Japan AI in Finance Market Size, Share, and COVID-19 Impact Analysis, By Components (Solutions and Service), By Deployment Mode (On-Premise and Cloud-Based), and Japan AI in Finance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialJapan AI in Finance Market Insights Forecasts to 2035

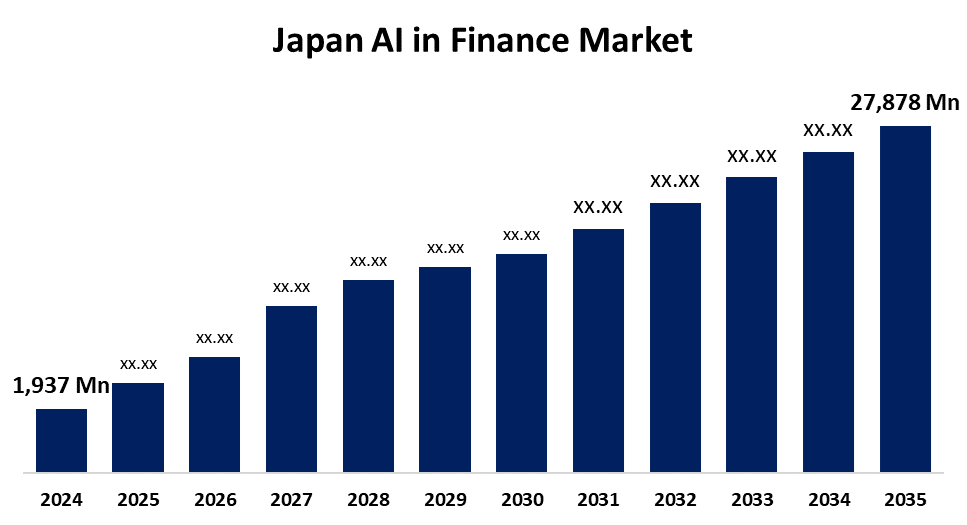

- The Japan AI in Finance Market Size Was Estimated at USD 1,937 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 27.43% from 2025 to 2035

- The Japan AI in Finance Market Size is Expected to Reach USD 27,878 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan AI in Finance Market is anticipated to reach USD 27,878 Million by 2035, Growing at a CAGR of 27.43% from 2025 to 2035. The market is fueled by digital transformation, increasing demand for predictive analytics, and the adoption of AI-powered chatbots, robo-advisors, and algorithmic trading.

Market Overview

The Japan artificial intelligence in finance market focuses on AI-driven solutions for banking, insurance, and investment, enhancing automation, fraud detection, and customer experience. One of the main factors driving the artificial intelligence (AI) in finance market in Japan is the quick development of machine learning and AI technology. In order to automate a number of procedures, including risk management, fraud detection, underwriting, and credit scoring, financial institutions are progressively implementing AI technologies. Through workflow optimization, human error reduction, and the automation of repetitive processes, AI-powered solutions are dramatically increasing operational efficiency. Financial institutions are also better equipped to manage massive amounts of data thanks to this automation, which enables them to provide quicker, more precise services.

Report Coverage

This research report categorizes the market for the Japan AI in finance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan AI in finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan AI in finance market.

Japan AI in Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,937 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 27.43% |

| 2035 Value Projection: | USD 27,878 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Components, By Deployment Mode and COVID-19 Impact Analysis |

| Companies covered:: | Zoho, Netapp, Inbenta Holdings Inc., Vectra AI, Nuance Communications, Inc., NVIDIA, FIS and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Japan, a number of important variables are propelling the development of AI in finance. These include cost optimization, better client experiences, increased fraud detection, and the growing requirement for automation. To maintain a competitive edge, financial institutions are using AI more and more for data analysis, predictive modeling, and customized services. The market is also growing as a result of the growing use of chatbots, robo-advisors, and algorithmic trading driven by AI. The deployment of AI technology is also being accelerated by trends like digital transformation and the incorporation of AI into regulatory compliance procedures.

Restraining Factors

A major obstacle confronting the Japanese AI finance business is guaranteeing strong data security and privacy. Fintech AI applications heavily rely on large volumes of sensitive data, such as financial, transactional, and personal data.

Market Segmentation

The Japan AI in finance market share is classified into components and deployment mode.

- The solutions segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan AI in finance market is segmented by components into solutions and service. Among these, the solutions segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The solution section consists of AI-driven software and solutions for risk management, automation, fraud detection, business analytics, and customer support.

- The on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan AI in finance market is segmented by deployment mode into on-premise and cloud-based. Among these, the on-premise segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Installing AI tools inside an organization's infrastructure is known as "on-premise deployment," and it offers more protection and control over data.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan AI in finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zoho

- Netapp

- Inbenta Holdings Inc.

- Vectra AI

- Nuance Communications, Inc.

- NVIDIA

- FIS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan AI in finance market based on the below-mentioned segments:

Japan AI in Finance Market, By Components

- Solutions

- Service

Japan AI in Finance Market, By Deployment Mode

- On-Premise

- Cloud-Based

Need help to buy this report?