Japan Advanced Ceramics Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Alumina, Titanate, Zirconia, Silicon Carbide, and Others), By Class Type (Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites, and Others), By End-Use (Electrical and Electronics, Medical, Transportation, Defense and Security, Chemical, and Others), and Japan Advanced Ceramics Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsJapan Advanced Ceramics Market Insights Forecasts to 2035

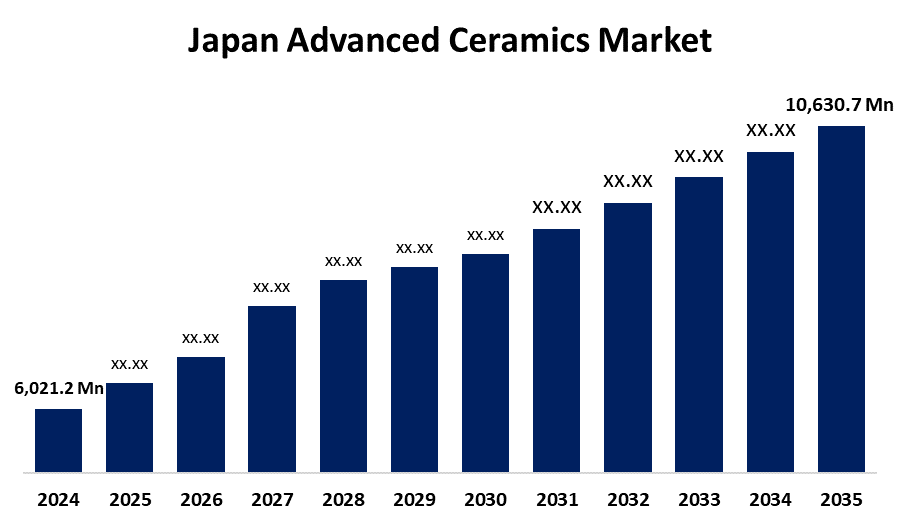

- The Japan Advanced Ceramics Market Size was Estimated at USD 6,021.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.30% from 2025 to 2035

- The Japan Advanced Ceramics Market Size is Expected to Reach USD 10,630.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan advanced ceramics market Size is anticipated to reach USD 10,630.7 Million by 2035, growing at a CAGR of 5.30% from 2025 to 2035. The Japan advanced ceramics market is expanding due to rising demand from multiple industries, improvement in technologies, and focus on sustainability. Some of the most influential drivers are the transition of the automobile industry toward green solutions, the electronics and medical industries, and the integration of advanced ceramics into emerging technologies such as AI, IoT, and 5G.

Market Overview

The Japan advanced ceramics market refers to inorganic, non-metallic materials that are designed for the purpose of high-performance applications in a wide array of industries. The ceramics, such as alumina, zirconia, and silicon carbide, are used in products ranging from spark plugs, engine filters, sensors, and electronic devices due to their superior heat resistance, durability, and electrical insulation characteristics. Japan's high-tech ceramics sector is supported by a solid manufacturing foundation, technical know-how, and dominance in high-value industries such as aerospace, defense, and medical equipment. New expansion opportunities are provided by emerging uses in bioceramics as well as environmentally friendly processes. Some of the major driving factors behind the market growth are the growing need for advanced ceramics in the automotive and electronic industries, especially for products such as sensors, capacitors, and fuel injectors. Organizations like the National Institute for Materials Science (NIMS) increase research and development of advanced ceramics, driving innovation and cooperation in the industry.

Report Coverage

This research report categorizes the market for the Japan advanced ceramics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan advanced ceramics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan advanced ceramics market.

Japan Advanced Ceramics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,021.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.30% |

| 2035 Value Projection: | USD 10,630.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 299 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Material Type, By Class Type and By End-Use |

| Companies covered:: | AGC Inc., Kyocera Corporation, Ceravision Kato Co. Ltd., KANO Corporation, Tokuyama Corporation, NGK Insulators Ltd., Maruwa Co., Ltd., Nippon Electric Glass Co. Ltd., Noritake Co., Ltd., Sumitomo Electric Industries, Ltd., Niterra Co. Ltd., Yamase Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan advanced ceramics market is supported by robust demand from the automotive, electronics, and medical industries due to the materials' excellent heat resistance, strength, and insulating characteristics. Technological advances such as electric vehicles, 5G, and IoT promote higher demand for high-performance products. Japan's industrial manufacturing base and precision engineering capabilities are also favorable for innovation and scaling up. Government stimulation of R&D and industry players' cooperation also fuels the evolution and uptake of advanced ceramic materials in different high-tech uses.

Restraining Factors

The Japan market for advanced ceramics is restrained by high manufacturing costs, intricate production methods, and scarce raw materials. Furthermore, the use of specialized equipment and knowledge inhibits scale-up operations, making the market challenging for new or smaller players to penetrate.

Market Segmentation

The Japan Advanced Ceramics Market share is classified into material type, class type, and end-use.

- The alumina segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan advanced ceramics market is segmented by material type into alumina, titanate, zirconia, silicon carbide, and others. Among these, the alumina segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The alumina is due to its superior mechanical qualities, thermal stability, and resistance to wear, corrosion, and heat, which is being applied in advanced material solutions-based applications that demand improvement.

- The monolithic ceramics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan advanced ceramics market is segmented by class type into monolithic ceramics, ceramic coatings, ceramic matrix composites, and others. Among these, the monolithic ceramics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The monolithic ceramics are owing to their superior durability, reliability, and insulation from high temperatures, which increases the component's lifespan. They are applied across industries, including aerospace, transportation, military, and defense.

- The electrical and electronics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan advanced ceramics market is segmented by end-use into electrical and electronics, medical, transportation, defense and security, chemical, and others. Among these, the electrical and electronics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electrical and electronicsis are attributed to the sophisticated forms of ceramics that are used as carriers of circuits, ceramic substrates, and core materials. The increased technological developments, along with the large demand for electronic sensors and power electronics, can drive the growth of the segment. They find application in electronic gadgets like smartphones, computers, and televisions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan advanced ceramics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGC Inc.

- Kyocera Corporation

- Ceravision Kato Co. Ltd.

- KANO Corporation

- Tokuyama Corporation

- NGK Insulators Ltd.

- Maruwa Co., Ltd.

- Nippon Electric Glass Co. Ltd.

- Noritake Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Niterra Co. Ltd.

- Yamase Co. Ltd.

- Others

Recent Developments:

- In April 2023, Kyocera Corporation completed its acquisition of 37 acres of land in Isahaya City, Japan, for the establishment of a new smart factory. The move is part of the company's strategy to increase production capacity for fine ceramic components due to growing demand for semiconductor-related products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan advanced ceramics market based on the below-mentioned segments:

Japan Advanced Ceramics Market, By Material Type

- Alumina

- Titanate

- Zirconia

- Silicon Carbide

- Others

Japan Advanced Ceramics Market, By Class Type

- Monolithic Ceramics

- Ceramic Coatings

- Ceramic Matrix Composites

- Others

Japan Advanced Ceramics Market, By End-Use

- Electrical and Electronics

- Medical

- Transportation

- Defense and Security

- Chemical

- Others

Need help to buy this report?