Japan Agricultural Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Type (Non-ionic Surfactants, Anionic Surfactants, Cationic Surfactants, Amphoteric Surfactants), By Substrate (Synthetic Surfactants, Bio-based Surfactants), and Japan Agricultural Surfactants Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Agricultural Surfactants Market Insights Forecasts to 2035

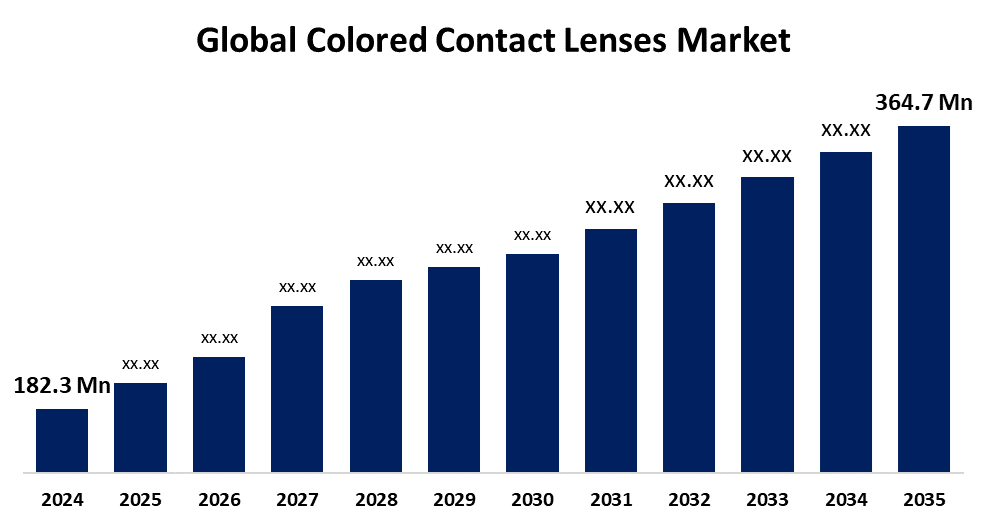

- The Japan Agricultural Surfactants Market Size Was Estimated at USD 182.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.51% from 2025 to 2035

- The Japan Agricultural Surfactants Market Size is Expected to Reach USD 364.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Agricultural Surfactants Market Size is anticipated to reach USD 364.7 Million by 2035, growing at a CAGR of 6.51% from 2025 to 2035. The agricultural surfactants market in Japan experiences market expansion because of multiple essential factors, which include rising population demands for food, the use of precision farming approaches, the rising focus on sustainable agriculture methods and environmental conservation.

Market Overview

Agricultural surfactants represent a market that focuses on producing and distributing surfactants that boost agrochemical performance in farming operations. The surfactants function as additives that improve pesticide, herbicide, and insecticide performance through better wetting, spreading, penetration, and adhesion on plant surfaces. Market growth happens because of rising sustainable agricultural practice demand, together with regulatory compliance needs and better crop protection efficiency requirements. The market expansion primarily stems from the rising need for crop protection products within Japanese agriculture. Japanese farming methods transform through various elements, which include precision agriculture methods and shrinking farming land area, coupled with expanding food consumption needs from population expansion. The expanding market finds its growth through two major factors, which consist of improved pest control methods and enhanced crop protection to sustain agricultural yields. Market expansion occurs because consumers become more aware of sustainable farming practices and how surfactants enhance agrochemical performance. Market growth happens because major trends drive the industry, which include precision farming adoption and bio-based surfactant development.

The main participants in the Japanese agricultural surfactants market discover key business opportunities through increasing demand for bio-based surfactants, expanding specialty surfactant applications, and sustainable solution development. The Ministry of Agriculture, Forestry and Fisheries (MAFF) in Japan directs the creation of agricultural regulations, which include surfactant policies. MAFF establishes policies to promote sustainable agriculture by defining specific applications for surfactants. The policies pursue three fundamental goals, which involve creating new agricultural methods, supporting environmentally friendly surfactants, and maintaining safety standards for the environment and products.

Report Coverage

This research report categorizes the market for the Japan agricultural surfactants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan agricultural surfactants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan agricultural surfactants market.

Japan Agricultural Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 182.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.51% |

| 2035 Value Projection: | USD 364.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Substrate and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Solvay, Clariant, Evonik Industries, Nufarm, Bayer AG, Croda International Plc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The agricultural surfactants market in Japan is experiencing growth because of the rising need for crops that produce greater yields. Japan needs to maximize crop yields because its land for farming remains small. The effectiveness of agrochemicals and overall productivity depend heavily on agricultural surfactants. The market for agricultural surfactants in Japan receives major support from growing recognition of sustainable agricultural methods. Farmers switch to environmentally friendly agricultural approaches, hence environmental concerns drive rising demand for bio-based surfactants, together with sustainable alternatives. The Japanese administration executes its Green Food System Strategy, which includes lowering chemical pesticide consumption by half until 2050. The agricultural surfactants market in Japan experiences strong growth because of improved farming techniques through technological progression. Modern technologies adopted by Japan's agricultural sector utilize surfactants to improve their operational effectiveness, which leads to sector-wide changes. The agricultural surfactants market in Japan needs government initiatives along with support systems to reach its potential expansion. The Japanese government spearheads sustainable agriculture development by running programs that promote cutting-edge farming techniques alongside environmentally safe agricultural methods. The adoption of agricultural surfactant-based practices by farmers receives support from various financial programs that include subsidies and grants, as well as incentives that drive market growth throughout the forecast period.

Restraining Factors

The Japanese agricultural surfactant industry faces a significant obstacle because of the elevated costs of sophisticated surfactant formulas. Advanced farm surfactants, which are environment-friendly, tend to have higher manufacturing expenses than traditional versions. Advanced surfactants, together with their related technologies, generate substantial expenses that block market expansion. The investment required for advanced agricultural technologies proves too expensive for small and medium-sized farms. The agricultural surfactants market in Japan faces a major challenge since farmers lack understanding about the benefits of surfactants and proper usage methods. Rural areas experience a particularly significant gap in agricultural knowledge because they lack access to extension services. Farmers who lack both awareness and technical expertise tend to use surfactants in ways that reduce their effectiveness and potential benefits, which leads to decreased crop protection and lower quality yields. Farmers struggle to stay updated about developments because they lack continuous educational support, and the challenge becomes worse due to the rapid pace of surfactant technology advancement.

Market Segmentation

The Japan agricultural surfactants market share is classified into type and substrate.

- The non-ionic surfactants segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan agricultural surfactants market is segmented by type into activated non-ionic surfactants, anionic surfactants, cationic surfactants, and amphoteric surfactants. Among these, the non-ionic surfactants segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The use of non-ionic surfactants remains popular because they function well with diverse agrochemicals, maintain stability through pH variations, and perform well across multiple uses. The agricultural sector uses non-ionic surfactants as essential tools that create major improvements in nutrient management, along with soil treatment and crop protection measures. Their environmental sustainability must be confirmed to reduce negative effects on the environment. The growing use of non-ionic surfactants in agricultural operations results from their reduced toxicity, together with their ability to combine with various formulations.

- The synthetic surfactants segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan agricultural surfactants market is segmented by substrate into synthetic surfactants, bio-based surfactants. Among these, the synthetic surfactants segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is because they provide reliable solutions while being affordable across different agricultural applications, which include herbicides and fungicides. The formulated compounds function as enhancers that improve the effectiveness of crop protection products, including herbicides and pesticides. Synthetic surfactants enhance the target delivery of agrochemicals because they optimize plant tissue absorption and penetration of these products. The compounds exhibit compatibility with multiple formulations, which enables their flexible use across different agricultural applications. The customized properties of these compounds enable them to perform better across different environmental settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan agricultural surfactants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Solvay

- Clariant

- Evonik Industries

- Nufarm

- Bayer AG

- Croda International Plc

- Others

Recent Developments:

- In July 2024, in the second quarter, Clariant achieved a significant improvement in its underlying margin, approaching 16%. This advancement is due to the successful application of our streamlined, customer-centric operational model and ongoing implementation of our performance enhancement initiatives.

- In April 2024, Evonik Coating Additives introduced two revolutionary defoamers, TEGO® Foamex 16 and TEGO® Foamex 11, at the American Coatings Show 2024 from April 30 to May 2 at the Indiana Convention Center in Indianapolis. The new additives focus on improving both performance and sustainability aspects of waterborne architectural coatings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Agricultural Surfactants Market based on the below-mentioned segments:

Japan Agricultural Surfactants Market, By Type

- Non-ionic Surfactants

- Anionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

Japan Agricultural Surfactants Market, By Substrate

- Synthetic Surfactants

- Bio-based Surfactants

Need help to buy this report?