Global Iron Ore Mining Market Size, Share, and COVID-19 Impact Analysis, By Type (Iron Ore Mining Fines, Iron Ore Mining Pellets, Iron Ore Pellet Feed, and Others), By End User (Construction, Transportation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Iron Ore Mining Market Insights Forecasts to 2035

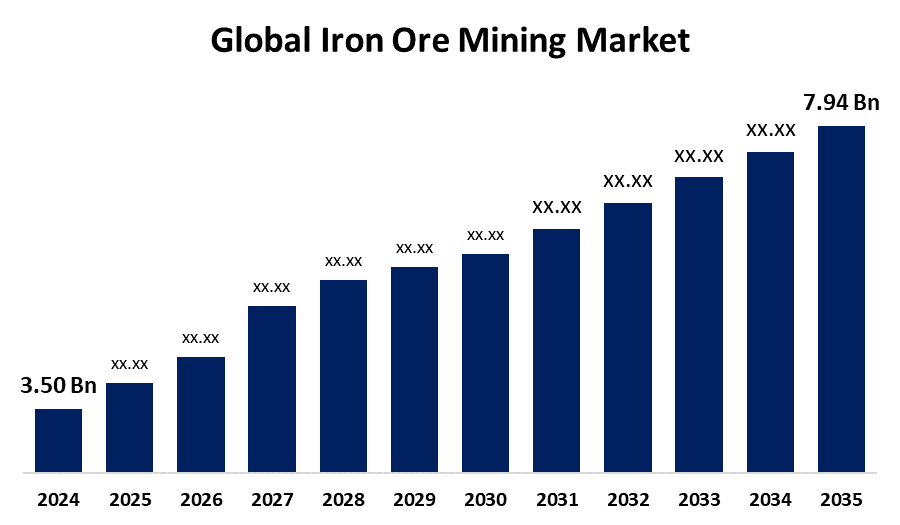

- The Global Iron Ore Mining Market Size Was Estimated at USD 3.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.73% from 2025 to 2035

- The Worldwide Iron Ore Mining Market Size is Expected to Reach USD 7.94 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Iron Ore Mining Market Size was worth around USD 3.50 Billion in 2024 and is predicted to Grow to around USD 7.94 Billion by 2035 with a compound annual growth rate (CAGR) of 7.73% from 2025 and 2035. The growing need for steel worldwide, the development of infrastructure, technical advancements, and sustainable mining methods, particularly in developing nations and eco-aware industries, present prospects for the iron ore mining market.

Market Overview

The global industry engaged in its exploration, extraction, processing, and sale is known as the iron ore mining market. This market comprises activities like beneficiation, sintering, and pelletizing to improve the grade of the ore, as well as different mining techniques like surface and underground mining. The market for iron ore mining is centered on the exploration, extraction, and processing of iron ore in order to supply the growing steel demand worldwide, as well as the expansion of infrastructure and industry, particularly in emerging economies.

Increasing global steel demand, more extraction activity, technical breakthroughs, and expanding infrastructure development, especially in emerging economies, are some of the major trends in the iron ore mining market. Increased use of steel and high-strength iron ore, industrialization in developing nations, and growing demand from the building industry are the main drivers of the expansion. The increase in mining and extraction activities, as well as its high use in building, are the main drivers of iron ore mining market.

Report Coverage

This research report categorizes the iron ore mining market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the iron ore mining market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the iron ore mining market.

Global Iron Ore Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.73% |

| 2035 Value Projection: | USD 7.94 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Companies covered:: | Rio Tinto, POSCO, Tata Steel, ArcelorMittal, GFG Alliance, Mineral Resources, Shree Minerals Ltd., Mount Gibson Iron, Cleveland-Cliffs Inc., Eurasian Resources Group, Northern Iron & Machine, NIPPON STEEL CORPORATION, Great Panther Mining Limited, Kudremukh Iron Ore Company, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in extraction operations is the main factor propelling the iron ore mining market's expansion. Iron ore mining market growth is expected to be further fueled by the expansion of end-use industries as well as rising urbanization and population. The growing need for steel worldwide, which is widely utilized in the infrastructure, automotive, and construction industries, is the main factor propelling the iron ore mining market. The expansion of mining capacity, more investments in exploration and development projects, and advantageous government regulations all contribute to the iron ore mining market's growth.

Restraining Factors

The depletion of high-grade reserves, strict environmental restrictions, price volatility, and geopolitical conflicts that disrupt global supply chains and raise operational uncertainty are some of the issues that limit the iron ore mining market.

Market Segmentation

The iron ore mining market share is classified into type and end user.

- The iron ore mining pellets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the iron ore mining market is divided into iron ore mining fines, iron ore mining pellets, iron ore pellet feed, and others. Among these, the iron ore mining pellets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. A range of tiny, spherical balls formed from iron ore fines make up iron ore mining pellets. Beneficiated or natural iron ore fines are combined with additives to create green pellets, which are then subjected to high-temperature induration as part of the manufacturing process.

- The construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the iron ore mining market is divided into construction, transportation, and others. Among these, the construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The section on construction raw material used to make steel, the structural foundation of some of the tallest structures in the world, is iron ore. Aluminum, another essential commodity for manufacturing and construction, is also used extensively; 730 tons were used to build the Empire State Building alone.

Regional Segment Analysis of the Iron Ore Mining Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the iron ore mining market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the iron ore mining market over the predicted timeframe. The growing need for iron ore in the North American steel industry is the main driver of the iron ore mining market in North America, which is influenced by a number of important variables. An important contributor to the regional iron ore market is the United States. Steel utilization is rising in industries including construction, oil and gas, and automotive, which is product for business prospects. In addition, the demand for American steel has increased due to the use of more economical and effective steel production techniques.

Asia Pacific is expected to grow at a rapid CAGR in the iron ore mining market during the forecast period. Rising steel consumption in growing nations like China and India, as well as fast industrialization and infrastructure development, are the main drivers of the Asia Pacific region. The development of production capabilities and growing investments in mining technology reinforce this rising trend, making the Asia Pacific a major contributor to the growth of the global iron ore market. Asia Pacific continues to be a key driver of the expansion of iron ore mining worldwide, with India predicted to have the highest CAGR in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the iron ore mining market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rio Tinto

- POSCO

- Tata Steel

- ArcelorMittal

- GFG Alliance

- Mineral Resources

- Shree Minerals Ltd.

- Mount Gibson Iron

- Cleveland-Cliffs Inc.

- Eurasian Resources Group

- Northern Iron & Machine

- NIPPON STEEL CORPORATION

- Great Panther Mining Limited

- Kudremukh Iron Ore Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Rio Tinto (RIO.AX) lays out a series of improvements that will return to record production levels as early as 2025, including plans to increase output at its newest iron ore mine in Western Australia by 16%.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the iron ore mining market based on the below-mentioned segments:

Global Iron Ore Mining Market, By Type

- Iron Ore Mining Fines

- Iron Ore Mining Pellets

- Iron Ore Pellet Feed

- Others

Global Iron Ore Mining Market, By End User

- Construction

- Transportation

- Others

Global Iron Ore Mining Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?