Iran Defense Market Size, Share, and COVID-19 Impact Analysis, By Type (Infantry Weapons, Vehicles, Fighter Aircraft, Other Fixed Wing Aircraft, Helicopters, Submarines, Ships, and Missile Systems), By End-User (Army, Navy, Air Force), and Iran Defense Market Insights Forecasts 2023 – 2033

Industry: Aerospace & DefenseIran Defense Market Insights Forecasts to 2032

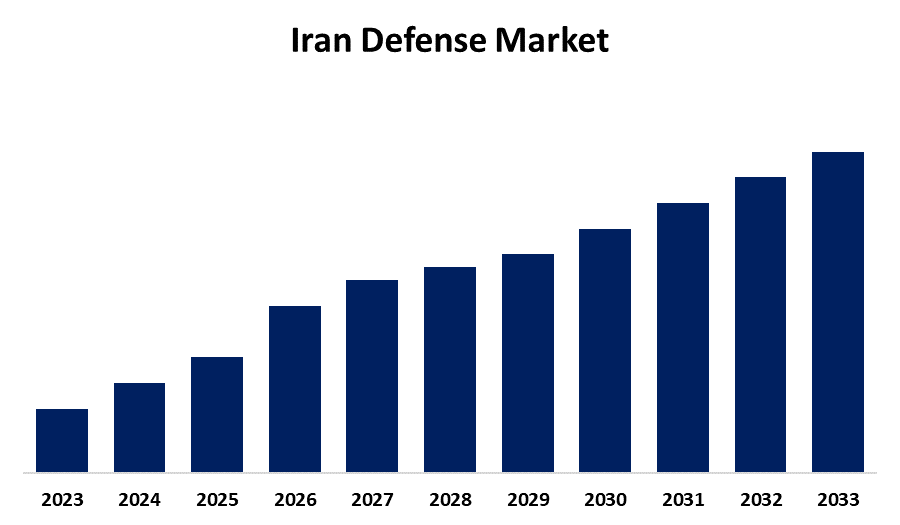

- The Market Size is Growing at a CAGR of 3.88% from 2023 to 2033.

- The Iran Defense Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Iran Defense Market Size is expected to hold a significant share by 2033, at a CAGR of 3.88% during the forecast period 2023 to 2033.

Market Overview

Defense includes a wide range of activities, including the development of air-based, sea-based, and land-based military equipment, as well as support and auxiliary equipment such as radar, satellites, sonars, and other auxiliary equipment, as well as the maintenance, repair, and overhaul of defense equipment. The primary defense types include air-based defense equipment, sea-based defense equipment, land-based defense equipment, defense equipment maintenance, repair, and overhaul services, defense support, and auxiliary equipment. Air-based defense equipment includes radar, satellites, sonar, and other auxiliary equipment. The various operations include autonomous defense equipment, and manuals, and use a variety of platforms, including airborne, ground, and naval. Iran, officially known as the Islamic Republic of Iran, has always been against the United States' presence in the Middle East and its support for Israel. To strengthen its deterrence against foreign attack and influence, the country has pledged to become the dominant power in the volatile and strategic Middle East region by adapting its military capabilities and doctrine to reflect developments by the United States and its allies. To achieve its objectives, Iran keeps depending on unconventional warfare elements and asymmetric capabilities designed to exploit perceived weaknesses in a superior adversary, such as the United States. Iran's defense market is moderately consolidated, with a few major players. Furthermore, companies are focusing on product development and the integration of next-generation technologies to gain market share.

Report Coverage

This research report categorizes the market for the Iran defense market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran defense market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Iran defense market.

Iran Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.88% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-User |

| Companies covered:: | General Dynamics, Iran Electronics Industries, Lockheed Martin, Northrop Grumman, Raytheon Corporation, SAAB AB, Thales Group, BAE Systems, The Boeing Company, Dassault Aviation and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main factors influencing the growth of Iran's defense market are increased investment in modernization and the expansion of combat aircraft. The growing number of commercial and cargo fleets in Iran is also boosting the defense market. Furthermore, the rapid development and application of advanced materials continue to drive defense market growth.

Restraining Factors

Making certification an accepted source is a significant challenge for the Iranian defense materials market. Some political interventions in Iran have hampered market growth, and reduced military expenses have had a significant impact on the value bar.

Market Segment

- In 2023, the missile systems segment accounted for the largest revenue share over the forecast period.

Based on type, the Iran defense market is segmented into infantry weapons, vehicles, fighter aircraft, other fixed-wing aircraft, helicopters, submarines, ships, and missile systems. Among these, the missile systems segment has the largest revenue share over the forecast period. Iran's missile program is an integral part of its armed forces, and the country considers it critical to national security. Iran has the Middle East's largest and most diverse missile arsenal, with thousands of ballistic and cruise missiles, some of which can reach Israel and southeast Europe. Such developments have transformed Iran's missile forces into a powerful tool for Iranian power projection, as well as a credible threat to the United States and its allied forces in the region.

- In 2023, the navy segment accounted for a significant revenue share over the forecast period.

Based on the end user, the Iran defense market is segmented into the army, navy, and air force. Among these, the navy segment has a significant revenue share over the forecast period. The navy segment is likely to remain the most important segment in Iran's defense sector in the coming years. The Iranian Navy has a well-established submarine fleet that includes both Russian and Iranian-built vessels, and the Iranian government is working to develop destroyers and strengthen its fleet. Destroyers are larger than frigates and can transport and power powerful high-resolution radar and numerous vertical launch cells in a convenient manner. These warships can also provide theatre-wide air and missile defense for forces like carrier battle groups.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran defense market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Dynamics

- Iran Electronics Industries

- Lockheed Martin

- Northrop Grumman

- Raytheon Corporation

- SAAB AB

- Thales Group

- BAE Systems

- The Boeing Company

- Dassault Aviation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, The Defense Minister of Iran confirmed that the Islamic Republic of Iran Air Force (IRIAF) will purchase the Sukhoi Su-35SE Flanker-E fighter jet. The SU-35 is a modified version of the SU-27 with enhanced capabilities for aerial, ground, and sea-surface targets.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Iran Defense Market based on the below-mentioned segments:

Iran Defense Market, By Type

- Infantry Weapons

- Vehicles

- Fighter Aircraft

- Other Fixed Wing Aircraft

- Helicopters

- Submarines

- Ships

- Missile Systems

Iran Defense Market, By End-User

- Army

- Navy

- Air Force

Need help to buy this report?