Japan Activated Carbon Market Size, Share, and COVID-19 Impact Analysis, By Type (Powdered, Granular, and Others), By Application (Liquid Phase and Gas Phase), and Japan Activated Carbon Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Activated Carbon Market Insights Forecasts to 2035

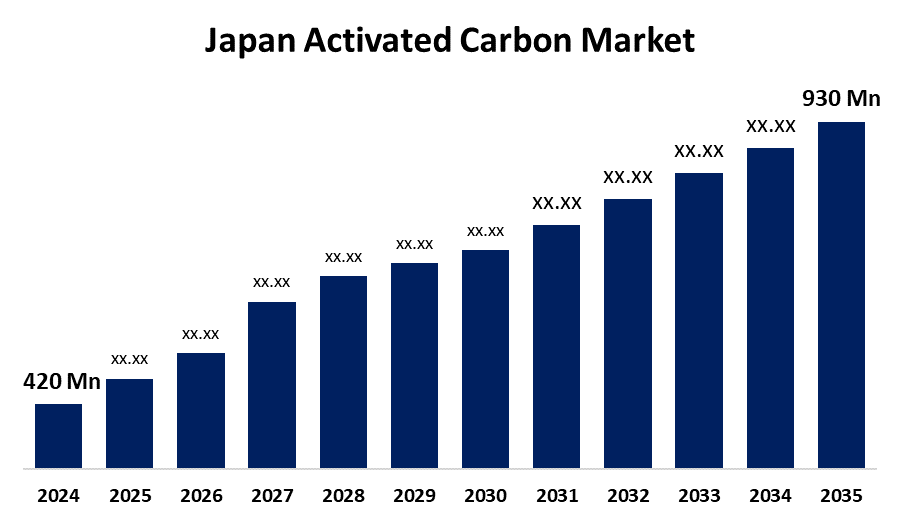

- The Japan Activated Carbon Market Size Was Estimated at USD 420 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.49 % from 2025 to 2035

- The Japan Activated Carbon Market Size is Expected to Reach USD 930 million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Activated Carbon Market Size is Anticipated to reach USD 930 Million by 2035, Growing at a CAGR of 7.49 % from 2025 to 2035. The activated carbon market in Japan is driven by various factors, including rising environmental regulations, growing concerns surroundings water and air pollution across industrial, municipal, and residential sectors, and growing awareness about health and hygiene.

Market Overview

Activated carbon, with other common names including activated charcoal, active carbon, and active coal. The activated carbon is a processed type of carbon that is a great adsorbent due to its enormous surface area and highly porous structure. The activated carbon market focuses on the production, distribution, and application of activated carbon, a material with high adsorption capacity used for purification and separation processes in various sectors. They are commonly used for purification, filtration, and separation. They can trap impurities, toxins, and pollutants from gases and liquids, hence they are widely used in various industries such as water treatment, food & beverage processing, pharmaceutical & medical, automotive, and air purification. The Japan activated carbon market is expanding as a result of higher environmental standards and increased emphasis on sustainability. Pollution regulations from the government and health matters increase air and water treatment solution demand. Besides that, increasing consumer knowledge of water purity is driving residential filtration systems to utilize activated carbon, opening up new opportunities for innovation and growth.

Report Coverage

This research report categorizes the market for the Japan activated carbon market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan activated carbon market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan activated carbon market.

Japan Activated Carbon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 420 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.49 % |

| 2035 Value Projection: | USD 930 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Calgon Carbon Japan KK, SABIC, CarboTech AC, Osaka Gas Chemicals Co., Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's emphasis on water quality and sustainability is promoting demand for activated carbon for purification as well as wastewater treatment. The Ministry of Health specifies increased usage of activated carbon filters by households and industries, while 60% of Tokyo residents use water filtration systems. Stricter air regulations in Japan drive activated carbon demand for industrial emission control in cities like Tokyo and Osaka. Additionally, increased health issues faced by Japanese consumers, where 40% are concerned about indoor air quality, are pushing the demand for air purifiers with activated carbon and investment in the sector.

Restraining Factors

The cost of raw materials and energy-intensive manufacturing processes makes activated carbon expensive is one of the notable restraints in this market. Additionally, alternatives like synthetic adsorbents or membrane filtration systems can restrain market demand.

Market Segmentation

The Japan activated carbon market share is classified into type and application.

- The powdered segment held the largest share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan activated carbon market is segmented by type into powdered, granular, and others. Among these, the powdered segment held the largest share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its widespread applicability, high adsorption efficiency, and cost-effectiveness. Additionally, their flexibility in dosing and ease of handling drive their adsorption in both centralised and decentralised treatment systems.

- The gas phase segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan activated carbon market is segmented by application into liquid phase and gas phase. Among these, the gas phase segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the rising demand for air purification and emission control solutions in both industrial and urban areas. Additionally, due to its ability to effectively adsorb sulphur compounds, volatile organic compounds (VOCs), and other dangerous air pollutants, activated carbon is now a vital part of solvent recovery systems, vehicle emission control technologies, and flue gas treatment

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan activated carbon market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Calgon Carbon Japan KK

- SABIC

- CarboTech AC

- Osaka Gas Chemicals Co., Ltd.

- Others

Recent Developments

- In May 2024, Calgon Carbon, a U.S. subsidiary of Japan’s Kuraray, acquired Sprint Environmental Services’ reactivated carbon business. This strengthens Kuraray’s global supply and supports activated carbon demand in Japan

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan activated carbon market based on the below-mentioned segments:

Japan Activated Carbon Market, By Type

- Powdered

- Granular

- Others

Japan Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

Need help to buy this report?