Global ISO Tank Container Market Size, Share, and COVID-19 Impact Analysis, By Transport Mode (Road, Rail, and Marine), By Container Type (Multi-Compartment Tank, Lined Tank, Reefer Tank, Cryogenic & Gas Tanks, and Swap Body Tank), By End-use Industry (Chemicals, Petrochemicals, Food & Beverage, Pharmaceuticals, Industrial Gas, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Machinery & EquipmentGlobal ISO Tank Container Market Size Insights Forecasts to 2032

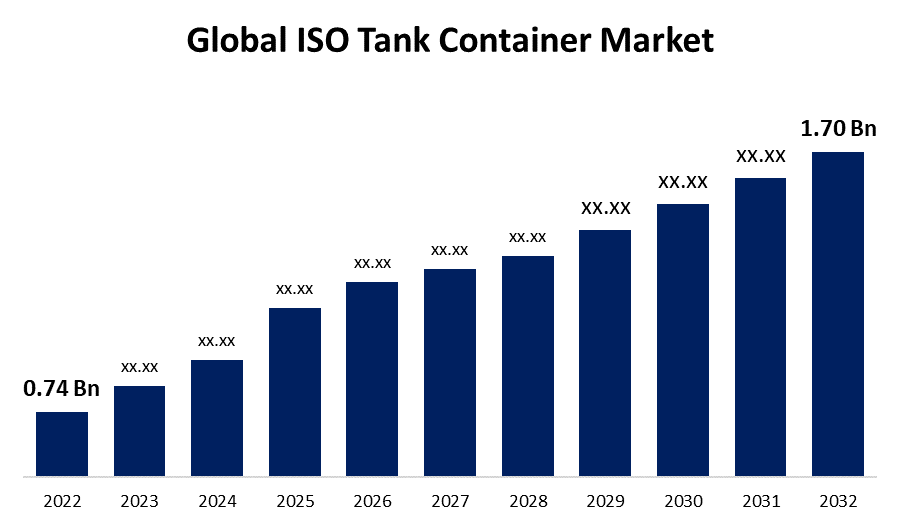

- The ISO Tank Container Market Size was valued at USD 0.74 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.7% from 2023 to 2032

- The Worldwide ISO Tank Container Market Size is expected to reach USD 1.70 Billion by 2032

- Europe is expected to Grow significant during the forecast period

Get more details on this report -

The global ISO Tank Container Market Size is expected to reach USD 1.70 Billion by 2032, at a CAGR of 8.7% during the forecast period 2023 to 2032.

Market Overview

An ISO tank container, short for International Organization for Standardization tank container, is a standardized shipping container specifically designed for the safe and efficient transport of liquids, gases, and bulk materials. These containers adhere to strict international standards to ensure compatibility and safety during transportation. ISO tank containers come in various sizes, typically ranging from 20 to 40 feet in length, and are constructed from durable materials like stainless steel to withstand the rigors of long-distance shipping and various environmental conditions. They feature standardized fittings, including valves, vents, and pressure relief devices, making them versatile for handling a wide range of commodities such as chemicals, food products, and hazardous materials. ISO tank containers have revolutionized the logistics industry by providing a cost-effective and secure means of transporting bulk liquids and gases globally, ensuring product integrity and reducing environmental risks associated with traditional methods of transportation.

Report Coverage

This research report categorizes the market for ISO tank container market based on various segments and regions and forecasts revenue Growth and analyzes trends in each submarket. The report analyses the key Growth drivers, opportunities, and challenges influencing the ISO tank container market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the ISO tank container market.

Global ISO Tank Container Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.74 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 1.70 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Transport Mode, By Container Type, By End-use Industry, By Region and COVID-19 Impact |

| Companies covered:: | Intermodal Tank Transport, Bertschi AG, Bulkhaul Limited, Royal Den Hartogh Logistics, HOYER GmbH, Interflow TCS Ltd., New Port Tank, Sinochain Logistics Co., Ltd., Stolt-Nielsen Limited, VTG Tanktainer GmbH, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The ISO tank container market is influenced by a multitude of drivers, each playing a pivotal role in shaping its Growth trajectory. The globalization and the expansion of international trade have significantly boosted the demand for ISO tank containers. These containers offer a standardized and efficient means of transporting a wide range of bulk liquids, chemicals, and gases across borders, facilitating the seamless movement of goods in an increasingly interconnected world. Safety and environmental concerns are driving factors in the ISO tank container market. With a Growing emphasis on the safe handling and transportation of hazardous materials, ISO tank containers are preferred due to their robust construction and rigorous safety standards. They provide containment for potentially harmful substances, reducing the risk of leaks or spills, which can have devastating environmental and human health consequences. The chemical industry is a major driver of the ISO tank container market. As the chemical industry continues to expand, the need for reliable and secure transportation of chemicals becomes increasingly vital. ISO tank containers are well-suited for this purpose, ensuring the integrity of chemical products during transit and adhering to stringent regulations governing chemical transport. The food and beverage industry plays a key role in driving demand for ISO tank containers. These containers are used for the transportation of bulk liquid and food-grade products, ensuring product quality and safety. With consumers demanding a wider variety of food and beverage products from around the world, ISO tank containers enable the efficient movement of perishable and non-perishable goods across long distances. Technological advancements in container design and tracking systems are driving efficiency improvements in the ISO tank container market. Integrated telematics and tracking technologies enable real-time monitoring of cargo, enhancing security and reducing the risk of theft or tampering during transit.

Restraining Factors

The ISO tank container market faces several constraints, including high initial procurement costs due to the specialized design and materials required for these containers. Additionally, regulatory compliance and safety standards impose stringent requirements, leading to increased operational expenses. Limited flexibility in terms of cargo handling and relatively lower capacity compared to alternative bulk transportation methods can be restrictive. Geographic restrictions may also arise due to infrastructure limitations, such as the availability of suitable loading and unloading facilities. The ISO tank container market can be impacted by economic fluctuations and global trade uncertainties, affecting demand and utilization rates in a sensitive manner.

Market Segmentation

- In 2022, the road segment accounted for around 42.5% market share

On the basis of the transport mode, the global ISO tank container market is segmented into road, rail, and marine. The road segment held the largest market share in the ISO Tank Container industry due to its versatility and accessibility. ISO tank containers can be easily transported via trucks, making them ideal for short to medium-distance shipments. This mode of transportation is particularly prevalent for the delivery of bulk liquids and gases to various industries, ensuring timely and efficient supply chains. The convenience and reliability of road transport contribute to its dominance in the market, especially for destinations where rail or sea routes may not be as readily available or feasible.

- The multi-compartment tank segment held the largest market with more than 26.4% revenue share in 2022

Based on the container type, the global ISO tank container market is segmented into multi-compartment tank, lined tank, reefer tank, cryogenic & gas tanks, and swap body tank. The multi-compartment tank segment held the largest market share in the ISO Tank Container industry due to its versatility and efficiency in transporting various types of liquids or gases simultaneously. These tanks feature multiple compartments within a single container, allowing for the transportation of different products without contamination or the need for separate containers. This capability is highly sought after in industries requiring flexibility in cargo handling, such as chemicals, food, and pharmaceuticals, driving the demand for multi-compartment ISO tank containers and solidifying their leading market position.

- The petrochemicals segment is expected to Grow at a CAGR of around 8.9% during the forecast period

Based on the end-use industry, the global ISO tank container market is segmented into chemicals, petrochemicals, food & beverage, pharmaceuticals, industrial gas, and others. The petrochemicals segment is poised for substantial Growth during the forecast period due to expanding global demand for petrochemical products, including chemicals, plastics, and fuels, fuels a continuous need for efficient and secure transportation solutions like ISO tank containers. Additionally, the increased exploration and production activities in the petrochemical sector drive the requirement for safe and reliable bulk liquid transport, further boosting demand. Moreover, stringent safety regulations and environmental concerns emphasize the importance of specialized containers like ISO tanks for transporting petrochemicals, ensuring their continued Growth in the market.

Regional Segment Analysis of the ISO Tank Container Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

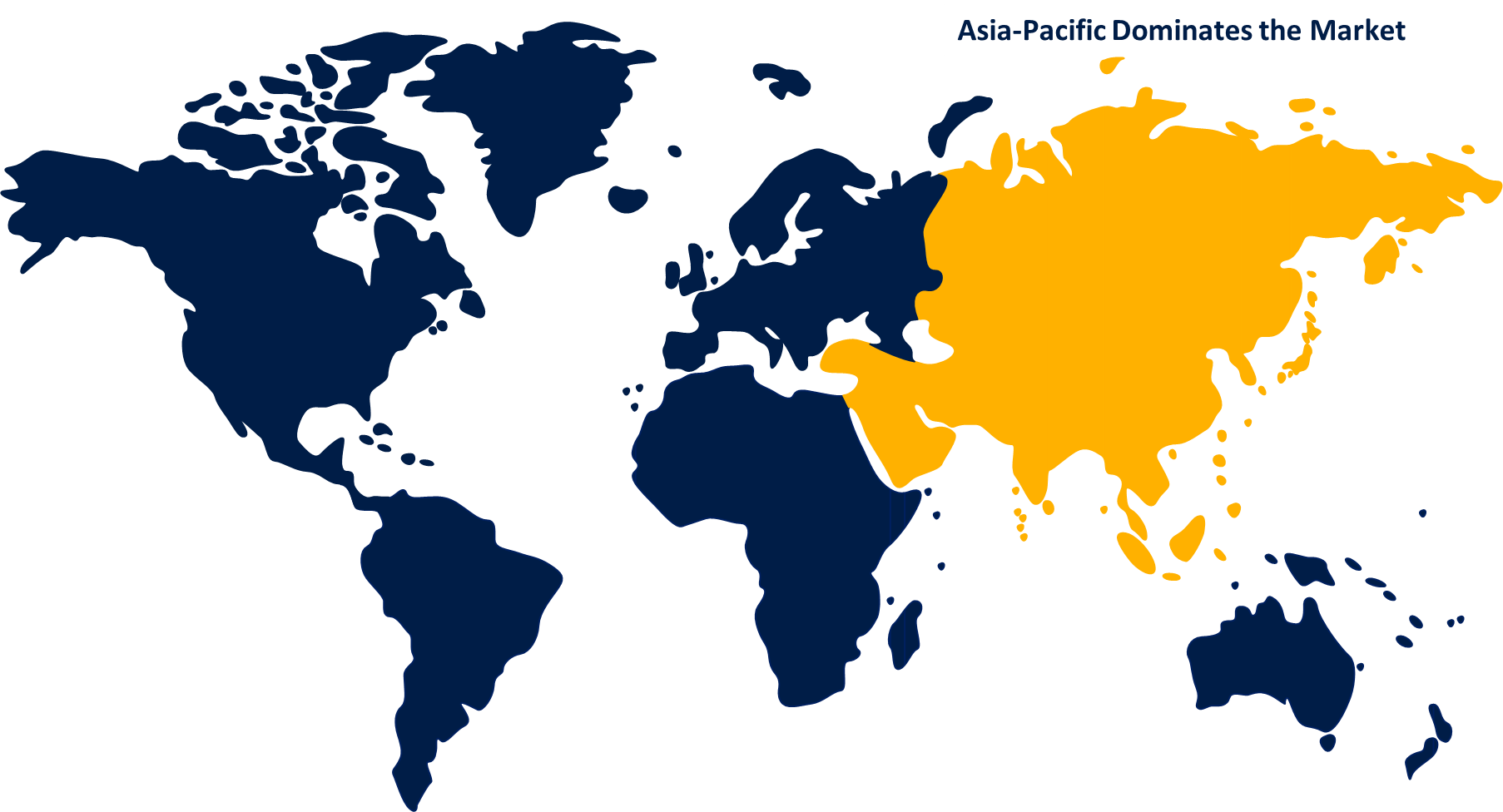

Asia-Pacific dominated the market with more than 42.7% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific's dominance in the ISO tank container market can be attributed to robust industrial and manufacturing sectors, particularly in countries like China and India, drive substantial demand for bulk liquid and gas transportation. Asia-Pacific's position as a major global trade hub, with extensive imports and exports, necessitates efficient logistics solutions, making ISO tank containers a preferred choice. Additionally, ongoing infrastructural developments and investments in transport facilities further support their widespread use. Overall, the region's economic Growth, industrialization, and international trade activities collectively contribute to its largest market share in the ISO tank container industry.

Europe's anticipated significant Growth in the ISO tank container market during the forecast period can be attributed to stringent regulations and emphasis on safety standards make ISO tank containers an attractive option for transporting hazardous and sensitive materials. The Growth of chemical manufacturing and pharmaceutical industries in Europe drives the demand for these containers. Additionally, the continent's well-developed transportation infrastructure and connectivity facilitate efficient distribution, further fueling market expansion.

Recent Developments

- In March 2022, Suttons Group has declared that it would invest in ISO containers. One hundred 24,000 litre ISO tanks were purchased to bolster the company's international tank fleet.

- In November 2021, Royal Den Hartogh Logistics has amalgamated with MUTO Group, a Korean chemical and petrochemical sector independent logistics service provider. This strategic initiative broadens both organizations' geographical footprint.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ISO tank container market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Intermodal Tank Transport

- Bertschi AG

- Bulkhaul Limited

- Royal Den Hartogh Logistics

- HOYER GmbH

- Interflow TCS Ltd.

- New Port Tank

- Sinochain Logistics Co., Ltd.

- Stolt-Nielsen Limited

- VTG Tanktainer GmbH

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global ISO tank container market based on the below-mentioned segments:

ISO Tank Container Market, By Transport Mode

- Road

- Rail

- Marine

ISO Tank Container Market, By Container Type

- Multi-Compartment Tank

- Lined Tank

- Reefer Tank

- Cryogenic & Gas Tanks

- Swap Body Tank

ISO Tank Container Market, By End-use Industry

- Chemicals

- Petrochemicals

- Food & Beverage

- Pharmaceuticals

- Industrial Gas

- Others

ISO Tank Container Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?