Iran Unmanned Aerial Vehicle (UAV) Market Size, Share, and COVID-19 Impact Analysis, By Type (Combat, Tactical, Small, Strategic), By Operation Mode (Fully Autonomous, Semi-Autonomous, Remotely-Operated), By Application (Commercial Military, Agriculture, Others), and Iran Unmanned Aerial Vehicle (UAV) Market Insights Forecasts to 2033

Industry: Aerospace & DefenseIran Unmanned Aerial Vehicle (UAV) Market Size Insights Forecasts to 2033

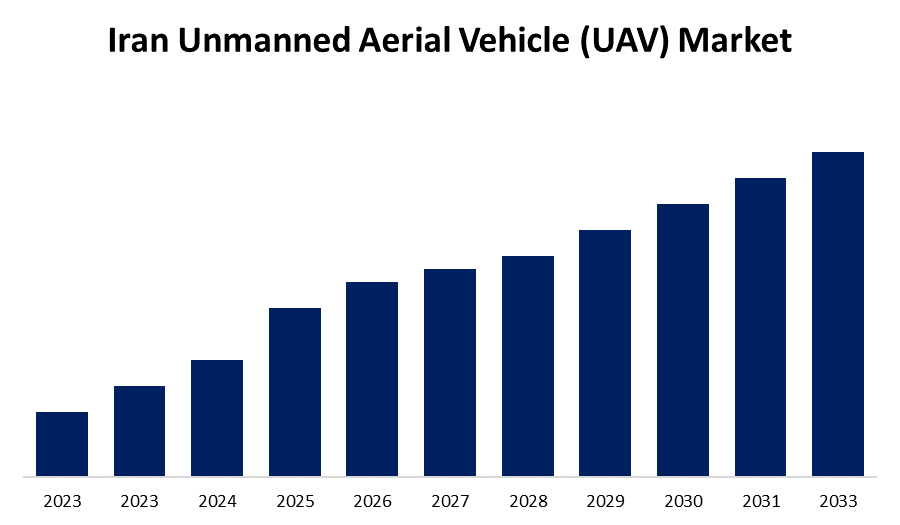

- The Market Size is Growing at a CAGR of 8.7% from 2023 to 2033.

- The Iran Unmanned Aerial Vehicle (UAV) Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Iran Unmanned Aerial Vehicle (UAV) Market Size is Expected to hold a significant share by 2033, at a CAGR of 8.7% during the Forecast period 2023 to 2033.

Market Overview

The computers situated on board the UAV, often known as a drone, are critical components that are remotely controlled by ground-based controllers. UAVs feature aerodynamic structures that allow them to perform a variety of functions when equipped with the right navigation system. The technology was first used in perilous military missions that did not endanger human life, as well as other military uses. Military unmanned aerial vehicles (UAVs) are outfitted with missiles designed to strike specified targets from high altitudes. Military-operated UAVs have customized propulsion systems that use liquid hydrogen fuel to conduct long-range operations against enemy forces. Furthermore, Iran has sent drones to the Houthis in Yemen and Hezbollah in Lebanon. Tehran delegated these abilities to its network of regional actors in order to influence their behaviour. Iran can also cause significant trouble for some of its regional competitors. The Houthis have claimed a number of strikes with UAVs, ballistic systems, and cruise missiles. These systems closely reflect Iranian systems. Exporting systems also allow Iran to observe how their systems perform in a conflict scenario. Moreover, Iran have seen a large growth in demand for UAVs as drone technology and its various applications have advanced. Due to increased enemy trespassing and border crossing in country have reported making major UAV purchases. Iran is developed military drones to prepare for future conflict situations and counterterrorism activities.

Report Coverage

This research report categorizes the market for Iran unmanned aerial vehicle (UAV) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran unmanned aerial vehicle (UAV) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Iran unmanned aerial vehicle (UAV) market.

Iran Unmanned Aerial Vehicle (UAV) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Operation Mode, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Sarmad Electronic Sepahan, Kimia Part Sivan Company, Iran Aircraft Manufacturing Industries, Qods Aviation Industries, Oje Parvaz Mado Nafar Company, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

UAVs and drones are quickly being used in business applications. Many firms perceive drones as a more cost-effective and efficient way to distribute products. Drones avoid gridlock on roads, allowing for faster delivery. Drone flying is becoming increasingly popular as a leisure activity in Iran. Moreover, Iran filmmakers and videographers use drones with high-quality cameras and axis stabilization. These enable aerial shots that would otherwise be impossible to achieve with such ease and accuracy. Drones can potentially be utilized in the healthcare industry for delivering medicines, carrying test samples, and many other activities Iran have begun utilizing drones in the healthcare industry.

Restraining Factors

Growing geopolitical conflicts throughout the world have also contributed to the slowing of market growth in Iran. The majority of commercial UAVs and drones are equipped with cameras, leaving them vulnerable to cyberattacks. These qualities also heighten the possibility of network spying, which increases the risk to national security. Following this reasoning, Iran have begun to restrict items from a given manufacturer to a particular country, thereby hampering the market expansion.

Market Segment

- In 2023, the small segment accounted for the largest revenue share over the forecast period.

Based on the type, the Iran unmanned aerial vehicle (UAV) market is segmented into combat, tactical, small, and strategic. Among these, the small segment has the largest revenue share over the forecast period. due to the fact that it has several military and commercial uses throughout. Small unmanned aerial vehicles are commonly used for security, monitoring, and surveillance purposes. The main factors of driving the expansion of the unmanned combat aerial vehicle are the greater use of UCAVs in civil and military applications, the rising use of UAVs in disaster relief operations, and changes in legal frameworks related to aerial activities.

- In 2023, the remotely-operated segment accounted for the largest revenue share over the forecast period.

On the basis of operation mode, the Iran unmanned aerial vehicle (UAV) market is segmented fully autonomous, semi-autonomous, and remotely-operated. Among these, the remotely-operated segment has the largest revenue share over the forecast period. A UAV carries no passengers or personnel. Unmanned aerial vehicles (UAVs) can be remotely piloted vehicles. UAVs may fly for an extended period of time at low altitude. Iran has seen a rise in demand for remotely piloted UAVs in recent years as drone technology and its varied applications have gained popularity.

- In 2023, the military segment is expected to hold the largest share of the Iran unmanned aerial vehicle (UAV) market during the forecast period.

Based on the application, the Iran unmanned aerial vehicle (UAV) market is classified into commercial military, agriculture, and others. Among these, the military segment is expected to hold the largest share of the Iran unmanned aerial vehicle (UAV) market during the forecast period. In the military UAVs will remain in high demand as the defense and security communities increasingly deploy them for a variety of applications such as surveying, mapping, transport, combat, and monitoring.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran unmanned aerial vehicle (UAV) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sarmad Electronic Sepahan

- Kimia Part Sivan Company

- Iran Aircraft Manufacturing Industries

- Qods Aviation Industries

- Oje Parvaz Mado Nafar Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On September 2023, The United States has designated a network of 11 individuals and businesses in four countries to promote Iran's unmanned aerial vehicle (UAV) and military aircraft industries. This network is in charge of procurement and maintenance activities in support of Iran Aircraft Manufacturing Industrial Company's (HESA) UAV and military aircraft production.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Iran Unmanned Aerial Vehicle (UAV) Market based on the below-mentioned segments:

Iran Unmanned Aerial Vehicle (UAV) Market, By Type

- Combat

- Tactical

- Small

- Strategic

Iran Unmanned Aerial Vehicle (UAV) Market, By Operation Mode

- Fully Autonomous

- Semi-Autonomous

- Remotely-Operated

Iran Unmanned Aerial Vehicle (UAV) Market, By Application

- Commercial Military

- Agriculture

- Others

Need help to buy this report?