Italy B2B2C Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Life Insurance and Non-Life Insurance), By Application (Individuals and Corporates/Group), and Italy B2B2C Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialItaly B2B2C Insurance Market Insights Forecasts To 2033

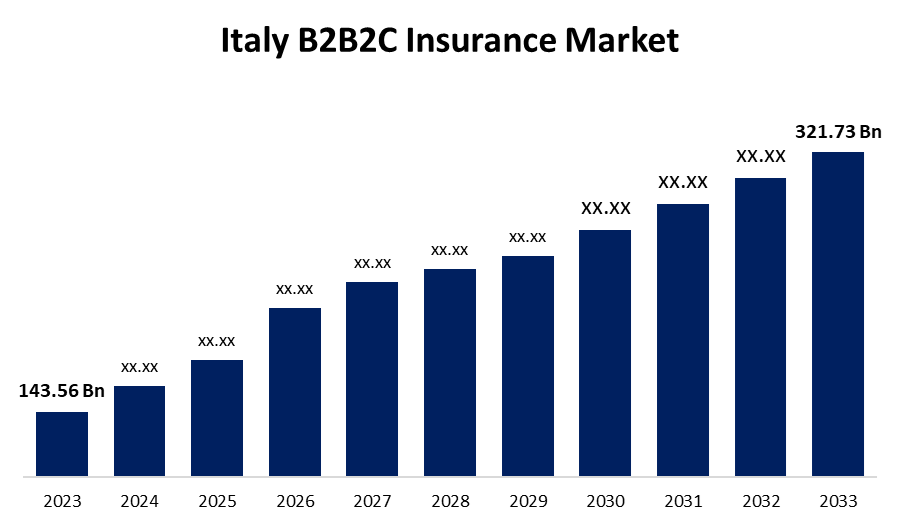

- The Italy B2B2C Insurance Market Size was valued at USD 143.56 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.40% from 2023 to 2033

- The Italy B2B2C Insurance Market Size is Expected to Reach USD 321.73 Billion by 2033

Get more details on this report -

The Italy B2B2C Insurance Market Size is Anticipated to Reach USD 321.73 Billion by 2033, Growing at a CAGR of 8.40% from 2023 to 2033.

Market Overview

Italy B2B2C insurance market refers to the business model where insurers collaborate with businesses (B2B), such as banks, retailers, automotive companies, or tech platforms, to offer insurance products directly to the end consumers (B2C) through these partners. This model enables insurers to reach a broader customer base using the partner’s existing infrastructure and customer relationships. In recent years, Italy has seen growing interest in B2B2C insurance, particularly in sectors like automotive, travel, e-commerce, and fintech. The Italian government has supported digitalization and innovation in the financial and insurance sectors through initiatives such as the “Piano Nazionale di Ripresa e Resilienza” (PNRR), which includes investments in digital transformation and the promotion of open finance and insurtech ecosystems. These efforts aim to enhance transparency, increase competition, and improve consumer protection. The B2B2C model offers numerous benefits: it reduces customer acquisition costs for insurers, enhances the value proposition of partner businesses, and provides consumers with convenient, tailored insurance solutions integrated into products or services they already use.

Report Coverage

This research report categorizes the Italy B2B2C insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy B2B2C insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy B2B2C insurance market.

Italy B2B2C Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 143.56 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.40% |

| 2033 Value Projection: | USD 321.73 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Insurance Type, By Application |

| Companies covered:: | Zurich Insurance Group, China Life Insurance Company Limited, ICICI Lombard General Insurance Company Ltd., AXA Partners Holding SA, Munich Re, UnitedHealth Group Inc., American International Group, Inc., Prudential plc, Allianz, Berkshire Hathaway Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Consumers are increasingly looking for convenience and personalized services, which the B2B2C model supports by offering insurance solutions that are relevant to their immediate needs. Businesses partnering with insurers also see value in enhancing their customer offerings with added protection and services, boosting customer loyalty and satisfaction. Furthermore, regulatory support and the growth of Italy's insurtech ecosystem have encouraged innovation and partnerships between traditional insurers and tech-savvy businesses, making the B2B2C model more viable and attractive.

Restraining Factors

A significant challenge is the complex regulatory environment, which includes stringent laws related to insurance services, cybersecurity, and data privacy.

Market Segmentation

The Italy B2B2C insurance market share is classified into insurance type and application.

- The non-life insurance segment accounted for the major market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Italy B2B2C Insurance market is segmented by insurance type into life insurance and non-life insurance. Among these, the non-life insurance segment accounted for the major market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment includes products such as motor, travel, health, property, and gadget insurance, which are often embedded in consumer services like car rentals, online shopping, and mobile subscriptions. The strong performance of non-life insurance is largely driven by its flexibility and relevance to daily consumer needs, making it highly suitable for distribution through B2B2C partnerships.

- The individuals segment accounted for the largest market share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Italy B2B2C Insurance market is segmented by application into individuals and corporates/group. Among these, the individuals segment accounted for the largest market share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The growth is primarily due to the increasing demand for personalized and on-demand insurance products offered through digital platforms, retail chains, travel agencies, and e-commerce sites. Consumers are becoming more aware of the convenience and value of embedded insurance solutions, particularly for health, travel, automotive, and device protection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy B2B2C insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zurich Insurance Group

- China Life Insurance Company Limited

- ICICI Lombard General Insurance Company Ltd.

- AXA Partners Holding SA

- Munich Re

- UnitedHealth Group Inc.

- American International Group, Inc.

- Prudential plc

- Allianz

- Berkshire Hathaway Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy B2B2C insurance market based on the below-mentioned segments:

Italy B2B2C Insurance Market, By Insurance Type

- Life Insurance

- Non-Life Insurance

Italy B2B2C Insurance Market, By Application

- Individuals

- Corporates/Group

Need help to buy this report?