Japan Amorphous Soft Magnetic Materials Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Iron-Based Amorphous Soft Magnetic Materials, Cobalt-Based Amorphous Soft Magnetic Materials, and Others), By Application (Transformers, Motors, Inductors, Sensors, and Others), and Japan Amorphous Soft Magnetic Materials Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Amorphous Soft Magnetic Materials Market Insights Forecasts to 2035

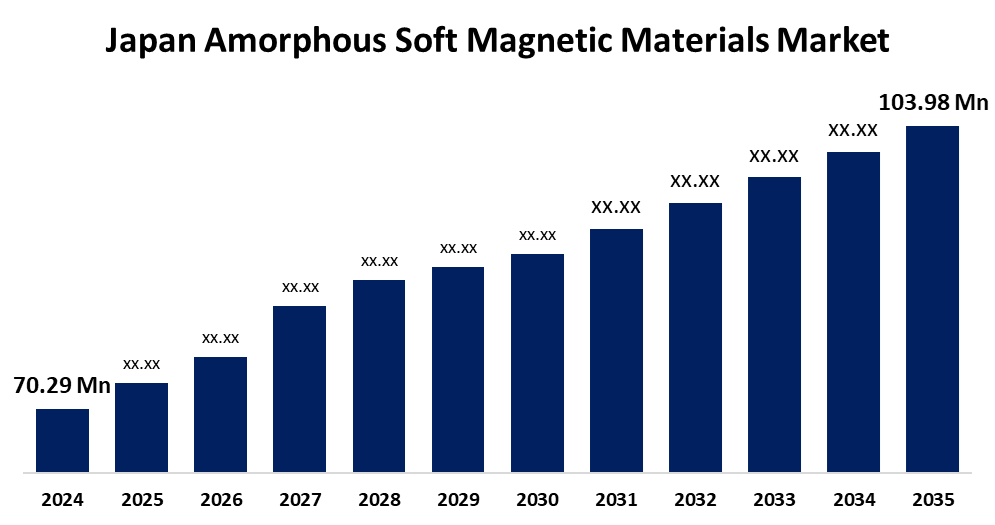

- The Japan Amorphous Soft Magnetic Materials Market Size Was Estimated at USD 70.29 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.62% from 2025 to 2035

- The Japan Amorphous Soft Magnetic Materials Market Size is Expected to Reach USD 103.98 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Amorphous Soft Magnetic Materials Market Size is anticipated to Reach USD 103.98 Million by 2035, Growing at a CAGR of 3.62% from 2025 to 2035. Technological advancements and government support for renewable energy and smart grid infrastructure also contribute to market growth.

Market Overview

The Japan Amorphous Soft Magnetic Materials Market Size refers to the industry segment focused on the production and application of non-crystalline magnetic alloys, primarily used in transformers, motors, inductors, and sensors. The market for amorphous soft magnetic materials is significantly influenced by Japans increasing use of electric vehicles (EVs). For example, EV sales have been steadily rising over the last several years. By 2035, the Japanese government wants all new car sales to be electric, setting high goals for EV adoption. Numerous subsidies and incentives for EV purchases assist this movement. The manufacture of electric vehicles has increased, and major Japanese automakers including Toyota, Nissan, and Honda are making significant investments in R&D. According to the Ministry of Economy, Trade, and Industry (METI), there are now a significant number of EV charging stations nationwide.

Report Coverage

This research report categorizes the market for the Japan amorphous soft magnetic materials market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan amorphous soft magnetic materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan amorphous soft magnetic materials market.

Japan Amorphous Soft Magnetic Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 70.29 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.62% |

| 2035 Value Projection: | USD 103.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 87 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Hitachi Metals, Ltd., VACUUMSCHMELZE GmbH & Co. KG, Metglas, Inc., Qingdao Yunlu Advanced Materials Technology Co., Ltd., TDK Corporation, Nippon Steel Corporation, Sumitomo Electric Industries, Ltd., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for amorphous soft magnetic materials is being driven by Japans dedication to improving energy efficiency and developing renewable energy projects. By 2030, Japan wants to dramatically raise the proportion of renewable energy in its power mix. To encourage the use of renewable energy, the government has put in place feed-in tariffs and other incentives. The number of solar power installations is steadily increasing. The number of offshore wind projects under development is rising, according to the Japan Wind Power Association. Because of these efforts, there is a growing demand for effective power transmission and distribution systems, in which amorphous soft magnetic materials are essential. Furthermore, the significance of smart grid technologies is emphasized in the governments Strategic Energy Plan, which increases demand for these materials in modern power infrastructure.

Restraining Factors

The market is hampered by factors including high production costs brought on by intricate manufacturing procedures such quick solidification, which call for specialized machinery. Scalability is further complicated by the high cost and restricted supply of raw materials like as high-purity iron and cobalt. Broader adoption may also be hampered by competition from substitute magnetic materials and the requirement for ongoing R&D expenditure to boost efficiency and cut expenses. Expanding the market is also hampered by supply chain weaknesses and a lack of knowledge in cost-sensitive industries.

Market Segmentation

The Japan amorphous soft magnetic materials market share is classified into product type and application.

- The iron-based amorphous soft magnetic materials segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan amorphous soft magnetic materials market is segmented by product type into iron-based amorphous soft magnetic materials, cobalt-based amorphous soft magnetic materials, and others. Among these, the iron-based amorphous soft magnetic materials segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their cost-effectiveness, excellent magnetic properties such as low core loss and high permeability, and widespread use in power distribution and electronic applications.

- The transformers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan amorphous soft magnetic materials market is segmented by application into transformers, motors, inductors, sensors, and others. Among these, the transformers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Amorphous metal transformers are widely adopted in Japans energy infrastructure due to their superior energy efficiency and reduced core losses compared to traditional silicon steel cores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the Japan amorphous soft magnetic materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Metals, Ltd.

- VACUUMSCHMELZE GmbH & Co. KG

- Metglas, Inc.

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- TDK Corporation

- Nippon Steel Corporation

- Sumitomo Electric Industries, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Amorphous Soft Magnetic Materials Market based on the below-mentioned segments:

Japan Amorphous Soft Magnetic Materials Market, By Product Type

- Iron-Based Amorphous Soft Magnetic Materials

- Cobalt-Based Amorphous Soft Magnetic Materials

- Others

Japan Amorphous Soft Magnetic Materials Market, By Application

- Transformers

- Motors

- Inductors

- Sensors

- Others

Need help to buy this report?