Iran Torpedoes Market Size, Share, and COVID-19 Impact Analysis, By Type (Wire-Guided Torpedoes, Wake-Homing Torpedoes), By Launch Platform (Surface Ships, Submarines), and Iran Torpedoes Market Insights Forecasts to 2033

Industry: Aerospace & DefenseIran Torpedoes Market Insights Forecasts to 2033

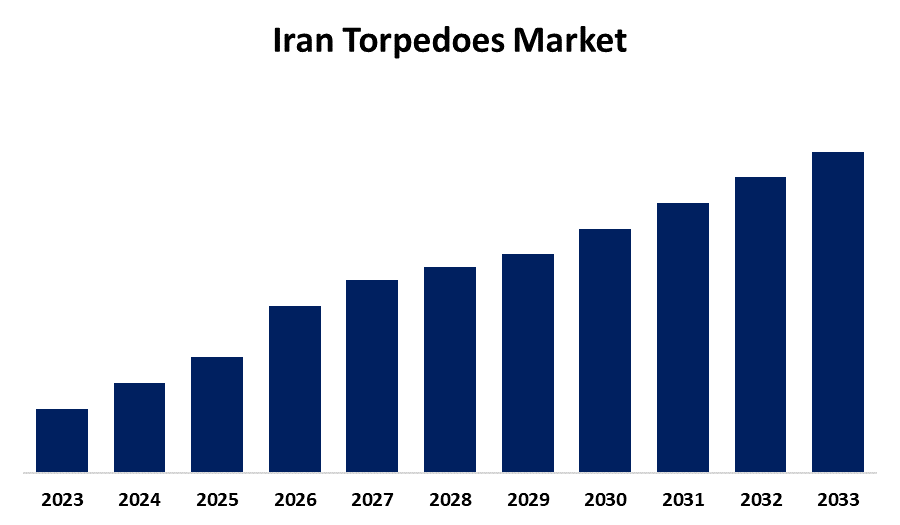

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033.

- The Iran Torpedoes Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Iran Torpedoes Market Size is expected to hold a significant share by 2033, at a CAGR of XX% during the forecast period 2023 to 2033.

Market Overview

Torpedo is a cigar-shaped, self-propelled underwater missile that is launched from a submarine, surface vessel, or airplane and designed to explode when it comes into contact with the hulls of surface vessels and submarines. A modern torpedo is equipped with complex devices that allow it to control its direction and depth by a predetermined plan or in response to signals from an external source. It also has a device that explodes the warhead filled with explosives when it hits or approaches its target. Furthermore, torpedoes now incorporate advanced sensors and communication systems. To improve their target detection and tracking abilities, torpedoes are being outfitted with advanced sensors, such as sonar and acoustic sensors, as a result of technological advancements. With the use of these sensors, torpedoes can obtain current situational awareness and engage enemy vessels with accuracy and efficiency. Moreover, torpedoes and their launch platforms or command centers now have better connectivity and coordination through to developments in communication systems. In addition, rising conflicts between governments in Iran, as well as terrorist activity around the world, will contribute to the Iran adoption of torpedoes. The concerns regarding border security in country throughout in Iran increased dramatically in response to the rise in terrorist activities. The Iran is putting new capacities to the test that will aid in market expansion in the forecast period.

Report Coverage

This research report categorizes the market for Iran torpedoes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran torpedoes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Iran Torpedoes Market.

Iran Torpedoes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Launch Platform |

| Companies covered:: | HESA, SADRA Iran Marin Industrials Company, Lockheed Martin, Dassault Aviation, Leonardo SpA, Saab AB., General Dynamics, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is a growing concentration on improving naval defense capabilities. To improve both their offensive and defensive capabilities, nations are actively investing in torpedoes as a vital part of their naval forces. The demand for torpedoes is being driven by the need to defend strategic assets, secure maritime borders, and maintain maritime dominance. Geopolitical conflicts play a major role in the Iran market as nations strive to keep a potent deterrent and the capacity to neutralize possible threats. For Instance, Tehran, IRNA - The Iranian Navy's Tareq, Fateh, and Qadir submarines launched their indigenous Miad and Valfajr-2 torpedoes for the first time on the fourth day of the Zolfaqar 1401 drill, which was conducted in an area extending from the eastern portion of the Strait of Hormuz to the northern tip of the Indian Ocean. Thus, the Iran governments are developing and concentrating on the development of navy ships, submarines, and maritime helicopters equipped with torpedoes in order to enhance marine border security and marine mission capabilities.

Restraining Factors

The changing nature of warfare, as well as the adoption of Internet of things (IoT) and artificial intelligence (AI) technology in maritime industries, will increase the risk of cyber-attacks. In the duration of the forecast period, these factors are probably going to hamper market growth. Once the location has been established, self-guiding weapons like torpedoes can be launched towards the target. It is possible to alter the route to the destination by gaining access to the guided system. Furthermore, since missile-protected submarines are impervious to torpedo attacks, the increased emphasis on their development is predicted to hamper market expansion.

Market Segment

- In 2023, the wire-guided torpedoes segment accounted for the largest revenue share over the forecast period.

Based on the type, the Iran torpedoes market is segmented into wire-guided torpedoes, and wake-homing torpedoes. Among these, the wire-guided torpedoes segment has the largest revenue share over the forecast period. Wire-guided torpedoes are highly accurate and have precise target-tracking capabilities, making them the preferred option for naval forces. A wire connecting the torpedoes to the launch platform provides guidance, enabling real-time control and adjustments during the attack. Because of its proven deployment by numerous naval forces in Iran, as well as its dependability and effectiveness, wire-guided torpedoes have a substantial market share.

- In 2023, the surface ships segment accounted for the largest revenue share over the forecast period.

On the basis of launch platform, the Iran torpedoes market is segmented into surface ships, and submarines. Among these, the surface ships segment has the largest revenue share over the forecast period. The main platforms for torpedo launches are surface vessels such as aircraft carriers, destroyers, and frigates. By providing a flexible and mobile torpedo deployment system, these platforms enable naval forces to engage enemy vessels in a successful manner. Because torpedoes are widely deployed on a variety of surface vessel types by various naval fleets in Iran, the surface ships segment has a substantial market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran torpedoes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HESA

- SADRA Iran Marin Industrials Company

- Lockheed Martin

- Dassault Aviation

- Leonardo SpA

- Saab AB.

- General Dynamics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Iran Torpedoes Market based on the below-mentioned segments:

Iran Torpedoes Market, By Type

- Wire-Guided Torpedoes

- Wake-Homing Torpedoes

Iran Torpedoes Market, By Lauch planform

- Surface Ships

- Submarines

Need help to buy this report?