Japan Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Fertilizers, Crop Protection Chemicals), By Application (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables), and Japan Agrochemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Agrochemicals Market Insights Forecasts to 2035

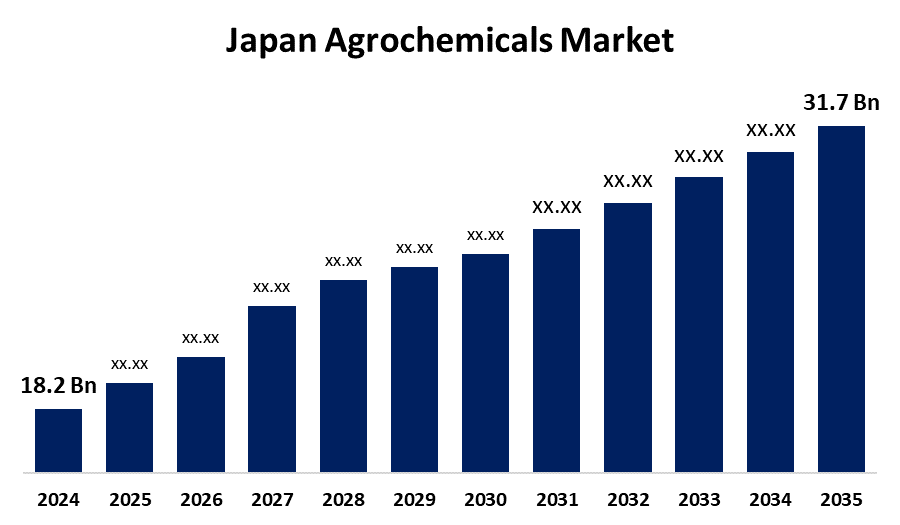

- The Japan Agrochemicals Market Size Was Estimated at USD 18.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2025 to 2035

- The Japan Agrochemicals Market Size is Expected to Reach USD 31.7 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Agrochemicals Market Size is anticipated to reach USD 31.7 Billion by 2035, growing at a CAGR of 5.17% from 2025 to 2035. The Japanese agrochemicals market is growing due to a combination of factors, including the country's advanced agricultural technologies, high-intensity farming practices, and a focus on sustainable solutions.

Market Overview

The market for the chemicals used in agriculture for the purpose of increasing agricultural yields and protecting crops by managing weeds, pests, and diseases is known as the agrochemical market. This category of chemicals includes insecticides, herbicides, fertilizers, etc. The agrochemical industry is attempting to find solutions to the problems associated with pests and environmental factors (weather, soil types, and more) while maximizing production in agriculture. The Japanese agrochemical market is increasing rapidly in part due to the increasing number of commercial farms that require pest management and disease management. Other influences include the expanding utilization of integrated pest management (IPM) practices, which are used to manage crop pests, diseases, and improve efficiency (i.e. developed farming, sustainable farming, and improved farming practices). The increasing consumption of fruits and vegetables is also contributing to growth in the agrochemical market.

In the agrochemical market in Japan, huge opportunities exist for big companies in areas such as biopesticides, sustainable agriculture, and digital agriculture solutions. They also include possible opportunities in the organic farming sectors, the application of digital technologies for precision farming, or simply prioritize the R&D and marketing of environmentally-conscious pest control options. The Japanese government regulations for the agrochemical industry are intended to support ecological options, stimulate sustainable farming, and provide food security. Thus, it includes a variety of laws, grants, and programs to support the use of chemical pesticides, and endorse agricultural practice based on organic production. The Agricultural Chemicals Regulation Act is the legislation that controls the usage, manufacture, sale, and registration of agrochemicals to guarantee their performance and to ensure their safety to the environment and health. Through innovation and smart technology, the Ministry of Agriculture, Forestry, and Fisheries (MAFF) has put into practice the "MeaDRI" strategy, which seeks to cut the risk-weighted usage of chemical pesticides by 50% by 2050.

Report Coverage

This research report categorizes the market for the Japan agrochemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan agrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan agrochemicals market.

Japan Agrochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.17% |

| 2035 Value Projection: | USD 31.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Corteva, Syngenta, FMC, Bayer, Kumiai Chemical, BASF, Sumitomo Chemical, Hokko, Agro Kanesho, Nihon Nohyaku, Kyoyu Agri, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Improvements in farming methods is a major factor propelling the agrochemicals market. The rapid development of agricultural technologies has sustained the increased use of modern farming methods and equipment by Japanese farmers to improve crop yield and efficiency. Precision farming monitors and controls agricultural areas using GPS and IoT devices with high accuracy. Precision agriculture farms have managed to maintain or increase crop yields while reducing agrochemical usage by 15% on average, stated by the Japan Agricultural Technology Association. Further, due to the automation and mechanization of farming operations, the use of agrochemicals is more efficiently and effectively carried out, thereby propelling market growth even more. The agrochemicals market in Japan is greatly shaped by rising requirements for crop yield and quality. Improving agricultural productivity is an ideal step towards food security, for the expanding population and with rising demand for food. Agrochemicals are also drawn by the shift towards high-value crops that need more attention and control. Another major driver of the Japanese agrochemicals market is the growing trend of bio-based and sustainable agrochemicals. Sustainable and environmentally friendly agrochemical solutions are increasingly being used by environmentally conscious people to counteract the adverse effects posed by conventional chemical pesticides and fertilizers on the environment. The trend of organic farming is also promoted by bio-based agrochemicals, with the growing request for food that is responsibly and organically produced. Further, the market is being fueled by supportive government policies that foster investment and innovation in developing new lines of bio-based agrochemicals.

Restraining Factors

The very narrowly constrained use of chemical pesticides and fertilizers is a significant challenge for chemical-based agrochemicals from Japan. To promote the safety and environmental sustainability of agrochemicals, the government of Japan has a rule on pesticides and fungicides that prohibits their use. While the strict regulation of usage is related specifically to factors such as agricultural production, the rigidity of approval systems, the delay of testing, and continued monitoring of pesticides for potential hazards to human health, animal health, and to the environment as a whole. Furthermore, agrochemicals also create ongoing monitoring and reporting costs for themselves, which are regulated by the government. Moreover, the push from the public for natural and organic products is also a challenge for the Japanese pesticide manufacturers. With increasing public awareness of the potential health risks associated with chemical residues in food, and the unevenness of the environmental effects of synthetic agrochemicals, farmers are constrained to abandon pesticide-based practices altogether, and become less reliant or dependent on organic practices. It requires huge amounts of capital investment funding to develop organically viable and bio-based alternatives, and may prove to be too much financial restriction for a small company with few investment options.

Market Segmentation

The Japan Agrochemicals Market share is classified into product and application.

- The fertilizers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan agrochemicals market is segmented by product into fertilizers, crop protection chemicals. Among these, the fertilizers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is mainly due to farmers focusing on increasing agricultural yields in a more limited time frame. Farmers are using more fertiliser in an attempt to increase productivity and yields with a variety of crops due to normal and excessive demand for food and crops on agricultural land. Japan's population growth is driving the need for fertilisers to enhance yields. These populations require food security, which requires efficient production methods through agriculture. Additionally, Japan has limited arable land and hence farmers relies on fertilisers to satisfy population needs and optimise yields.

- The cereal & grains segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan agrochemicals market is segmented by application into cereal & grains, oilseeds & pulses, and fruits & vegetables. Among these, the cereal & grains segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is a result of many cereals and grains such as rice, wheat, rye, corn, oats, sorghum, and barley becoming increasingly popular in Japan. Because the cereal grain crops are relatively vulnerable to weed, pest, and disease problems, they need fertilizer and pesticide applications to optimize production. The industry has experienced advances in technology, including higher-yielding seed varieties, and the emergence of agrochemical treatments designed specifically to minimize cereal grain losses due to biotic and abiotic stressors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan agrochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corteva

- Syngenta

- FMC

- Bayer

- Kumiai Chemical

- BASF

- Sumitomo Chemical

- Hokko

- Agro Kanesho

- Nihon Nohyaku

- Kyoyu Agri

- Others

Recent Developments:

- In March 2024, Corteva Inc. has announced the launch of Corteva Catalyst, a partnerships and investment platform that intends to find and commercialize agricultural innovations that can accelerate value creation as well as provide avenues for Corteva’s R&D goals. Corteva Catalyst will work with innovators and entrepreneurs to accelerate transformative early-stage technologies that help farmers sustainably produce more food and feed.

- In February 2024, The Syngenta Group has announced the launch of "Shoots by Syngenta," the first global platform focused on solving the largest challenges facing agriculture, driving innovation, and fostering more sustainable practices. Shoots by Syngenta will feature a startup accelerator, helping to provide a nurturing environment where fledgling businesses can create uniquely innovative agricultural solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Agrochemicals Market based on the below-mentioned segments:

Japan Agrochemicals Market, By Product

- Fertilizers

- Crop Protection Chemicals

Japan Agrochemicals Market, By Application

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

Need help to buy this report?