Japan Airless Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Glass, Plastic, and Metal), By Application (Personal & Home Care, Pharmaceutical, Pet Care, and Others), and Japan Airless Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Airless Packaging Market Insights Forecasts to 2035

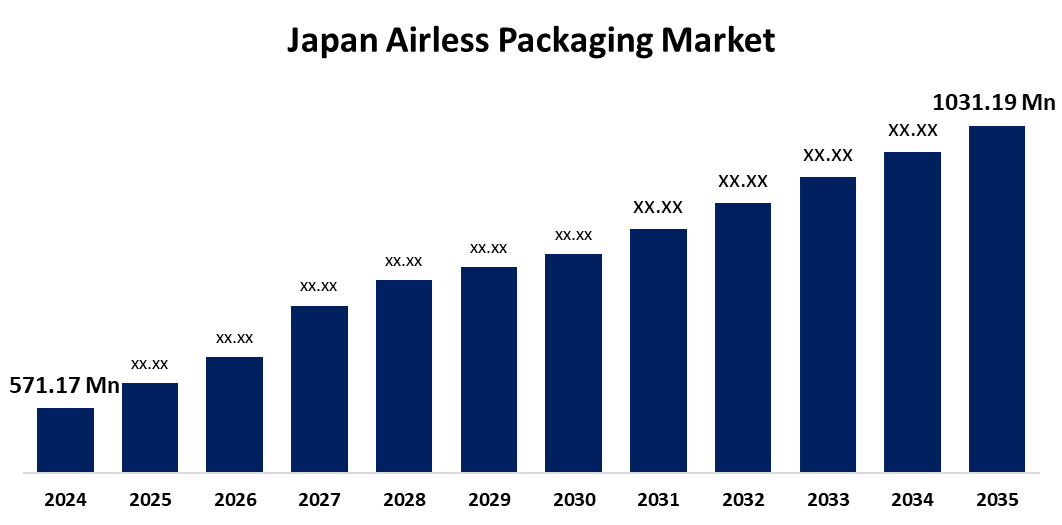

- The Japan Airless Packaging Market Size Was Estimated at USD 571.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.52% from 2025 to 2035

- The Japan Airless Packaging Market Size is Expected to Reach USD 1031.19 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Airless Packaging Market Size is anticipated to reach USD 1031.19 Million by 2035, Growing at a CAGR of 5.52% from 2025 to 2035. Rising demand for sustainable and hygienic packaging, especially in cosmetics and pharmaceuticals.

Market Overview

The Japan Airless Packaging Market Size refers to the industry focused on packaging systems that prevent air exposure, thereby protecting sensitive products from contamination, oxidation, and spoilage. Japanese buyers are becoming more conscious about the quality and safety of products, especially when it comes to skincare, cosmetics, and medications. Sensitive compositions are shielded from oxidation and contamination by airless packaging, preserving product integrity. For natural or preservative-free items that are prone to deterioration, this is essential. The ability of packaging to preserve product freshness is a major consideration for more than 80% of Japanese skincare consumers. Big brands are taking advantage of this trend. For example, SK-II introduced an airless jar for its best-selling face treatment essence, highlighting how it maintains the product's effectiveness. Manufacturers are using transparent labeling and marketing to highlight the advantages of airless packaging. For instance, the website for Shiseido's ELIXIR brand includes instructional materials regarding how airless packaging preserves product effectiveness.

Report Coverage

This research report categorizes the market for the Japan Airless packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Airless packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan Airless packaging market.

Japan Airless Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 571.17 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.52% |

| 2035 Value Projection: | USD 1031.19 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Material, By Application |

| Companies covered:: | Aptar Group Inc., Albea Beauty Holdings S.A., HCP Packaging, Libo Cosmetics Company, Fusion Packaging, WestRock Company, ABC Packaging Ltd., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Airless packaging and other eco-friendly packaging solutions are in high demand due to strict government laws on sustainable practices and growing environmental consciousness among Japanese customers. Because customers may use almost all of the product in airless packaging, less waste and surplus resources are produced. This supports recycling and Japan's efforts to cut down on plastic waste. For example, more than 70% of buyers take the environment into account when choosing cosmetic packaging. In 2022, Shiseido introduced its first refillable airless jar built from recycled materials, demonstrating how major corporations are reacting to this trend. Additionally, the market has experienced a rise in the use of innovations such as biodegradable materials and refillable airless bottles. Kao Corporation launched its Sofina skincare brand with a refillable, airless pump bottle composed entirely of recycled plastic.

Restraining Factors

One of the key restraints in Japan’s airless packaging market is the high cost of manufacturing, especially for advanced designs with smart dispensing features or sustainable materials. This can be a barrier for small and mid-sized brands. Additionally, limited consumer awareness in budget segments hinders the widespread adoption of such packaging, particularly outside urban markets. There are also material compatibility concerns, especially when working with natural or reactive formulations, which can compromise product safety or shelf life.

Market Segmentation

The Japan airless packaging market share is classified into material and application.

- The plastic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan airless packaging market is segmented by material into glass, plastic, and metal. Among these, the plastic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Plastic dominates due to its lightweight, cost-effectiveness, and ease of customization. It supports various dispensing mechanisms and is ideal for mass production, especially in personal care and cosmetics.

- The personal & home care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan airless packaging market is segmented by application into personal & home care, pharmaceutical, pet care, and others. Among these, the personal & home care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment leads because of high demand for skincare, cosmetics, and hygiene products in Japan. Consumers prioritize product freshness and hygiene, making airless packaging a preferred choice.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan airless packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aptar Group Inc.

- Albea Beauty Holdings S.A.

- HCP Packaging

- Libo Cosmetics Company

- Fusion Packaging

- WestRock Company

- ABC Packaging Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Airless Packaging Market based on the following segments:

Japan Airless Packaging Market, By Material

- Glass

- Plastic

- Metal

Japan Airless Packaging Market, By Application

- Personal & Home Care

- Pharmaceutical

- Pet Care

- Others

Need help to buy this report?