Iran Tire Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Car, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, Two Wheelers, Three Wheelers, OTR), By Tire Construction Type (Radial, Bias), and Iran Tire Market Insights Forecasts to 2033

Industry: Automotive & TransportationIran Tire Market Insights Forecasts to 2033

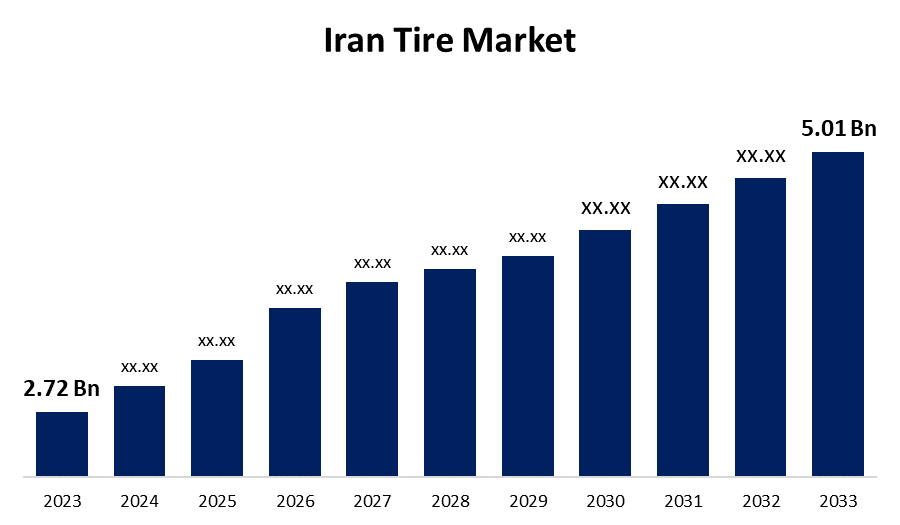

- The Iran Tire Market Size was valued at USD 2.72 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.3% from 2023 to 2033.

- The Iran Tire Market Size is Expected to Reach USD 5.01 Billion by 2033.

Get more details on this report -

The Iran Tire Market Size is expected to reach USD 5.01 Billion by 2033, at a CAGR of 6.3% during the forecast period 2023 to 2033.

Market Overview

A tire is a rubber component of a vehicle that protects the wheel's rim from the elements. Tires are now an important technical component of automobiles, serving multiple functions such as cushioning, dampening, directional stability, and long-term service. Most importantly, it must be able to transmit longitudinal solid and lateral forces during braking, acceleration, and cornering maneuvers in order to provide optimal and consistent road-holding quality. The tires act as a cushion between the vehicle and the ground, absorbing road shocks and providing friction, allowing the vehicle to function normally. In addition, tires are made from a variety of materials, including natural and synthetic rubber. Rubber tire materials include tread, jointless cap piles, beads, synthetic rubber, carbon black, and fabric. The tire market is being driven by increased automotive production and sales across a wide range of vehicle segments. Furthermore, the introduction of progressive technology into the manufacturing process is expected to drive market growth. As a result, the Iranian tire market is expected to grow significantly due to a number of factors, including an expanding automobile industry, rising consumer demand, technological advancements, Western influences, and supportive regulatory policies. While challenges exist, the market's potential remains high, allowing both domestic and international players to expand and contribute to Iran's developing automotive sector.

Report Coverage

This research report categorizes the market for Iran tire market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Iran tire market.

Iran Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.3% |

| 2033 Value Projection: | USD 4.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Tire Construction Type and COVID-19 Impact Analysis. |

| Companies covered:: | Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Rubber Industries Ltd, Michelin Group, Pirelli & C. S.p.A., Yazd Rubber Industries., Yokohama Rubber Company Limited, Kumho Tire Co. Inc and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid expansion of Iran's automotive industry is a significant driver for the tire market. Iran is one of the Middle East's largest automobile producers, with significant growth in vehicle manufacturing. The increased production of passenger cars, commercial vehicles, and even specialized vehicles such as buses and trucks are directly proportional to the demand for tires. As more vehicles hit the road, there will be a simultaneous demand for both original equipment tires for new vehicles and replacement tires for existing ones, resulting in Iran tire market growth. Moreover, government policies and regulations have a significant impact on the Iranian tire market. Environmental concerns and road safety have prompted the government to enact regulations that set standards for tire quality, labeling, and emissions. These regulations not only promote the development and use of safer and more environmentally friendly tires, but they also influence consumer preferences. As a result, market manufacturers are compelled to innovate and comply with these regulations, promoting the development of safer and more sustainable tire solutions.

Restraining Factors

The fluctuating costs of raw materials such as nylon and polyester have a negative impact on the Iran tire market. In addition, rubber (natural and synthetic) is used extensively in the manufacture of tires, which is expensive. Rubber tires are made up of tread, textile cord ply, jointless cap plies, steel cord belt plies, bead reinforcement, apex, and core. It also includes steel wire, synthetic rubber, natural rubber, carbon black, and petrochemical reinforcement materials such as polyester, fabric, nylon, steel, and rayon. Because of economic fluctuations, the prices of these metals fluctuate irregularly. As a result, this factor has slowed market growth. Furthermore, a scarcity of skilled technicians hampers the market's growth.

Market Segment

- In 2023, the passenger car segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the Iran tire market is segmented into passenger car, light commercial vehicle, medium & heavy commercial vehicle, two wheelers, three wheelers, and OTR. Among these, the passenger car segment has the largest revenue share over the forecast period. This is primarily due to the high rate of vehicle ownership among the urban population. However, the growing emphasis on public transportation and the gradual introduction of electric and hybrid vehicles are influencing market dynamics. Meanwhile, demand for commercial vehicle tires, which primarily serve the logistics and construction industries, remains steady. Off-the-road (OTR) vehicles used in agriculture and mining add to the tire market, albeit on a smaller scale.

- In 2023, the radial segment accounted for the largest revenue share over the forecast period.

Based on the tire construction type, the Iran tire market is segmented into radial and bias. Among these, the radial segment has the largest revenue share over the forecast period owing to their exceptional strength and longevity. This increase in demand can be attributed to their superior ability to disperse heat, which results in higher fuel efficiency than their counterparts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd

- Michelin Group

- Pirelli & C. S.p.A.

- Yazd Rubber Industries.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2021, Yazd Rubber Industries (an Iranian tire manufacturer) has completed an expansion project at its manufacturing facility in the southern city of Yazd. According to the company, the project began three years ago and is expected to increase passenger car and light truck tire production capacity by 3,000 and 12,000 units per day, respectively.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the Iran tire market based on the below-mentioned segments:

Iran Tire Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Medium & Heavy Commercial Vehicle

- Two Wheelers

- Three Wheelers

- OTR

Iran Tire Market, By Construction Type

- Radial

- Bias

Need help to buy this report?