Iran Oil Refinery Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Merchant Hydrogen, Refining Catalysts, pH Adjusters, Corrosion Inhibitors, Others), By Application (Petroleum Conversion, Petroleum Treatment, Water and Wastewater Treatment, Others), and Iran Oil Refinery Chemicals Market Insights Forecasts 2023 – 2033

Industry: Chemicals & MaterialsIran Oil Refinery Chemicals Market Insights Forecasts to 2033

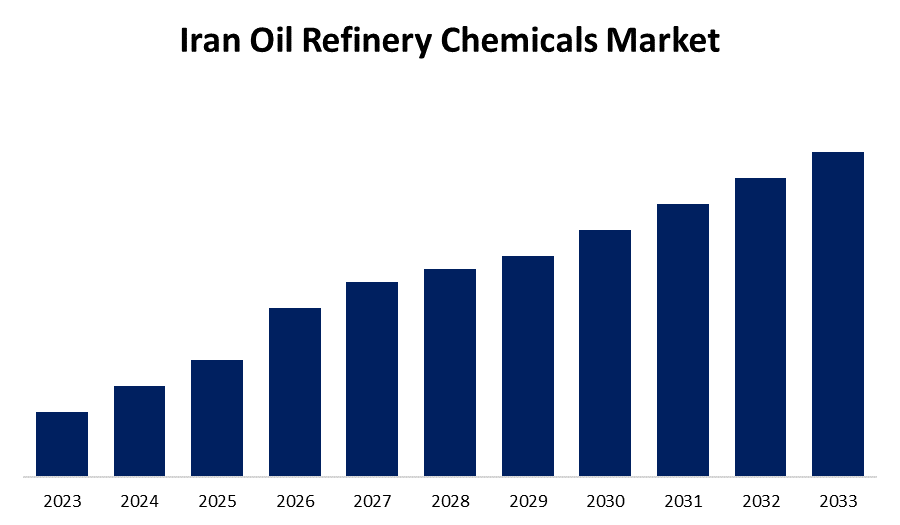

- The Market Size is Growing at a CAGR of 4.5% from 2023 to 2033.

- The Iran Oil Refinery Chemicals Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Iran Oil Refinery Chemicals Market size is expected to hold a significant share by 2033, at a CAGR of 4.5% during the forecast period 2023 to 2033.

Market Overview

Oil refinery chemicals play an important role in increasing the efficiency and lifespan of oil refineries. Crude oil is refined into a variety of products, including gasoline, petroleum naphtha, diesel fuel, kerosene, and fuel oils. Oil refineries are large and have extensive piping that transports fluids between large chemical processing units. These chemicals, which include catalysts, corrosion inhibitors, emulsion breakers, and others, are in high demand in countries with large refining capacity, such as Iran. They help to improve the refining process and ensure the production of high-quality petroleum products. The Iranian oil refinery chemicals market has grown significantly over the years, due primarily to the country's abundant crude reserves and extensive refining capacity. With its vast reserves and advanced refining infrastructure, Iran has emerged as a major player in the global oil industry.

Report Coverage

This research report categorizes the market for the Iran oil refinery chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran oil refinery chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Iran oil refinery chemicals market.

Iran Oil Refinery Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Tejaras Co., Mahestan Oil Company, Arak Petrochemical Company, Iran Ertebat Oil Refining Company, Mazandaran Oil Refinery, National Iranian Oil Company, Pars Oil Company, Lavan Refinery, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the major drivers of the oil refining market is the growing demand for a wide range of petroleum products, from gasoline and diesel to jet fuel and petrochemicals, as well as Iran, known for its abundant oil reserves and extensive refining capacity, is well-positioned to meet this rising demand. Iran's growing refining capacity is expected to boost major expansion in the country's oil refinery chemicals market. Technological advancements are transforming the oil refining industry, making processes more efficient and eco-friendlier. Furthermore, the expansion provides opportunities for domestic companies to increase production capacity and attract foreign investment. The development and adoption of advanced technologies in the oil refining sector can also help to create jobs and boost the country's economy.

Restraining Factors

Despite its promising growth, Iran's oil refinery chemicals market faces serious obstacles. The imposition of international sanctions has severely impacted Iran's crude exports, resulting in a significant decrease in crude oil production. Furthermore, limited infrastructure development in the oil refining sector creates barriers to the adoption of advanced technologies.

Market Segment

- In 2023, the merchant hydrogen segment accounted for the largest revenue share over the forecast period.

Based on type, the Iran oil refinery chemicals market is segmented into merchant hydrogen, refining catalysts, pH adjusters, corrosion inhibitors, and others. Among these, the merchant hydrogen segment has the largest revenue share over the forecast period. The oil refining and chemical industries are currently seeing an enormous boost in demand for hydrogen, a versatile element that plays an important role in a variety of industrial processes. In addition to its applications in oil refining, chemical production, and steel manufacturing, hydrogen is widely used to remove impurities from petroleum products during the refining process. The dominance of merchant hydrogen is further supported by ongoing advances in hydrogen generation technologies. These innovations transformed the manufacturing process, making it more efficient and cost-effective. As a consequence, merchant hydrogen has become more widely available, helping to maintain its market dominance.

- In 2023, the petroleum conversion segment is witnessing significant growth over the forecast period.

Based on application, the Iran oil refinery chemicals market is segmented into petroleum conversion, petroleum treatment, water & wastewater treatment, and others. Among these, the petroleum conversion segment is witnessing significant growth over the forecast period. Petroleum conversion's dominance in Iran's oil refinery chemicals market is due in large part to inefficiencies and inappropriate production patterns in the country's petroleum refining industry. These inefficiencies result from a lack of advanced conversion units in refineries, reducing the industry's overall efficiency and productivity. As such, petroleum conversion processes and the chemicals used to facilitate them are in great demand in Iran. Cracking, reforming, and hydrotreating are all important petroleum conversion processes that help oil refineries run more efficiently. These processes help to convert crude oil into high-value products such as gasoline, diesel, and jet fuel. Petroleum conversion breaks down large hydrocarbon molecules into smaller ones, allowing for the production of more refined and usable petroleum products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran oil refinery chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tejaras Co.

- Mahestan Oil Company

- Arak Petrochemical Company

- Iran Ertebat Oil Refining Company

- Mazandaran Oil Refinery

- National Iranian Oil Company

- Pars Oil Company

- Lavan Refinery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, The Lavan Refinery in southern Iran has announced the construction of a 150,000-barrel petro-refinery next to it, as well as efforts to increase refinery production by one million liters per day.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Iran Oil Refinery Chemicals Market based on the below-mentioned segments:

Iran Oil Refinery Chemicals Market, By Type

- Merchant Hydrogen

- Refining Catalysts

- pH Adjusters

- Corrosion Inhibitors

- Others

Iran Oil Refinery Chemicals Market, By Application

- Petroleum Conversion

- Petroleum Treatment

- Water & Wastewater Treatment

- Others

Need help to buy this report?