Japan 5G Market Size, Share, and COVID-19 Impact Analysis, By Communication Type (FWA, Enhanced Mobile Broadband (eMBB), Ultra-reliable, low-latency communications (URLLC), Massive Machine-Type Communications (mMTC)), By Industry Verticals (Manufacturing, Media & Entertainment, Transportation & Logistics, Government), and Japan 5G Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaJapan 5G Market Insights Forecasts to 2032

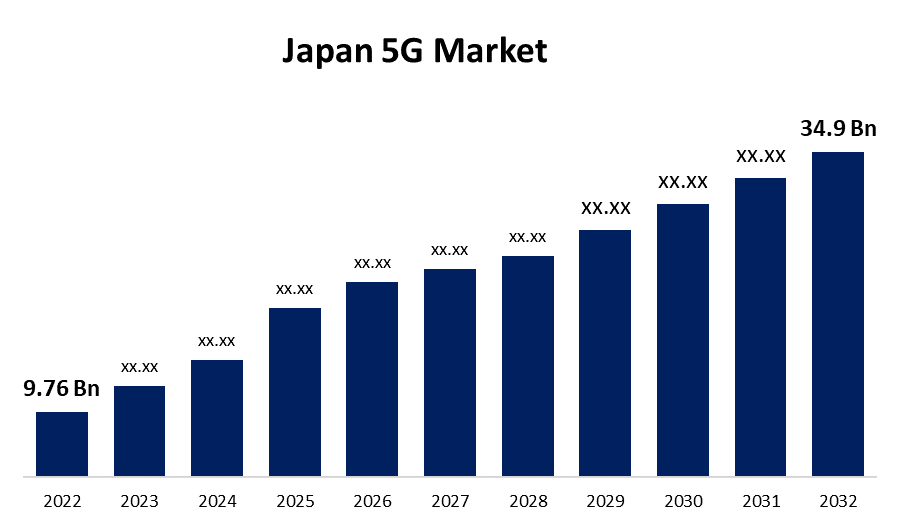

- The Japan 5G Market Size was valued at USD 9.76 Billion in 2022.

- The Market is growing at a CAGR of 9.37% from 2022 to 2032.

- The Japan 5G Market Size is expected to reach USD 34.9 Billion by 2032.

- Japan is expected to grow the fastest during the forecast period.

Get more details on this report -

The Japan 5G Market Size is expected to reach USD 34.9 Billion by 2032, at a CAGR of 13.5% during the forecast period 2022 to 2032. Major trends such as the ever-increasing Machine-to-Machine connection, IoT devices, primarily due to the inclusion of a number of devices, and a rise in general demand for mobile broadband services throughout Japan, particularly in the commercial industry, are among the factors influencing the demand for the 5G market in Japan

Market Overview

5G is more than just the forthcoming mobile broadband network. The technology represents a significant advancement, offering emerging markets and significant growth potential. The introduction of 5G networks will enable substantial advances in the rise of digitalization allowing for the online management of whole companies, encompassing supply and distribution networks. This offers new an infinite number of potential and creates a slew of new revenue sources for mobile network providers.

Japan is currently in the early stages of 5G development, as evidenced by how the 5G experience contrasts internationally. The launch of Japan's three long-standing main mobile carriers, NTT Docomo, KDDI, and SoftBank's respective 5G networks in March 2020 marked the introduction of commercial fifth-generation (5G) mobile phone services to the country. However, because several of the major 5G countries began 5G considerably earlier than Japan's operators, their networks are more advanced. Japan's service providers must be able to support 5G investment in order for Japan's 5G experience to grow and eventually achieve Japan's high international position in 4G experience. However, pressure to lower mobile pricing in Japan threatens operators to prolong the necessary investment to transition Japan from a 5G competitor to a 5G leader globally.

Rakuten Mobile, which had been operating as a mobile virtual network operator (MVNO) for some years before becoming the country's fourth major carrier in 2020, followed in September of that year. The company had intended to launch its 5G service in June but experienced a delay in software development due to COVID-related challenges. Japan's mobile carriers first targeted urban areas and high-traffic areas, with the goal of covering 95 percent of the country's population by 2032. Following the introduction, the number of 5G subscriptions in Japan surged dramatically, reaching more than 46 million in March 2022.

The Japanese government places a high priority on the deployment of 5G networks. Increasing consumer demand for cellular bandwidth, connectivity for IoT and sensor technology for smart city projects, and novel applications such as AR (augmented reality) and autonomous vehicles transportation are assisting the development of the 5G rollout. This, however, is likely to fuel the growth of Japan's 5G market.

The highly advanced Japanese industry sees smart factories and Industry 4.0 as the future of manufacturing, with the implementation of CPS (Cyber-Physical System) being particularly important. The usage of local 5G is critical for Japan in order to successfully implement CPS in the manufacturing sector. The emerging 5G epoch can be defined as an age of limitless connectivity for all and smart automation, which will improve people's lives and alter industrial operations. Furthermore, the primary goal of 5G market trends is to supply data at 5G speeds while keeping market costs low. In addition, 5G technology is predicted to consume significantly less energy. All of these variables operate as important driving factors for the market, increasing Japan 5G market share.

Japan 5G Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 9.76 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 13.5% |

| 2032 Value Projection: | USD 34.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Communication Type, By Industry Verticals and COVID-19 Impact Analysis |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for Japan 5G Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan 5G Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan 5G Market.

Market Segment

- In 2022, the Massive Machine-Type Communications (mMTC) segment accounted for the largest revenue share of more than 32.8% over the forecast period.

On the basis of communication type, the Japan 5G Market is segmented into FWA, Enhanced Mobile Broadband (eMBB), Ultra-reliable, low-latency communications (URLLC), and Massive Machine-Type Communications (mMTC). Among these, the Massive Machine-Type Communications (mMTC) segment is dominating the market with the largest revenue share of 32.8% over the forecast period. mMTC is primarily concerned with delivering services for high-density applications for example automated structures and smart cities. Over the projected period, increasing demand to maintain continuous connectivity for all IoT devices installed in a network is expected to contribute to the expansion of the mMTC segment.

- In 2022, the manufacturing segment accounted for the largest revenue share of more than 38.2% over the forecast period.

On the basis of industry verticals, the Japan 5G Market is segmented into manufacturing, media & entertainment, transportation & logistics, and government. Among these, the manufacturing segment is dominating the market with the largest revenue share of 38.2% over the forecast period. Japan's manufacturing industry is quickly digitizing. As a result, manufacturing processes are constantly being automated in order to increase productivity in general. This has resulted in the necessity for wireless connectivity between robots, sensors, actuators, and various other equipment put in industrial plants. As a result, the manufacturing industry is predicted to grow at the quickest rate during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan 5G Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TDK Corporation

- ZTE JAPAN K.K.

- Microsoft Japan Co., Ltd.

- SoftBank Group Corp.

- Asahi Kasei Networks Corporation

- Rakuten Group, Inc.

- NEC Corp

- FUJITSU LIMITED

- KDDI Corporation

- Ericsson Japan K.K.

- CommScope Japan K.K.

- NTT Docomo, Inc.

- Hitachi Ltd.

- Mitsubishi Electric Corp

- Nippon Telegraph and Telephone Corp

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On May 2023, Ericsson, a global pioneer in telecoms technology, has been chosen as a partner for Japan's first-ever vault 5G base stations by KDDI, one of Japan's main communication service providers. This cooperation intends to transform urban connection by deploying "manhole-shaped" base stations with subterranean antennae, so providing a unique alternative for urban infrastructure deployment.

- On February 2023, KDDI has selected Samsung Electronics to deliver its cloud-native 5G Standalone (SA) Core for the operator's commercial network in Japan, according to the firm. Samsung's 5G SA Core will provide a number of benefits to KDDI's network, including lower latency, more dependability, and 5G-enhanced capabilities. This heralds the arrival of a new generation of services and applications for KDDI's consumers and enterprise clients. Samsung's 5G Core solution works with both 4G and 5G networks, allowing for a smooth transition from 4G to 5G.

- On January 2023, KDDI CORPORATION announced a collaboration with Samsung Electronics Co., Ltd. and Fujitsu Limited to commercialize O-RAN (1) compatible 5G Open Virtual Radio Access Network (hereafter Open vRAN) sites in Osaka City, Osaka Prefecture, Japan. KDDI has been constructing O-RAN compliant 5G Open vRAN sites leveraging Samsung's virtualized technology to fulfill these expanding demands. KDDI hopes to contribute to the expansion of equipment procurement options and the creation of high-performance, cost-effective infrastructure by providing an open, wireless system.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan 5G Market based on the below-mentioned segments:

Japan 5G Market, By Communication Type

- FWA

- Enhanced Mobile Broadband (eMBB)

- Ultra-reliable, low-latency communications (URLLC)

- Massive Machine-Type Communications (mMTC)

Japan 5G Market, By Industry Verticals

- Manufacturing

- Media & Entertainment

- Transportation & Logistics

- Government

- Others

Need help to buy this report?