driving demand for angiography systems. Diagnostic centers and hospitals are spending money on these systems to provide better outcomes for patients, thus expanding their market size and fueling growth.

- The coronary segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan angiography equipment market is segmented by procedure into coronary, endovascular, and neurovascular. Among these, the coronary segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the growth in the incidence of coronary artery disease (CAD), one of the world's major causes of death, which propels demand for angiography systems. Increasing coronary interventions such as angioplasty and stenting, as well as improvements in catheter design and real-time imaging capabilities, additionally contribute to market growth in this sector.

- The diagnostic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan angiography equipment market is segmented by application into diagnostic and therapeutic. Among these, the diagnostic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing demand for precise and timely diagnosis of cardiovascular diseases is propelling demand for diagnostic angiography. Highly embraced by hospitals, it identifies blockages and vascular problems. Advances in technology, such as increased resolution, increased imaging speed, and decreased use of radiation, have further increased its popularity and usage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan angiography equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shimadzu Corporation

- Medtronic

- Terumo Corporation

- Canon Medical Systems

- Boston Scientific

- Nihon Kohden Corporation

- Siemens Healthineers

- AngioDynamics Inc.

- Nipro Corporation

- Abbott Laboratories

- Hamamatsu Photonics

- GE Healthcare

- Others

Recent Developments:

- In March 2024, Shimadzu Corporation launched “SHIMADZU Connected,” a service-focused program for diagnostic X-ray systems. It aims to generate recurring revenue through service contracts, spare parts, and licensed software. The initial product, SMILE guard, proactively replaces X-ray tubes to prevent malfunctions and ensure system reliability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan angiography equipment market based on the below-mentioned segments:

Japan Angiography Equipment Market, By Product

- Angiography Systems

- Catheters, Guidewire

- Balloons

- Contrast Media

- Vascular Closure Devices

- Angiography Accessories

Japan Angiography Equipment Market, By Procedure

- Coronary

- Endovascular

- Neurovascular

Japan Angiography Equipment Market, By Application

- Diagnostic

- Therapeutic

Need help to buy this report?