Japan Acetic Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Acetate Esters, Acetic Anhydride, and Others), By End User (Textile, Chemicals, Pharmaceuticals, Food & Beverage, and Others), and Japan Acetic Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Acetic Acid Market Insights Forecasts to 2035

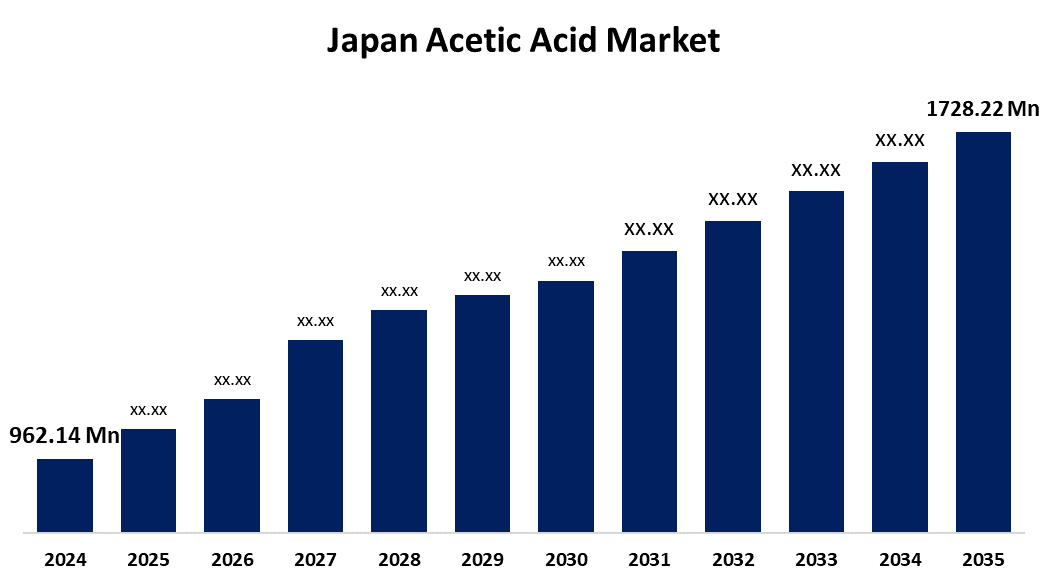

- The Japan Acetic Acid Market Size Was Estimated at USD 962.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.47% from 2025 to 2035

- The Japan Acetic Acid Market Size is Expected to Reach USD 1728.22 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Acetic Acid Market is anticipated to reach USD 1728.22 million by 2035, growing at a CAGR of 5.47% from 2025 to 2035. A major driver is the rising demand for vinyl acetate monomer (VAM), which is essential in paints, coatings, and adhesives, alongside growth in pharmaceuticals and food preservation sectors.

Market Overview

The Japan acetic acid market refers to the industry centered on the production and consumption of acetic acid, a key chemical used in manufacturing adhesives, plastics, textiles, and pharmaceuticals. The demand for acetic acid in Japan is mostly driven by the expansion of the industrial sector. The manufacture of vinyl acetate monomer (VAM) is one of the main industrial applications for acetic acid. A market analysis predicts that the vinyl acetate monomer (VAM) market in Japan would expand, with an emphasis on sales, revenue, and market share size. Since acetic acid is a crucial raw material in the production of VAM, the market's expansion has a direct effect on the demand for it. The emphasis on innovation and superior industrial products in the Japanese market has raised demand for these final products, which in turn has increased the demand for acetic acid.

Report Coverage

This research report categorizes the market for the Japan acetic acid market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan acetic acid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan acetic acid market.

Japan Acetic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 962.14 Million. |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.47% from |

| 2035 Value Projection: | USD 1728.22 Million. |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Mitsubishi Chemical Corporation, Jiangsu Sopo (Group), Wacker Chemie, Eastman Chemical Company, DuPont, British Petroleum, Celanese Corporation, and Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for acetic acid is also significantly influenced by Japan's pharmaceutical sector. According to predictions, the pharmaceutical market in Japan is expected to reach a size of ¥US$58.40 billion by 2029. Acetic acid is a vital raw material in the synthesis of many medications and active pharmaceutical ingredients (APIs), hence its demand is directly impacted by the expansion of the pharmaceutical industry. Japan still has one of the biggest pharmaceutical industries in the world, accounting for around 5% of the worldwide pharmaceutical market. This significant market share emphasizes how crucial the pharmaceutical industry is in driving Japan's demand for acetic acid. Acetic acid is used extensively in Japan's food and beverage sector, mostly as a flavoring and preservative. Acetic acid is used as a raw ingredient for spices and as a sour agent in sauces, vinegar, and pickled vegetables.

Restraining Factors

The market faces restraints such as volatile raw material prices, especially methanol, which directly impact production costs. Additionally, environmental regulations on chemical manufacturing, limited domestic production capacity, and dependency on imports from countries like China and South Korea pose challenges. The energy-intensive nature of acetic acid production and fluctuating demand from downstream industries like textiles and plastics also contribute to market uncertainty.

Market Segmentation

The Japan Acetic acid market share is classified into type and end user.

- The vinyl acetate monomer (VAM) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Acetic acid market is segmented by type into vinyl acetate monomer (VAM), purified terephthalic acid (PTA), acetate esters, acetic anhydride, and others. Among these, the vinyl acetate monomer (VAM) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use in adhesives, paints, and coatings, which are in high demand across Japan’s construction and automotive sectors.

- The chemicals segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Acetic acid market is segmented by end user into textile, chemicals, pharmaceuticals, food & beverage, and others. Among these, the chemicals segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. As acetic acid is a foundational input for producing various derivatives like acetate esters and acetic anhydride. This dominance is driven by Japan’s robust industrial base and the versatility of acetic acid in chemical synthesis and formulation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Acetic acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation

- Jiangsu Sopo (Group)

- Wacker Chemie

- Eastman Chemical Company

- DuPont

- British Petroleum

- Celanese Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Acetic Acid Market based on the below-mentioned segments:

Japan Acetic Acid Market, By Type

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Acetate Esters

- Acetic Anhydride

- Others

Japan Acetic Acid Market, By End User

- Textile

- Chemicals

- Pharmaceuticals

- Food & Beverage

- Others

Need help to buy this report?